Title: Readings in Money and Banking

Author: Chester Arthur Phillips

Release date: January 30, 2011 [eBook #35120]

Language: English

Credits: E-text prepared by Jonathan Ingram, Josephine Paolucci, and the Online Distributed Proofreading Team (http://www.pgdp.net) from page images generously made available by Internet Archive/Canadian Libraries (http://www.archive.org/details/toronto)

| Note: | Images of the original pages are available through Internet Archive/Canadian Libraries. See http://www.archive.org/details/readingsnimoney00philuoft |

THE MACMILLAN COMPANY

NEW YORK · BOSTON · CHICAGO · DALLAS

ATLANTA · SAN FRANCISCO

MACMILLAN & CO. Limited

LONDON · BOMBAY · CALCUTTA

MELBOURNE

THE MACMILLAN CO. OF CANADA. Ltd.

TORONTO

Assistant Professor of Economics in Dartmouth College

and Assistant Professor of Banking in the Amos

Tuck School of Administration and Finance

New York

THE MACMILLAN COMPANY

1921

All rights reserved

PRINTED IN THE UNITED STATES OF AMERICA

Copyright 1916

By THE MACMILLAN COMPANY

Set up and electrotyped. Published September, 1916.

FERRIS

PRINTING COMPANY

NEW YORK CITY

Designed mainly for class room use in connection with one of the introductory manuals on the subject of Money and Banking or of Money and Currency, this volume, in itself, lays no claim to completeness. Where its use is contemplated the problems of emphasis and proportion are, accordingly, to be solved by the selection of one or another of the available texts, or by the choice of supplementary lecture topics and materials. The contents of the introductory manuals are so divergent in character as to render possible combinations of text and readings that will include, it is hoped, matter of such range and variety as may be desired.

Fullness of treatment has been attempted, however, in the chapters dealing with the important recent developments in the "mechanism of exchange," and my aim has been throughout to select and, in many instances, to adapt with a view to meeting the wants of those who are interested chiefly in the modern phases of the subject.

For valuable suggestions in the preparation of the volume I am greatly indebted to Professors F. H. Dixon and G. R. Wicker and Mr. J. M. Shortliffe of Dartmouth, Professor Hastings Lyon of Columbia, Professor E. E. Day of Harvard, and to my former teacher, Professor F. R. Fairchild of Yale. I desire also to mention my great obligation to authors and publishers who alike have generously permitted the reproduction of copyrighted material.

Chester Arthur Phillips.

Dartmouth College,

Hanover, N. H., July, 1916.

CHAPTER PAGE

I The Origin and Functions of Money 1

II The Early History of Money 10

III Qualities of the Material of Money 18

IV Legal Tender 26

V The Greenback Issues 33

VI International Bimetallism 71

VII The Silver Question in the United States 82

VIII Index Numbers 115

IX Banking Operations and Accounts 121

X The Use of Credit Instruments in Payments in the United States 150

XI A Symposium on the Relation Between Money and General Prices 159

XII The Gold Exchange Standard 213

XIII A Plan for a Compensated Dollar 229

XIV Monetary Systems of Foreign Countries 246

XV The Nature and Functions of Trust Companies 256

XVI Savings Banks 270

XVII Domestic Exchange 290

XVIII Foreign Exchange 305

XIX Clearing Houses 355

XX State Banks and Trust Companies Since the Passage

of the National Bank Act 381

XXI The Canadian Banking System 406

XXII The English Banking System 435

XXIII The Scotch Banks 474

XXIV The French Banking System 488

XXV The German Banking System 526

XXVI Banking in South America 559

XXVII Agricultural Credit in the United States 575

XXVIII The Concentration of Control of Money and Credit 606

XXIX Crises 627

XXX The Weaknesses of Our Banking System Prior to

the Establishment of the Federal Reserve System 672

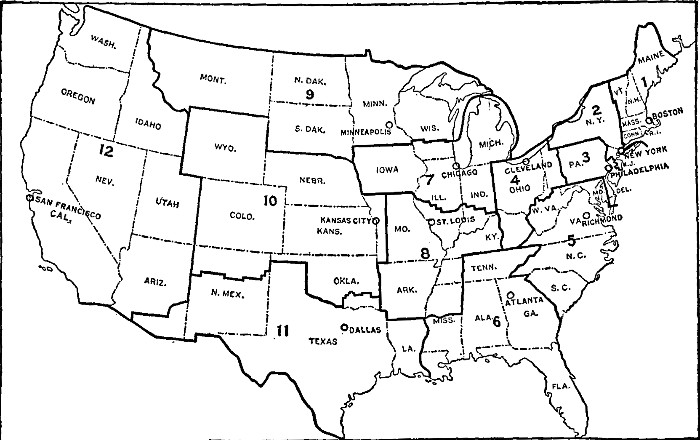

XXXI The Federal Reserve System 723

XXXII The European War in Relation to Money, Banking and Finance 797

Appendices 830

[1]In order to understand the manifold functions of a Circulating Medium, there is no better way than to consider what are the principal inconveniences which we should experience if we had not such a medium. The first and most obvious would be the want of a common measure for values of different sorts. If a tailor had only coats, and wanted to buy bread or a horse, it would be very troublesome to ascertain how much bread he ought to obtain for a coat, or how many coats he should give for a horse. The calculation must be recommenced on different data, every time he bartered his coats for a different kind of article; and there could be no current price, or regular quotations of value. Whereas now each thing has a current price in money, and he gets over all difficulties by reckoning his coat at £4 or £5, and a four-pound loaf at 6d. or 7d. As it is much easier to compare different lengths by expressing them in a common language of feet and inches, so it is much easier to compare values by means of a common language of pounds, shillings, and pence. In no other way can values be arranged one above another in a scale: in no other can a person conveniently calculate the sum of his possessions; and it is easier to ascertain and remember the relations of many things to one thing, than their innumerable cross relations with one another. This advantage of having a common language in which values may be expressed, is, even by itself, so important, that some such mode of expressing and computing them would probably[Pg 2] be used even if a pound or a shilling did not express any real thing, but a mere unit of calculation. It is said that there are African tribes in which this somewhat artificial contrivance actually prevails. They calculate the value of things in a sort of money of account, called macutes. They say, one thing is worth ten macutes, another fifteen, another twenty. There is no real thing called a macute: it is a conventional unit, for the more convenient comparison of things with one another.

This advantage, however, forms but an inconsiderable part of the economical benefits derived from the use of money. The inconveniences of barter are so great, that without some more commodious means of effecting exchanges, the division of employments could hardly have been carried to any considerable extent. A tailor, who had nothing but coats, might starve before he could find any person having bread to sell who wanted a coat: besides, he would not want as much bread at a time as would be worth a coat, and the coat could not be divided. Every person, therefore, would at all times hasten to dispose of his commodity in exchange for anything which, though it might not be fitted to his own immediate wants, was in great and general demand, and easily divisible, so that he might be sure of being able to purchase with it, whatever was offered for sale. The primary necessaries of life possess these properties in a high degree. Bread is extremely divisible, and an object of universal desire. Still, this is not the sort of thing required: for, of food, unless in expectation of a scarcity, no one wishes to possess more at once than is wanted for immediate consumption; so that a person is never sure of finding an immediate purchaser for articles of food; and unless soon disposed of, most of them perish. The thing which people would select to keep by them for making purchases, must be one which, besides being divisible, and generally desired, does not deteriorate by keeping. This reduces the choice to a small number of articles.

