The Project Gutenberg EBook of De Mortuis Nil Nisi Bona, by

Ernest Evan Spicer and Ernest Charles Pegler

This eBook is for the use of anyone anywhere at no cost and with

almost no restrictions whatsoever. You may copy it, give it away or

re-use it under the terms of the Project Gutenberg License included

with this eBook or online at www.gutenberg.org

Title: De Mortuis Nil Nisi Bona

Being a Series of Problems in Executorship Law and Accounts

Author: Ernest Evan Spicer

Ernest Charles Pegler

Contributor: D. F. de l'Hoste Ranking

Illustrator: E. T. Reed

Release Date: January 20, 2013 [EBook #41888]

Language: English

Character set encoding: ISO-8859-1

*** START OF THIS PROJECT GUTENBERG EBOOK DE MORTUIS NIL NISI BONA ***

Produced by tallforasmurf and the Online Distributed

Proofreading Team at http://www.pgdp.net (This file was

produced from images generously made available by The

Internet Archive/American Libraries.)

| BY THE SAME AUTHORS |

|

By SPICER and PEGLER. |

|

By ERNEST EVAN SPICER, F.C.A. |

|

By ERNEST C. PEGLER, F.C.A. |

|

By RANKING, SPICER and PEGLER. |

|

By RANKING and SPICER. |

Price 5/- net.

To

All Spinster Aunts and

Bachelor Uncles

who do their duty by

their Nephews and Nieces

in

Matters Testamentary

This Book is affectionately dedicated.

Three minor typographical errors were found and corrected, none affecting the sense of the text. The Foreword is in Latin. For the convenience of the reader it is repeated at the end of the file with an informal English translation added. A scanned image of a portion of the book's attractive cover is also preserved at the end of the document.

The drawings by E. T. Reed are linked to copies of higher resolution suitable for printing at 150ppi.

No one can say that our Motives are unworthy, for our object is to instruct. But there are some who may object to our Methods, and it is to such that we offer, not an apology, but an explanation.

A very large section of the Public cling to the belief that Law must be as dry as Dust, and Accounting as tedious as the Treadmill.

The truth is, it is not the Practice of Law or of Accounting that is uninteresting, but rather is it the Theory which is often rendered so by Teachers whom Providence never ordained to teach.

If, therefore, the employment of unorthodox methods helps to interest the Student in his subject, and to stimulate him to further effort, any apology would be out of place.

ERNEST EVAN SPICER.

ERNEST C. PEGLER.

60, Watling Street,

London, E.C.

January, 1914.

De mortuo illo quid dicam? "Nilnisi bonum" ut aiunt.

Sed quid si nil boni fecit? De bonis licet loqui.

At si nulla bona reliquit? De eo tacere decet: si neque bonum fecit nec bona acquisivit nil valet.

Sed si bona reliquit in sermonem hominum semper venit; vitia operta sunt; pecuniam fecit, illa quidem "non olet." Quem heredem instituit? Extraneis haec omnia livori proxima videntur. Te autem si tu aut cognatione aut affinitate propinquus exspectatio tenet. An mea interest? Si sic habet, quanti? Suave est ex magno tollere acervo; ejus pecunia quid non facere possim?

Siste, amice; aliquantulum cogita; supersunt multi cognati; fieri potest ut aut cum aliis bona partire debeas, aut exheredatus sis.

Gerrae! Sine dubio testamentum fecit: et cum ratione constat me alicuius rei legatarium esse. Nemo enim magis eum fovit; alii omnes cognati asseclae; solus eum amavi.

Insipiens, inter os et offam multa intervenire possunt. Audi de gente Fulvia fabellam: de multis mutato nomine narratur.

(In scena est coenatio Georgii Fusci, argentariorum interpretis. Fuscus, bene coenatus, alterum cyathum Falerni sorbillat. Accurrit uxor, commota; in manu litteras resignatas tenet).

U. Georgi!

F. Quid tibi nunc est? Num quid novi est?

U. Amita mea Maria decessit!

F. Bene! nunquam postea illud vile Sabinum necesse erit obsorbere: magnum est solatium.

U. At tu Georgi semper id laudasti!

F. Et tu simul filiaeque semper miratae estis Persicam illam detestabilem et psittacum dissonum, et laudibus extulistis: pretium fuit vetulae placere.

U. Esto: illa vero suavia erant. At hic mihi litterae a cognitore ejus Semaureo allatae: dicit se hodie vesperi te conventurum.

F. Demiror si testamentum fecit! Sin minus omnia ad te perveniunt, tu heres ex asse; cognati alii desunt.

U. Est quidem mariti nepos iste.

F. Nullus: tu sola heres: si intestata omnia ad te.

U. Tabulas vere fecit: cognitor scribit se te conventurum quia testamentum ad rem tuam maxime pertinet.

F. Mihi crede igitur! Aliquid magni tibi legavit: haud verisimile illam quidquam juveni Albo legasse: nunquam iliam observavit; homo nil est nisi pictor ignotus aut aliquid simile: uxorem quoque duxit quamdam inopem, et eis saepe amita tua subvenire debuit.