By a tacit concurrence, almost all nations, at a very early period, fixed upon certain metals, and especially gold and silver, to serve this purpose. No other substances unite the necessary qualities in so great a degree, with so many subordinate advantages. Next to food and clothing, and in some climates[Pg 3] even before clothing, the strongest inclination in a rude state of society is for personal ornament, and for the kind of distinction which is obtained by rarity or costliness in such ornaments. After the immediate necessities of life were satisfied, every one was eager to accumulate as great a store as possible of things at once costly and ornamental; which were chiefly gold, silver, and jewels. These were the things which it most pleased every one to possess, and which there was most certainty of finding others willing to receive in exchange for any kind of produce. They were among the most imperishable of all substances. They were also portable, and containing great value in small bulk, were easily hid; a consideration of much importance in an age of insecurity. Jewels are inferior to gold and silver in the quality of divisibility; and are of very various qualities, not to be accurately discriminated without great trouble. Gold and silver are eminently divisible, and when pure, always of the same quality; and their purity may be ascertained and certified by a public authority.

Accordingly, though furs have been employed as money in some countries, cattle in others, in Chinese Tartary cubes of tea closely pressed together, the shells called cowries on the coast of Western Africa, and in Abyssinia at this day blocks of rock salt; though even of metals, the less costly have sometimes been chosen, as iron in Lacedæmon from ascetic policy, copper in the early Roman republic from the poverty of the people; gold and silver have been generally preferred by nations which were able to obtain them, either by industry, commerce, or conquest. To the qualities which originally recommended them, another came to be added, the importance of which only unfolded itself by degrees. Of all commodities, they are among the least influenced by any of the causes which produce fluctuations of value. They fluctuate less than almost any other things in their cost of production. And from their durability, the total quantity in existence is at all times so great in proportion to the annual supply, that the effect on value even of a change in the cost of production is not sudden: a very long time being required to diminish materially the quantity in existence, and even to increase it very greatly not being a rapid process. Gold and silver, therefore, are more[Pg 4] fit than any other commodity to be the subject of engagements for receiving or paying a given quantity at some distant period. If the engagement were made in corn, a failure of crops might increase the burthen of the payment in one year to fourfold what was intended, or an exuberant harvest sink it in another to one-fourth. If stipulated in cloth, some manufacturing invention might permanently reduce the payment to a tenth of its original value. Such things have occurred even in the case of payments stipulated in gold and silver; but the great fall of their value after the discovery of America, is, as yet, the only authenticated instance; and in this case the change was extremely gradual, being spread over a period of many years.

When gold and silver had become virtually a medium of exchange, by becoming the things for which people generally sold, and with which they generally bought, whatever they had to sell or to buy; the contrivance of coining obviously suggested itself. By this process the metal was divided into convenient portions, of any degree of smallness, and bearing a recognized proportion to one another; and the trouble was saved of weighing and assaying at every change of possessors, an inconvenience which on the occasion of small purchases would soon have become insupportable. Governments found it their interest to take the operation into their own hands, and to interdict all coining by private persons; indeed, their guarantee was often the only one which would have been relied on, a reliance however which very often it ill deserved; profligate governments having until a very modern period seldom scrupled, for the sake of robbing their creditors, to confer on all other debtors a licence to rob theirs, by the shallow and impudent artifice of lowering the standard; that least covert of all modes of knavery, which consists in calling a shilling a pound, that a debt of a hundred pounds may be cancelled by the payment of a hundred shillings. It would have been as simple a plan, and would have answered the purpose as well, to have enacted that "a hundred" should always be interpreted to mean five, which would have effected the same reduction in all pecuniary contracts, and would not have been at all more shameless. Such strokes of policy have not wholly ceased to be recommended, but they have ceased to be practised;[Pg 5] except occasionally through the medium of paper money, in which case the character of the transaction, from the greater obscurity of the subject, is a little less barefaced.

Money, when its use has grown habitual, is the medium through which the incomes of the different members of the community are distributed to them, and the measure by which they estimate their possessions. As it is always by means of money that people provide for their different necessities, there grows up in their minds a powerful association leading them to regard money as wealth in a more peculiar sense than any other article; and even those who pass their lives in the production of the most useful objects, acquire the habit of regarding those objects as chiefly important by their capacity of being exchanged for money. A person who parts with money to obtain commodities, unless he intends to sell them, appears to the imagination to be making a worse bargain than a person who parts with commodities to get money; the one seems to be spending his means, the other adding to them. Illusions which, though now in some measure dispelled, were long powerful enough to overmaster the mind of every politician, both speculative and practical, in Europe.

It must be evident, however, that the mere introduction of a particular mode of exchanging things for one another, by first exchanging a thing for money, and then exchanging the money for something else, makes no difference in the essential character of transactions. It is not with money that things are really purchased. Nobody's income (except that of the gold or silver miner) is derived from the precious metals. The pounds or shillings which a person receives weekly or yearly, are not what constitutes his income; they are a sort of tickets or orders which he can present for payment at any shop he pleases, and which entitle him to receive a certain value of any commodity that he makes choice of. The farmer pays his laborers and his landlord in these tickets, as the most convenient plan for himself and them; but their real income is their share of his corn, cattle, and hay, and it makes no essential difference whether he distributes it to them directly or sells it for them and gives them the price; but as they would have to sell it for money if he did not, and he is[Pg 6] a seller at any rate, it best suits the purposes of all, that he should sell their share along with his own, and leave the laborers more leisure for work and the landlord for being idle. The capitalists, except those who are producers of the precious metals, derive no part of their income from those metals, since they only get them by buying them with their own produce: while all other persons have their incomes paid to them by the capitalists, or by those who have received payment from the capitalists, and as the capitalists have nothing, from the first, except their produce, it is that and nothing else which supplies all incomes furnished by them. There cannot, in short, be intrinsically a more insignificant thing, in the economy of society, than money; except in the character of a contrivance for sparing time and labor. It is a machine for doing quickly and commodiously, what would be done, though less quickly and commodiously, without it: and like many other kinds of machinery, it only exerts a distinct and independent influence of its own when it gets out of order.

The introduction of money does not interfere with the operation of any of the Laws of Value.... The reasons which make the temporary or market value of things depend on the demand and supply, and their average and permanent values upon their cost of production, are as applicable to a money system as to a system of barter. Things which by barter would exchange for one another, will, if sold for money, sell for an equal amount of it, and so will exchange for one another still, though the process of exchanging them will consist of two operations instead of only one. The relations of commodities to one another remain unaltered by money: the only new relation introduced, is their relation to money itself; how much or how little money they will exchange for; in other words, how the Exchange Value of money itself is determined. And this is not a question of any difficulty, when the illusion is dispelled, which caused money to be looked upon as a peculiar thing, not governed by the same laws as other things. Money is a commodity, and its value is determined like that of other commodities, temporarily by demand and supply, permanently and on the average by cost of production.[Pg 7]

In the foregoing,[2] attention has been directed mainly to the two functions of money known (1) as the Standard or Common Denominator of Value, and (2) as the Medium of Exchange. Concerning transactions begun and ended on the spot nothing more need be said; but the fact of contracts over a period of time introduces an important element—the time element. Whenever a contract is made covering a period of time, within which serious changes in the economic world may take place, then difficulties may arise as to what is a just standard of payments. Various articles might serve equally well as a standard for exchanges performed on the spot, but it is not so when any one article is chosen as a standard for deferred payments. Without much regard to theory, the world has in fact used the same standard for transactions whether settled on the spot, or whether extending over a period of time.

In order to work with perfection as a standard for deferred payments, the article chosen as that standard should place both debtors and creditors in exactly the same absolute, and the same relative, position to each other at the end of a contract that they occupied at its beginning; this implies that the chosen article should maintain the same exchange value in relation to goods, rents, and the wages of labour at the end as at the beginning of the contract, and it implies that the borrower and lender should preserve the same relative position as regards their fellow producers and consumers at the later as at the earlier point of time, and that they have not changed this relation, one at the loss of the other. This makes demands which any article that can be suggested as a standard cannot satisfy. And yet it is a practical necessity of society that some one article should in fact be selected as the standard. The business world has thus been forced to find some commodity which—while admittedly never capable of perfection—provides more nearly than anything else all the essentials of a desirable standard.

The causes which may bring about changes in the relations between goods and labor, on the one side, and the standard, on[Pg 8] the other, are various. We may, for instance, compare wheat with the existing gold standard. The quantity of gold for which the wheat will exchange is its price. As wheat falls in value relatively to gold, it exchanges for less gold, that is, its price falls; or, vice versa, gold exchanges for more wheat, and relatively to wheat gold has risen. As one goes up, the other term in the ratio necessarily goes down; just as certainly as a rise in one end of a plank balanced on a log necessitates a fall in the other end of the plank. Therefore, changes in prices can be caused by forces affecting either the gold side or the wheat side of the ratio; by forces affecting either the money standard or the goods compared with that standard. Consequences of importance follow from this explanation. First suppose that commodities and labor remain unchanged in their production and reward, respectively; then, anything affecting the supply of and demand for gold will affect in general the value of gold in comparison with goods and labor. Or, second, if we suppose an equilibrium between the demand for and supply of gold, then, prices and wages can be affected also by anything affecting the cost of obtaining goods or labor. It is one-sided to look for changes in prices solely from causes touching gold, or one term of the price ratio. If, however, it should be desired that prices should remain stationary, then this can be brought about only by finding for the standard an article that would automatically move in extent, and in the proper compensating direction, so as to meet any changes in value arising not only from causes affecting itself, but also from causes affecting labor and the vast number of goods that may be quoted in price. No commodity ever existed which could thus move in value.

During long periods of time—within which gains in mechanical skill and invention, revolutions in political and social habits, changes in taste or fashion, settlement of new countries, opening of new markets, may take place—great alterations in the value of the standard may occur wholly from natural causes affecting the commodity side of the price ratio. And yet, in default of a perfect standard, persons who borrow and lend create debts and obligations expressed in terms of that article which has been adopted as the standard[Pg 9] by the concurring habits of the commercial community of which they form a part. It should be understood, whenever men enter into obligations reaching over a period of time, that a necessary part of the risks involved in this undertaking is the possibility of an alteration in the exchange values of goods, on the one hand, and in the standard metal on the other, due to industrial changes and natural causes. This is one of the risks which belong to individual enterprise, differing in no way from other possibilities of gain and loss. For instance, prices rose, as indicated by an index number of 100 in 1860 to an index number of 216 in 1865. Therefore, in the United States, in this period of rising prices the creditor lost and the debtor gained. On the other hand, from 1865 to 1878, prices fell from 216 to 101, and in this period of falling prices the creditor gained and the debtor lost. It is to be observed, however, that these figures refer to actual quotations of prices during the fluctuations of our paper money. But it is evident in such movements as these, that parties to a time-contract must take their own chances of changes; and indeed it is much more wholesome that they should do so.

It should be kept well in mind that it is not a proper function of government to step in and save men from the ordinary risks of trade and industry. It goes without saying that if changes in the value of the standard due to natural causes take place during the continuance of a contract, it is not the business of government to indemnify either party to the contract. This is a matter on which every individual who enters into time obligations must bear his own responsibility.

[1] John Stuart Mill, Principles of Political Economy, Vol. II, pp. 17-23.

[2] Adapted from The Report of the Commission of the Indianapolis Convention, pp. 92, 93, 103, 104. The University of Chicago Press, 1898.

[3]Living in civilized communities, and accustomed to the use of coined metallic money, we learn to identify money with gold and silver; hence spring hurtful and insidious fallacies. It is always useful, therefore, to be reminded of the truth, so well stated by Turgot, that every kind of merchandise has the two properties of measuring value and transferring value. It is entirely a question of degree what commodities will in any given state of society form the most convenient currency, and this truth will be best impressed upon us by a brief consideration of the very numerous things which have at one time or other been employed as money. Though there are many numismatists and many political economists, the natural history of money is almost a virgin subject, upon which I should like to dilate; but the narrow limits of my space forbid me from attempting more than a brief sketch of the many interesting facts which may be collected.

Perhaps the most rudimentary state of industry is that in which subsistence is gained by hunting wild animals. The proceeds of the chase would, in such a state, be the property of most generally recognized value. The meat of the animals captured would, indeed, be too perishable in nature to be hoarded or often exchanged; but it is otherwise with the skins, which, being preserved and valued for clothing, became one of the earliest materials of currency. Accordingly, there is abundant evidence that furs or skins were employed as money in many ancient nations. They serve this purpose to the present day in some parts of the world.[Pg 11]

In the book of Job (ii, 4) we read, "Skin for skin, yea, all that a man hath will he give for his life"; a statement clearly implying that skins were taken as the representative of value among the ancient Oriental nations. Etymological research shows that the same may be said of the northern nations from the earliest times. In the Esthonian language the word râha generally signifies money, but its equivalent in the kindred Lappish tongue has not yet altogether lost the original meaning of skin or fur. Leather money is said to have circulated in Russia as late as the reign of Peter the Great, and it is worthy of notice, that classical writers have recorded traditions to the effect that the earliest currency used at Rome, Lacedæmon, and Carthage, was formed of leather.

We need not go back, however, to such early times to study the use of rude currencies. In the traffic of the Hudson's Bay Company with the North American Indians, furs, in spite of their differences of quality and size, long formed the medium of exchange. It is very instructive, and corroborative of the previous evidence to find that even after the use of coin had become common among the Indians the skin was still commonly used as the money of account. Thus Whymper says, "a gun, nominally worth about forty shillings, bought twenty 'skins.' This term is the old one employed by the company. One skin (beaver) is supposed to be worth two shillings, and it represents two marten, and so on. You heard a great deal about 'skins' at Fort Yukon, as the workmen were also charged for clothing, etc., in this way."

In the next higher stage of civilization, the pastoral state, sheep and cattle naturally form the most valuable and negotiable kind of property. They are easily transferable, convey themselves about, and can be kept for many years, so that they readily perform some of the functions of money.

We have abundance of evidence, traditional, written, and etymological, to show this. In the Homeric poems oxen are distinctly and repeatedly mentioned as the commodity in terms of which other objects are valued. The arms of Diomed are stated to be worth nine oxen, and are compared with those of[Pg 12] Glaucos, worth one hundred. The tripod, the first prize for wrestlers in the 23rd Iliad, was valued at twelve oxen, and a woman captive, skilled in industry, at four. It is peculiarly interesting to find oxen thus used as the common measure of value, because from other passages it is probable, as already mentioned, that the precious metals, though as yet uncoined, were used as a store of value, and occasionally as a medium of exchange. The several functions of money were thus clearly performed by different commodities at this early period.