U. Fores pulsantur: advenit cognitor!

F. Dic famulae ut alteram cyathum ponat.

(Ingreditur Dominus Semaureus.)

Quid agis vir doctissime? Mea uxor dixit te venturum; nonne ob testamentum amitae ejus?

S. Sic res habet, Fusce; venio ad te quod hoc res tua maxime refert; et scio te onus suscepturum.

F. An sic habet? Vetulae illi multa bona provenere ut opinor.

S. Permulta: super haec te consulendum putavi. Hic mecum tabulas attuli ut eas inspicias.

F. Bene est; Dignissima erat; cui semper plurimum tribui. Falerni sume cyathum.

S. Benigne dicis; dimidium: bona venia uxoris tuae est mihi in animo summas testamenti reddere; ad illam quoque pertinet. (Testamenta allata resignat.)

Post nonnulla famulis legata ita instituit:

"Fratris filiae Mariae lego Persicam et Psittacum quae animalia tantopere admirata est, certa fiducia se illis hospitium praebituram; eidem etiam lego annulum meum gemmatum. Nepoti ejusdem Mariae viro Georgio Fusco lego omne quod in hypogaeo superest vinum illud Falernum quod semper laudabat."

F. (In malam rem.)

S. "Quod ad ceteras possessiones Georgius Fuscus heres esto ex asse: (subridet Fuscus et uxori in aurem susurrat "ita ut dixi.")

S. (Conversa tabula) "et rogo eum ut cum primum potuerit haereditatem adire, omnibus et fundis et mobilibus venditis, pecunias in cautionibus publica auctoritate factis collocet et fructus reddat nepoti mariti mei Jacobo Albo et uxori suae in aetatem aut utri eorum vita superarit: eis mortuis ut inter liberos eorum caput dividat: aut liberis sine prole defunctis caput reddat ad sodalitatem Anthropophagis Africanis informandis et nutriendis institutam: praemio sint fiduciario viginti in annum librae."

F. Anus odiosa et malefica! At enitar ut testamentum rescindatur; inofficiosi testamenti querelam instituam! Delira fuit!

S. Immo mentis omnino compos fuit, Improbe: sic summa fide clamabo et testabor. Verba tua pro tempore et re indecora. Tui piget me: evado.

F. Maria!

U. Georgi!

Uterque. Exsecrabilis Illa!

(Aulaeum tollitur.)

Charles Augustus Algernon de Jones "... he gave Five Thousand Pounds to London's Home for Lost and Straying Hounds."

And when Joseph was dead his son Benjamin took unto himself a Wife and they had issue, two Boys and one Girl.

Now the elder of these two Sons was comely to gaze upon and when he was yet two years from Man's Estate his Father said unto him, "My Son, your Father's Brother is old and nearing death. Take heed, therefore, lest his wealth be scattered amongst the Gentiles." And the Son answered, "Fear not, my Father, from henceforth I will be unto my Father's Brother as a Son."

But after Seven Days had passed away the Uncle died and all his Flocks and Herds were left to his Brother Benjamin's Children. And on the Seventh Day after the Brother's death, the Woman, whom Benjamin had taken to wife, gave birth to Twin Children, and after Seven more Days had passed, the Male Child sickened and died. And Benjamin wept for his Son and looked not upon the Child that lived, and refused all meat, so that he weakened, and after Seven more Days he was buried in the Tomb of his Fathers (near Shepherd's Bush).

N.B.—There were fortunately no further deaths in Benjamin's family, and the Uncle's Legacy to his "Brother's Children," which was valued for Probate at £12,000, was duly divided between them.

How much did each receive?

Sir Hazel Knut, Bart., died, and the whole of his Estate, after the payment of Estate Duty, Debts, and all expenses, amounted to exactly £15,000.

He bequeathed the following Legacies, all free of Duty except the Settled Property.

Lady Knut, his widow, £2,000.

Lady Knut also had the use of a Governess Cart, together with a Shetland Pony, for life, with remainder over to the Toddington Cottage Hospital. These were valued for Probate at £60, and the value of the life interest was computed at £12.

George Filbert (aged 12), a son of Lady Knut by a former husband, £200.

Selina Knut, daughter (aged 4), £1,200.

George Lightfoot, son-in-law, who married Sir Hazel's charming daughter Rose, £1,200. Rose predeceased Sir Hazel by 4 years, but the Twins survived. To each of these children Sir Hazel left One Thousand Guineas.

Mrs. Gubbins, Sir Hazel's aged mother, £1,000.

Mr. Gubbins, Stepfather to Sir Hazel, the Racehorse "Fleetfoot," aged 14, by Footrest out of Fleet Rabbit, valued at £19 19s. 0d.

Rev. Stirling Knut, nephew, £100.

And £50 each to the following:

Cutforth Crawley, Lady Knut's sister's son.