In several languages the name for money is identical with that of some kind of cattle or domesticated animal. It is generally allowed that pecunia, the Latin word for money, is derived from pecus, cattle. From the Agamemnon of Æschylus we learn that the figure of an ox was the sign first impressed upon coins, and the same is said to have been the case with the earliest issues of the Roman As. Numismatic researches fail to bear out these traditions, which were probably invented to explain the connection between the name of the coin and the animal. A corresponding connection between these notions may be detected in much more modern languages. Our common expression for the payment of a sum of money is fee, which is nothing but the Anglo-Saxon feoh, meaning alike money and cattle, a word cognate with the German vieh, which still bears only the original meaning of cattle.

In the ancient German codes of law, fines and penalties are actually defined in terms of live-stock. In the Zend Avesta, as Professor Theodores ... informs me, the scale of rewards to be paid to physicians is carefully stated, and in every case the fee consists in some sort of cattle. The fifth and sixth lectures in Sir H. S. Maine's most interesting work on The Early History of Institutions, which has just been published, are full of curious information showing the importance of live-stock in a primitive state of society. Being counted by the head, the kine was called capitale, whence the economical term capital, the law term chattel, and our common name cattle.

In countries where slaves form one of the most common and valuable possessions, it is quite natural that they should[Pg 13] serve as the medium of exchange like cattle. Pausanias mentions their use in this way, and in Central Africa and some other places where slavery still flourishes, they are the medium of exchange along with cattle and ivory tusks. According to Earl's account of New Guinea, there is in that island a large traffic in slaves, and a slave forms the unit of value. Even in England slaves are believed to have been exchanged at one time in the manner of money.

A passion for personal adornment is one of the most primitive and powerful instincts of the human race, and as articles used for such purposes would be durable, universally esteemed, and easily transferable, it is natural that they should be circulated as money. The wampumpeag of the North American Indians is a case in point, as it certainly served as jewellery. It consisted of beads made of the ends of black and white shells, rubbed down and polished, and then strung into belts or necklaces, which were valued according to their length, and also according to their color and luster, a foot of black peag being worth two feet of white peag. It was so well established as currency among the natives that the Court of Massachusetts ordered in 1649, that it should be received in the payment of debts among settlers to the amount of forty shillings. It is curious to learn, too, that just as European misers hoard up gold and silver coins, the richer Indian chiefs secrete piles of wampum beads, having no better means of investing their superfluous wealth.

Exactly analogous to this North American currency, is that of the cowry shells, which, under one name or another—chamgos, zimbis, bouges, porcelanes, etc.—have long been used in the East Indies as small money. In British India, Siam, the West Coast of Africa, and elsewhere on the tropical coasts, they are still used as small change, being collected on the shores of the Maldive and Laccadive Islands, and exported for the purpose. Their value varies somewhat, according to the abundance of the yield, but in India the current rate used to be about five thousand shells for one rupee, at which rate each shell is worth about the two-hundredth part of a penny.[Pg 14] Among our interesting fellow-subjects, the Fijians, whale's teeth served in the place of cowries, and white teeth were exchanged for red teeth somewhat in the ratio of shillings to sovereigns.

Among other articles of ornament or of special value used as currency, may be mentioned yellow amber, engraved stones, such as the Egyptian scarabæi, and tusks of ivory.

Many vegetable productions are at least as well suited for circulation as some of the articles which have been mentioned. It is not surprising to find, then, that among a people supporting themselves by agriculture, the more durable products were thus used. Corn has been the medium of exchange in remote parts of Europe from the time of the ancient Greeks to the present day. In Norway corn is even deposited in banks, and lent and borrowed. What wheat, barley, and oats are to Europe, such is maize in parts of Central America, especially Mexico, where it formerly circulated. In many of the countries surrounding the Mediterranean, olive oil is one of the commonest articles of produce and consumption; being, moreover, pretty uniform in quality, durable, and easily divisible, it has long served as currency in the Ionian Islands, Mytilene, some towns of Asia Minor, and elsewhere in the Levant.

Just as cowries circulate in the East Indies, so cacao nuts, in Central America and Yucatan, form a perfectly recognized and probably an ancient fractional money. Travellers have published many distinct statements as to their value, but it is impossible to reconcile these statements without supposing great changes of value either in the nuts or in the coins with which they are compared. In 1521, at Caracas, about thirty cacao nuts were worth one penny English, whereas recently ten beans would go to a penny, according to Squier's statements. In the European countries, where almonds are commonly grown, they have circulated to some extent like the cacao nuts, but are variable in value, according to the success of the harvest.

It is not only, however, as a minor currency that vegetable[Pg 15] products have been used in modern times. In the American settlements and the West India Islands, in former days, specie used to become inconveniently scarce, and the legislators fell back upon the device of obliging creditors to receive payment in produce at stated rates. In 1618, the Governor of the Plantations of Virginia ordered that tobacco should be received at the rate of three shillings for the pound weight, under the penalty of three years' hard labor. We are told that, when the Virginia Company imported young women as wives for the settlers, the price per head was one hundred pounds of tobacco, subsequently raised to one hundred and fifty. As late as 1732, the legislature of Maryland made tobacco and Indian corn legal tenders; and in 1641 there were similar laws concerning corn in Massachusetts. The governments of some of the West India Islands seem to have made attempts to imitate these peculiar currency laws, and it was provided that the successful plaintiff in a lawsuit should be obliged to accept various kinds of raw produce, such as sugar, rum, molasses, ginger, indigo, or tobacco....

The perishable nature of most kinds of animal food prevents them from being much used as money; but eggs are said to have circulated in the Alpine villages of Switzerland, and dried codfish have certainly acted as currency in the colony of Newfoundland.

The enumeration of articles which have served as money may already seem long enough for the purposes in view. I will, therefore, only add briefly that a great number of manufactured commodities have been used as a medium of exchange in various times and places. Such are the pieces of cotton cloth, called Guinea pieces, used for traffic upon the banks of the Senegal, or the somewhat similar pieces circulated in Abyssinia, the Soulou Archipelago, Sumatra, Mexico, Peru, Siberia, and among the Veddahs. It is less easy to understand the origin of the curious straw money which circulated until 1694 in the Portuguese possessions in Angola, and which consisted of small mats, called libongos, woven out[Pg 16] of rice straw, and worth about 1-1/2d. each. These mats must have had, at least originally, some purpose apart from their use as currency, and were perhaps analogous to the fine woven mats so much valued by the Samoans, and also treated by them as a medium of exchange.

Salt has been circulated not only in Abyssinia, but in Sumatra, Mexico, and elsewhere. Cubes of benzoin gum or beeswax in Sumatra, red feathers in the Islands of the Pacific Ocean, cubes of tea in Tartary, iron shovels or hoes among the Malagasy, are other peculiar forms of currency. The remarks of Adam Smith concerning the use of hand-made nails as money in some Scotch villages will be remembered by many readers, and need not be repeated. M. Chevalier has adduced an exactly corresponding case from one of the French coalfields.

Were space available it would be interesting to discuss the not improbable suggestion of Boucher de Perthes, that, perhaps, after all, the finely worked stone implements now so frequently discovered were among the earliest mediums of exchange. Some of them are certainly made of jade, nephrite, or other hard stones, only found in distant countries, so that an active traffic in such implements must have existed in times of which we have no records whatever.

There are some obscure allusions in classical authors to a wooden money circulating among the Byzantines, and to a wooden talent used at Antioch and Alexandria, but in the absence of fuller information as to their nature, it is impossible to do more than mention them....

The date of the invention of coining can be assigned with some degree of probability. Coined money was clearly unknown in the Homeric times, and it was known in the time of Lycurgus. We might therefore assume, with various authorities, that it was invented in the mean time, or about 900 b. c. There is tradition, moreover, that Pheidon, King of Argos, first struck silver money in the island of Ægina about 895 b. c., and the tradition is supported by the existence of small stamped ingots of silver, which have been found[Pg 17] in Ægina. Later inquiries, however, lead to the conclusion that Pheidon lived in the middle of the eighth century b. c., and Grote has shown good reasons for believing that what he did accomplish was done in Argos, and not in Ægina.

The mode in which the invention happened is sufficiently evident. Seals were familiarly employed in very early times, as we learn from the Egyptian paintings or the stamped bricks of Nineveh. Being employed to signify possession, or to ratify contracts, they came to indicate authority. When a ruler first undertook to certify the weights of pieces of metal, he naturally employed his seal to make the fact known, just as, at Goldsmiths' Hall, a small punch is used to certify the fineness of plate. In the earliest forms of coinage there were no attempts at so fashioning the metal that its weight could not be altered without destroying the stamp or design. The earliest coins struck, both in Lydia and in the Peloponnesus, were stamped on one side only....

[3] W. Stanley Jevons, Money and the Mechanism of Exchange, D. Appleton and Company, New York, 1902, pp. 19-28, 54, 55.

[4]Many recent writers, such as Huskisson, MacCulloch, James Mill, Garnier, Chevalier, and Walras, have satisfactorily described the qualities which should be possessed by the material of money. Earlier writers seem, however, to have understood the subject almost as well.... Of all writers, M. Chevalier ... probably gives the most accurate and full account of the properties which money should possess, and I shall in many points follow his views.

The prevailing defect in the treatment of the subject is the failure to observe that money requires different properties as regards different functions. To decide upon the best material for money is thus a problem of great complexity, because we must take into account at once the relative importance of the several functions of money, the degree in which money is employed for each function, and the importance of each of the physical qualities of the substance with respect to each function. In a simple state of industry money is chiefly required to pass about between buyers and sellers. It should, then, be conveniently portable, divisible into pieces of various size, so that any sum may readily be made up, and easily distinguishable by its appearance, or by the design impressed upon it. When money, however, comes to serve, as it will at some future time, almost exclusively as a measure and standard of value, the system of exchange, being one of perfected barter, such properties become a matter of comparative indifference, and stability of value, joined perhaps to portability, is the most important quality. Before venturing, however, to discuss such complex questions, we must proceed to a preliminary discussion of the properties in question, which[Pg 19] may thus perhaps be enumerated in the order of their importance:

Since money has to be exchanged for valuable goods, it should itself possess value and it must therefore have utility as the basis of value. Money, when once in full currency, is only received in order to be passed on, so that if all people could be induced to take worthless bits of material at a fixed rate of valuation, it might seem that money does not really require to have substantial value. Something like this does frequently happen in the history of currencies, and apparently valueless shells, bits of leather, or scraps of paper are actually received in exchange for costly commodities. This strange phenomenon is, however, in most cases capable of easy explanation, and if we were acquainted with the history of every kind of money the like explanation would no doubt be possible in other cases. The essential point is that people should be induced to receive money, and pass it on freely at steady ratios of exchange for other objects; but there must always be some sufficient reason first inducing people to accept the money. The force of habit, convention, or legal enactment may do much to maintain money in circulation when once it is afloat, but it is doubtful whether the most powerful government could oblige its subjects to accept and circulate as money a worthless substance which they had no other motive for receiving.

Certainly, in the early stages of society, the use of money was not based on legal regulations, so that the utility of the substance for other purposes must have been the prior condition of its employment as money. Thus the singular peag currency, or wampumpeag, which was found in circulation among the North American Indians by the early explorers, was esteemed for the purpose of adornment, as already mentioned.... The cowry shells, so widely used as a small[Pg 20] currency in the East, are valued for ornamental purposes on the West Coast of Africa, and were in all probability employed as ornaments before they were employed as money. All the other articles [previously] mentioned ... such as oxen, corn, skins, tobacco, salt, cacao nuts, tea, olive oil, etc., which have performed the functions of money in one place or another, possessed independent utility and value. If there are any apparent exceptions at all to this rule, they would doubtless admit of explanation by fuller knowledge. We may, therefore, agree with Storch when he says: "It is impossible that a substance which has no direct value should be introduced as money, however suitable it may be in other respects for this use."

When once a substance is widely employed as money, it is conceivable that its utility will come to depend mainly upon the services which it thus confers upon the community. Gold, for instance, is far more important as the material of money than in the production of plate, jewellery, watches, gold-leaf, etc. A substance originally used for many purposes may eventually serve only as money, and yet, by the demand for currency and the force of habit, may maintain its value. The cowry circulation of the Indian coasts is probably a case in point. The importance of habit, personal or hereditary, is at least as great in monetary science as it is, according to Mr. Herbert Spencer, in morals and sociological phenomena generally.

There is, however, no reason to suppose that the value of gold and silver is at present due solely to their conventional use as money. These metals are endowed with such singularly useful properties that, if we could only get them in sufficient abundance, they would supplant all the other metals in the manufacture of household utensils, ornaments, fittings of all kinds, and an infinite multitude of small articles, which are now made of brass, copper, bronze, pewter, German silver, or other inferior metals and alloys.

In order that money may perform some of its functions efficiently, especially those of a medium of exchange and a store of value, to be carried about, it is important that it should be made of a substance valued highly in all parts of[Pg 21] the world, and, if possible, almost equally esteemed by all peoples. There is reason to think that gold and silver have been admired and valued by all tribes which have been lucky enough to procure them. The beautiful lustre of these metals must have drawn attention and excited admiration as much in the earliest as in the present times.

The material of money must not only be valuable, but the value must be so related to the weight and bulk of the material, that the money shall not be inconveniently heavy on the one hand, nor inconveniently minute on the other. There was a tradition in Greece that Lycurgus obliged the Lacedæmonians to use iron money, in order that its weight might deter them from overmuch trading. However this may be, it is certain that iron money could not be used in cash payments at the present day, since a penny would weigh about a pound, and instead of a five-pound note, we should have to deliver a ton of iron. During the last century copper was actually used as the chief medium of exchange in Sweden; and merchants had to take a wheelbarrow with them when they went to receive payments in copper dalers. Many of the substances used as currency in former times must have been sadly wanting in portability. Oxen and sheep, indeed, would transport themselves on their own legs; but corn, skins, oil, nuts, almonds, etc., though in several respects forming fair currency, would be intolerably bulky and troublesome to transfer.

The portability of money is an important quality not merely because it enables the owner to carry small sums in the pocket without trouble, but because large sums can be transferred from place to place, or from continent to continent, at little cost. The result is to secure an approximate uniformity in the value of money in all parts of the world. A substance which is very heavy and bulky in proportion to value, like corn or coal, may be very scarce in one place and over-abundant in another; yet the supply and demand cannot be equalised without great expense in carriage. The cost of conveying gold or silver from London to Paris, including insurance, is only about four-tenths of one per cent.; and[Pg 22] between the most distant parts of the world it does not exceed from 2 to 3 per cent.

Substances may be too valuable as well as too cheap, so that for ordinary transactions it would be necessary to call in the aid of the microscope and the chemical balance. Diamonds, apart from other objections, would be far too valuable for small transactions. The value of such stones is said to vary as the square of the weight, so that we cannot institute any exact comparison with metals of which the value is simply proportional to the weight. But taking a one-carat diamond (four grains) as worth £15, we find it is, weight for weight, 460 times as valuable as gold. There are several rare metals, such as iridium and osmium, which would likewise be far too valuable to circulate. Even gold and silver are too costly for small currency. A silver penny now weighs 7-1/4 grains, and a gold penny would weigh only half a grain. The pretty octagonal quarter-dollar tokens circulated in California are the smallest gold coins I have seen, weighing less than four grains each, and are so thin that they can almost be blown away.

If it is to be passed about in trade, and kept in reserve, money must not be subject to easy deterioration or loss. It must not evaporate like alcohol, nor putrefy like animal substances, nor decay like wood, nor rust like iron. Destructible articles, such as eggs, dried codfish, cattle, or oil, have certainly been used as currency; but what is treated as money one day must soon afterwards be eaten up. Thus a large stock of such perishable commodities cannot be kept on hand, and their value must be very variable. The several kinds of corn are less subject to this objection, since, when well dried at first, they suffer no appreciable deterioration for several years.

All portions of specimens of the substance used as money should be homogeneous, that is, of the same quality, so that equal weights will have exactly the same value. In order that we may correctly count in terms of any unit, the units must[Pg 23] be equal and similar, so that twice two will always make four. If we were to count in precious stones, it would seldom happen that four stones would be just twice as valuable as two stones. Even the precious metals, as found in the native state, are not perfectly homogeneous, being mixed together in almost all proportions; but this produces little inconvenience, because the assayer readily determines the quantity of each pure metal present in any ingot. In the processes of refining and coining, the metals are afterwards reduced to almost exactly uniform degrees of fineness, so that equal weights are then of exactly equal value.

Closely connected with the last property is that of divisibility. Every material is, indeed, mechanically divisible, almost without limit. The hardest gems can be broken, and steel can be cut by harder steel. But the material of money should be not merely capable of division, but the aggregate value of the mass after division should be almost exactly the same as before division. If we cut up a skin or fur the pieces will, as a general rule, be far less valuable than the whole skin or fur, except for a special intended purpose; and the same is the case with timber, stone, and most other materials in which reunion is impossible. But portions of metal can be melted together again whenever it is desirable, and the cost of doing this, including the metal lost, is in the case of precious metals very inconsiderable, varying from 1/4d. to 1/2d. per ounce. Thus, approximately speaking, the value of any piece of gold or silver is simply proportional to the weight of fine metal which it contains.

It is evidently desirable that the currency should not be subject to fluctuations of value. The ratios in which money exchanges for other commodities should be maintained as nearly as possible invariable on the average. This would be a matter of comparatively minor importance were money used only as a measure of values at any one moment, and as a medium of exchange. If all prices were altered in like proportion[Pg 24] as soon as money varied in value, no one would lose or gain, except as regards the coin which he happened to have in his pocket, safe, or bank balance. But, practically speaking, as we have seen, people do employ money as a standard of value for long contracts, and they often maintain payments at the same variable rate, by custom or law, even when the real value of the payment is much altered. Hence every change in the value of money does some injury to society.

It might be plausibly said, indeed, that the debtor gains as much as the creditor loses, or vice versa, so that on the whole the community is as rich as before; but this is not really true. A mathematical analysis of the subject shows that to take any sum of money from one and give it to another will, on the average of cases, injure the loser more than it benefits the receiver. A person with an income of one hundred pounds a year would suffer more by losing ten pounds than he would gain by an addition of ten pounds, because the degree of utility of money to him is considerably higher at ninety pounds than it is at one hundred and ten. On the same principle, all gaming, betting, pure speculation, or other accidental modes of transferring property involve, on the average, a dead loss of utility. The whole incitement to industry and commerce and the accumulation of capital depends upon the expectation of enjoyment thence arising, and every variation of the currency tends in some degree to frustrate such expectation and to lessen the motives for exertion.

By this name we may denote the capability of a substance for being easily recognised and distinguished from all other substances. As a medium of exchange, money has to be continually handed about, and it will occasion great trouble if every person receiving currency has to scrutinize, weigh, and test it. If it requires any skill to discriminate good money from bad, poor ignorant people are sure to be imposed upon. Hence the medium of exchange should have certain distinct marks which nobody can mistake. Precious stones, even if in other respects good as money, could not be so used, because[Pg 25] only a skilled lapidary can surely distinguish between true and imitation gems.

Under cognisability we may properly include what has been aptly called impressibility, namely, the capability of a substance to receive such an impression, seal, or design, as shall establish its character as current money of certain value. We might more simply say, that the material of money should be coinable, so that a portion, being once issued according to proper regulations with the impress of the state, may be known to all as good and legal currency, equal in weight, size, and value to all similarly marked currency....

[4] W. Stanley Jevons, Money and the Mechanism of Exchange, pp. 29-39. D. Appleton & Company, New York, 1902.

The essential idea of "legal tender" is that quality given to money by law which obliges the creditor to receive it in full satisfaction of a past debt when expressed in general terms of the money of a country. A debt is a sum of money due by contract, express or implied. When our laws, for instance, declare that United States notes are legal tender—and this is the only complete designation of a legal-tender money—for "all debts public and private," it must be understood that this provision does not cover any operations not arising from contract. Current buying and selling do not make a situation calling for legal tender; a purchaser cannot compel the delivery of goods over a counter by offering legal-tender money for them, because, as yet, no debt has been created.[6]

Contracts made in general terms of the money units of the country must necessarily often be interpreted by the courts. The existence of contracts calling for a given sum of dollars and the necessity of adjudicating and enforcing such contracts, require that there should be an accurate legal interpretation of what a dollar is. As every one knows, the name, or unit of account, is affixed to a given number of grains of a specified fineness of a certain metal. This being the standard, and this having been chosen by the concurring habits of the business world, it is fit that the law should designate that, when only[Pg 27] dollars are mentioned in a contract, it should be satisfied only by the payment of that which is the standard money of the community.

Since prices and contracts are expressed in terms of the standard article, it is clear that the legal-tender quality should not be equally affixed to different articles having different values, but called by the same name. This method would be sure to bring confusion, uncertainty, and injustice into trade and industry. No one who had made a contract would know in what he was to be paid. The legal-tender quality, then, should be confined to that which is the sole standard. And it is also obvious that when a standard is satisfactorily determined upon, and when various effective media of exchange, like bank notes, checks, or bills of exchange, have sprung up, the legal-tender quality should not be given to these instruments of convenience. They are themselves expressed in, and are resolvable into, the standard metal; so the power to satisfy debts should be given not to the shadow, but to the substance, not to the devices drawn in terms of the standard, but only to the standard itself, even though, as a matter of fact, nine-tenths of the debts and contracts are actually settled by means of these devices. So long as these instruments are convertible into, and thus made fully equal to, the standard in terms of which they are drawn, they will be used by the business community for the settlement of debts without being made a legal tender. And whenever they are worth less than the standard they certainly should not be made a legal tender, because of the injustice which in such a case they would work.

Having shown that the legal-tender quality is only a necessary legal complement of the choice of a standard, it will not be difficult to see that the state properly chooses an article fit to have the legal-tender attribute for exactly the reasons that governed the selection of the same article as a standard. The whole history of money shows that the standard article was the one which had utility to the community using it. As the evolution of the money commodity went on from cattle to silver and gold, so the legal-tender provisions naturally followed this course.

A state may select a valueless commodity as a standard,[Pg 28] but that will not make it of value to those who would already give nothing for it; and so, it may give the legal-tender quality to a thing which has become valueless, but that will not of itself insure the maintenance of its former value. This proposition may, at first, appear to be opposed to a widely-spread belief; but its soundness can be fully supported. It should be learned that a commodity, or a standard, holds its value for reasons quite independent of the fact that it is given legal recognition. It has happened that legal recognition has been given to it because it possessed qualities that gave it value to the commercial world, and not that it came to have these qualities and this value because it was made a legal tender.

A good illustration of this truth is to be found in international trade. Money which is not dependent on artificial influences for its value, and which is not redeemable in something else, is good the world over at its actual commercial value, not at its value as fixed by any legal-tender laws. It is not the legal-tender stamp that gives a coin its value in international payments. A sovereign, an eagle, a napoleon, is constantly given and received in international trade not because of the stamp it bears, but because of the number of grains of a given fineness of gold which it contains—the value of which is determined in the markets of the world. And an enormous trade among the great commercial countries goes on easily and effectively without regard to the legal-tender laws of the particular country whose coins are used.

By imposing the attribute of legal tender, however, upon a given metal or money, it may be believed that thereby a new demand is created for that metal, and that its value is thus controlled. And in theory there is some basis for this belief. It is, of course, true that, in so far as giving to money a legal-tender power creates a new demand for it (which without that power would not have existed) an effect upon its value can be produced. But this effect is undoubtedly much less than is usually supposed. It must be remembered that the value of gold, for instance, is affected by world influences; that its value is determined by the demand of the whole world as compared with the whole existing supply in the world. In order to affect the value of gold in any one country, a demand created[Pg 29] by a legal-tender enactment must be sufficient to affect the world-value of gold. Evidently the effect will be only in the proportion that the new demand bears to the whole stock in the world. It is like the addition of a barrel of water to a pond; theoretically the surface level is raised, but not to any appreciable extent.

It may now be permissible to examine into the extent to which a demand is created by legal-tender laws. If the article endowed with a legal-tender power is already used as the standard and as a medium of exchange, it is given no value which it did not have before. The customs and business habits of a country alone determine how much of the standard coin will be carried about and used in hand-to-hand purchases, and how much of the business will be performed by other media of exchange, such as checks or drafts. The decision of a country to adopt gold—when it had only paper before, as was the case in Italy—would create a demand for gold to an extent determined by the monetary habits of that country; and this demand has an effect, as was said, only in the proportion of this amount to the total supply in the world. This operation arises from choosing gold as the standard of prices and as the medium of exchange. To give this standard a legal-tender power in addition does not increase the demand for it, because the stamp on the coin does not in any way alter the existing habits of the community as to the quantity of money it will use.

But in case an equal power to pay debts is given to fixed quantities of two metals, while each quantity so fixed has a different metallic value but the same denomination in the coinage, Gresham's law is set in operation with the result that the cheaper metal becomes the standard. After this change has been accomplished, the legal tender has no value-giving force. When the cheaper metal has become the standard, its legal-tender quality does not raise the value of the coin beyond the value of its content. This cheaper standard, in international trade, would be worth no more in the purchase of goods because it bore the stamp of any one country. Prices must necessarily be adjusted between the relative values of goods and the standard with which they are compared. If the[Pg 30] standard is cheaper, prices will be higher, irrespective of legal-tender acts. Where two metals are concerned, then, the only effect of a legal-tender clause is an injurious one, in that the metal which is overvalued drives out that which is under-valued.

The example of an inconvertible paper, such as our United States notes (greenbacks) in 1862-1879, is still more conclusive. Although a full legal tender for all debts public and private, their value steadily sank until they were at one time worth only 35 cents in gold. In California, moreover, these notes, although legal-tender, were even kept out of circulation by public opinion. In short, the value of inconvertible paper can be but little affected by legal-tender powers. Its value is more directly governed, as in the case of token coins, by the probabilities of redemption.[7] As bearing on the point that the value of the paper was more influenced by the chances of redemption than by legal-tender laws, we may cite the sudden fluctuations in the value of our United States notes during the Civil War. With no change in the legal-tender quality and no change in the indebtedness which might be paid with such notes, their value frequently rose or fell many per cent. in a single day owing to reports of Federal successes or defeats in battle, which had a tendency to affect one way or the other the public estimate of the probabilities of an early resumption of specie payments. The fact that they were legal tender evidently had no effect whatever in maintaining their value.

In view of the evident fact that legal-tender acts do not preserve the value of money, it is clear that the demand created by such legislation must be insignificant. And this must be so in principle as well as in fact.

There is but one thing which the legal-tender quality enables money to do which it could not equally well do without being a legal tender; that is, to pay past debts. An examination, however, shows that this use of money is very small compared with its other uses. The amount of past debts coming due and which might be paid in any year, month or day is insignificant when compared with the total transactions of that[Pg 31] year, month or day—so very small as to lose all measurable value-giving power. In other words, the one thing which legal-tender money can surely do in spite of the habits, wishes or prejudices of the business community in which it exists, namely, cancel past debt, is infinitesimally small when compared with those other things which man wishes money to do for him. It is for this reason that it ceases to give value, and this is why history has shown so many instances where money endowed with legal-tender power has become utterly valueless. The legal-tender money is no longer money if it will not secure for man the things which are most important for his welfare, if it will not buy food, clothes and shelter; for it performs none of the functions of money except the subsidiary one of cancelling past debts.

Moreover, the obligatory uses of legal-tender money are in fact very inconsiderable. A law requiring a past debt to be satisfied with money of a certain kind has for its essence only the payment of something of a definite value, or its equivalent; in practice, it does not even bring about the actual use of a legal money, since the monetary habits of the community will not necessarily require the debt to be paid in such money. Take the extreme case of a judgment by a court against a defendant for fulfilment of a contract; in such an example, of all others, it would be supposed that legal money would be exacted. But even here, the judgment would most probably be satisfied by the attorney's check, or at most by a certified check. If such media of exchange are of common usage in the community they will be resorted to in practice even for legal-tender payments.

The necessity of paying that which would be mutually satisfactory to payer and payee also makes clear why the existence of a legal-tender money does not necessarily cause its actual use in payments. The business habits of the community are stronger than legislative powers. Business men will not as a rule take advantage of a legal-tender act to pay debts in a cheaper money, if they look forward to remaining in business. For, if, by taking advantage of legal devices they defraud the creditor, they cannot expect credit again from the same source; and since loans are a necessity of legitimate[Pg 32] modern trade, such action would ruin their credit and cut them off from business activity in the future. Gold was not driven out of circulation by paper money during the years 1862-1879 in California, because the sentiment of the business public was against the use of our depreciated greenback currency; and a discrimination was made against merchants who resorted to the use of paper.

Explanation has been given of the principles according to which legal-tender laws should be applied, if at all. It is not wholly clear that there is any reason for their existence. It may now be well to indicate briefly the origin of legal-tender provisions. It can scarcely be doubted that their use arose from the desire of defaulting monarchs to ease their indebtedness by forcing upon creditors a debased coinage. Having possession of the mints, the right of coinage vesting in the lord, the rulers of previous centuries have covered the pages of history with the records of successive debasements of the money of account. The legal-tender enactment was the instrument by which the full payment of debts was evaded. There would have been no reason for debasing coins, if they could not be forced upon unwilling creditors. It is, therefore, strange indeed that, in imitation of monarchical morals of a past day, republican countries should have thought it a wise policy to clothe depreciated money with a nominal value for paying debts. Although the people are now sovereign, they should not embrace the vices of mediæval sovereignty for their own dishonest gain in scaling debts.

[5] Report of the Monetary Commission of the Indianapolis Convention, pp. 131-7. The Hollenbeck Press, Indianapolis, 1900.

[6] "A contract payable in money generally is, undoubtedly, payable in any kind of money made by law legal tender, at the option of the debtor at the time of payment. He contracts simply to pay so much money, and creates a debt pure and simple; and by paying what the law says is money his contract is performed. But, if he agrees to pay in gold coin, it is not an agreement to pay money simply, but to pay or deliver a specific kind of money and nothing else; and the payment in any other is not a fulfilment of the contract according to its terms or the intention of the parties." 25 California 564, Carpenter vs. Atherton.

[7] For a contrary view, see Joseph French Johnson, Money and Currency, Chapter 13.—Editor.

[8]The greenbacks were an outgrowth of the Civil War. Soon after the opening of the struggle the Secretary of the Treasury negotiated a loan of $150,000,000 with Eastern banks. Partly because of Confederate successes and partly because of the failure of Secretary Chase to adopt a firm policy of loans supported by taxation, public credit greatly declined, and Government bonds became almost unsaleable. The outlook became alarming and depositors withdrew gold from the New York banks in such large amounts that specie payments were suspended, December 30, 1861. In February, 1862, Congress provided for the issue of $150,000,000 in United States notes or greenbacks. Bond sales proceeded slowly and a second issue of $150,000,000 of notes was authorised in July of the same year. As a result of "military necessity" a third issue of $100,000,000 was authorised January 17, 1863, and temporarily increased March 3 to $150,000,000. Provision was made for the reissue of the greenbacks and $400,000,000 were outstanding at the close of the war.

Depreciation of the greenbacks occurred at once and the value of gold as expressed in greenbacks was subject to almost constant change. During the year 1862 the premium varied from 2 to 32; in 1863 from 25 to 60; and in 1864 from 55 to 185. Among the most important political and economic factors which caused these fluctuations may be mentioned:

(1) The increase in the amount of the greenbacks. Each new issue was reflected in a rise in the premium.

(2) The condition of the treasury. The annual reports of the Secretary of the Treasury were anxiously awaited and their appearance caused a rise or fall of the premium according as the condition of the finances seemed gloomy or hopeful.

(3) Ability of the Government to borrow. The fate of a loan indicated public confidence or distrust.

(4) Changes in the officials of the treasury department. Secretary Chase's resignation, July 1, 1864, depressed the currency decidedly.

(5) War news. Every victory raised the price of currency and every defeat depressed it.

From 1862 to 1865 the premium on gold and the median of relative prices correspond so well that one cannot resist the conclusion that these changes were mainly due to a common cause, which can hardly be other than the varying esteem in which the notes of the Government that constituted the standard money of the country were held. If this conclusion be accepted, it follows that the suspension of specie payments and the legal-tender acts must be held almost entirely responsible for all the far-reaching economic disturbances following from the price upheaval which it is our task now to trace in detail.

Statistical evidence supports unequivocally the common theory that persons whose incomes are derived from wages suffer seriously from a depreciation of the currency. The confirmation seems particularly striking when the conditions other than monetary affecting the labour market are taken into consideration. American workingmen are intelligent and keenly alive to their interests. There are probably few districts where custom plays a smaller and competition a larger rôle in determining wages than in the Northern States. While labor organisations had not yet attained their present power, manual laborers did not fail to avail themselves of the help of concerted action in the attempt to secure more pay. Strikes were frequent. All these facts favored a speedy readjustment of money wages to correspond with changed prices.[Pg 35] But more than all else, a very considerable part of the labor supply was withdrawn from the market into the army and navy. In 1864 and 1865 about one million of men seem to have been enrolled. About one-seventh of the labor supply withdrew from the market. But despite all these favoring circumstances, the men who stayed at home did not succeed in obtaining an advance in pay at all commensurate with the increase in living expenses. Women on the whole succeeded less well than men in the struggle to readjust money wages to the increased cost of living.

It is sometimes argued that the withdrawal of laborers from industrial life was the chief cause of the price disturbances of the war period. This withdrawal, it is said, caused the advance of wages, and greater cost of labor led to the rise of prices. The baselessness of this view is shown by two well established facts—first, that the advance of wages was later than the advance of prices, and second, that wages continued to rise in 1866 after the volunteer armies had been disbanded and the men gone back to work.

Wage-earners, however, seem to have been more fully employed during the war than in common times of prosperity. Of course, the enlistment of so many thousands of the most efficient workers made places for many who might otherwise have found it difficult to secure work. Moreover, the paper currency itself tended to obtain full employment for the laborer, for the very reason that it diminished his real income. In the distribution of what Marshall has termed the "national dividend" a diminution of the proportion received by the laborer must have been accompanied by an increase in the share of some one else. Nor is it difficult to determine who this person was. The beneficiary was the active employer, who found that the money wages, interest, and rent he had to pay increased less rapidly than the money prices of his products. The difference between the increase of receipts and the increase of expenses swelled his profits. Of course, the possibility of making high profits provided an incentive for employing as many hands as possible.

After an examination of the change in the condition of the great mass of wage-earners, it may seem surprising that few[Pg 36] complaints were heard from them of unusual privations. This silence may be due in part to the fact that a considerable increase of money income produces in the minds of many a fatuous feeling of prosperity, even though it be more than offset by an increase of prices. But doubtless the chief reason is to be found in the absorption of public interest in the events of the war. The people both of the South and North were so vitally concerned with the struggle that they bore without murmuring the hardships it entailed of whatever kind. Government taxation that under other circumstances might have been felt to be intolerable was submitted to with cheerfulness. The paper currency imposed upon wage-earners a heavier tax—amounting to confiscation of perhaps a fifth or a sixth of real incomes. But the workingmen of the North were receiving considerably more than a bare subsistence minimum before the war, and reduction of consumption was possible without producing serious want. Accordingly the currency tax, like the tariff and the internal revenue duties, was accepted as a necessary sacrifice to the common cause and paid without protest by severe retrenchment.

In studying the influence of depreciation upon rent, it is necessary to use that term in its popular rather than in its scientific sense. This fact is less to be lamented, because the theorist himself admits that the distinction becomes sadly blurred when he attempts to deal with short intervals of time. Capital once invested in improvements can seldom be withdrawn rapidly. In "the short run," therefore, it is practically a part of the land, and the return to it follows the analogy of rent rather than of interest.

The renting landlord found that the degree in which he was affected by the fluctuations in the value of the paper money depended largely upon the terms of the contract into which he had entered. It is clear from a careful examination that the landlord who before suspension had leased his property for a considerable period without opportunity for revaluation[Pg 37] must have suffered severely if paid in greenbacks. The number of "dollars" received as rental might be the same in 1865 as in 1860, but their purchasing power was less than one-half as great. Somewhat less hard was the situation of the landlord who had let his property for but one or two years. At the expiration of the leases he had opportunities to make new contracts with the tenants.

In his capacity as special commissioner of the revenue, Mr. David A. Wells devoted some attention to the rise of rent. His report for December, 1866, says:

The average advance in the rents of houses occupied by mechanics and laborers in the great manufacturing centres of the country is estimated to have been about 90 per cent.; in some sections, however, a much greater advance has been experienced, as for example, at Pittsburgh, where 200 per cent. and upward is reported. In many of the rural districts, on the other hand, the advance has been much less. Mr. Wells later modified this estimate somewhat.

The advance in rents was greater in cities than in minor towns. In some cities—e. g., Cincinnati and Louisville—owners of workingmen's tenements appear to have been able to increase their money incomes rather more rapidly than prices advanced, but in Boston, Philadelphia, St. Louis, and in smaller towns, their money incomes appear to have increased more slowly than living expenses. These conclusions rest, however, on a narrow statistical basis.