Lady Augusta Ramsbotham (sister-in-law, Lady Knut's eldest sister).

Dorothy Smith, who married Robert, Sir Hazel's eldest son, 3 months after the funeral.

The Residue of the Estate was left absolutely to Robert.

Show how much Sir Robert Knut inherited.

Mr. Mordecai Moribund was a pessimist during life and died a violent death. His facial appearance was much disfigured by a sad squint, and this affliction to his eyes contributed in no small degree to the tragedy which at once deprived Mrs. Moribund of a husband and a son. The son, a bright youth of twenty summers, had been sent down from Oxford University by the authorities rather as a warning to others than for any great offence which he had committed. Nevertheless, the disgrace was keenly felt by his mother, and it was for this reason that Mr. Moribund decided to take him for a trip to India, until time had healed the wound.

Arrived in India, Mr. Moribund promised his son, Morton, to arrange for a tiger shooting expedition. This fatal promise caused all the trouble, for Mr. Moribund, owing to his visual defects, thought he observed a tiger approaching from the west and forthwith discharged his rifle. The bullet missed the tiger and passed through the head of the unfortunate Morton, who was thereby killed on the spot. Mr. Moribund, horrified by the accident, moved his position and slid from the back of the elephant right into the jaws of the infuriated animal. Assistance was rendered immediately, and Mr. Moribund was rescued from his unfortunate position, but not before he had sustained injuries from which he succumbed four days subsequently.

Mr. Moribund, by his will, left everything of which he was possessed to his widow absolutely. This property, after deducting debts, amounted to £137,500, but an examination of his affairs disclosed the fact that two years previously he had conveyed as an absolute gift to his son, Morton, the sum of £100,000. This money had been invested by Morton in Bearer Bonds of the Royal Japanese Steamship Company at an average price of £80%, but on the date of Morton's death these Bonds stood at £120%. Morton, by will, had left his entire fortune to a Miss Flossie Teazle, an actress whom he had met at Oxford.

Show what duties were payable to the State as a direct consequence of the Tragedy.

Note.—The following epitaph, shamelessly copied from one in Malmesbury Abbey, was inscribed on Mr. Moribund's Tomb:—

It is a strange circumstance that little men with red hair usually have large families. At any rate Septimus Hawkins had red hair and twelve children, of whom eleven were living, but strangest of all he died intestate worth £122,600 subject to the payment of Estate Duty, and of which the Real property was valued at £36,000.

Mrs. Hawkins had been very beautiful in her younger days, but time and children had robbed her of her rosy cheeks; and realising that widow's weeds did not become her, she withdrew shortly after the funeral to the seclusion of a country life, where she spent her time ministering to the sick, and looking after her late daughter Pearl's two small children. The names of her children in chronological order were as follows:—

| 1. | P | earl. Died 1912 |

| 2. | E | dward. |

| 3. | R | ebecca. |

| 4. | S | elina. |

| 5. | E | mma. |

| 6. | V | era. |

| 7. | E | velyn. |

| 8. | R | ichard. |

| 9. | A | melia. |

| 10. | N | athaniel. |

| 11. | C | hlotilde. |

| 12. | E | rmyntrude. |

How should the property of the late Septimus Hawkins be distributed, and how much did the respective beneficiaries receive?

Very few men can state with any degree of accuracy how long they will live, but Nathaniel Hibbert told his Wife he would die at 8 o'clock in the morning of Tuesday, the 22nd April, 1913, and he did die at that very time on that very day. He was standing on some scaffolding when a platform gave way under his very feet, and he broke his spinal cord. In other words he was hanged. His Solicitor urged him to make a Will and the prison Chaplain added his earnest entreaties, but Mr. Hibbert turned a deaf ear to all such suggestions. Even the sight of his Wife and only child did not affect his determination, and he died intestate.

What happened to the £1,200 of which he died possessed?

Mr. Chicory loved his wife almost as much as Mrs. Chicory loved her husband. They had lived together for nearly forty years, and every Saturday morning throughout that long time Mr. Chicory had faithfully handed over to his wife his entire earnings, which were not much, and deducted only 5s. per week, which served as pocket money for Mr. Chicory, and enabled him to provide coals during the winter months, collection money at church, oil for the lamps, and sundry presents from time to time to his children, to say nothing of the Lame Crossing Sweeper.

Each week a small sum was deposited in the Post Office Savings Bank, and when Mr. Chicory died, not only had he to the credit of this account a balance of £108 0s. 10d., but his Cottage, which was valued at £90, was his own Freehold Property. He had made a Will and paid the Solicitor 10s. 6d. for drawing it up, and nobody could have read what he said about his old wife, to whom he left everything, without feeling a lump in the throat.

On the day of his funeral not one blind was undrawn in all the Cottages round about, and Mr. Michaelmas, the Carriage Builder, sent a landau specially for Mrs. Chicory. At least one hundred people went to the Church, where the good old Vicar read the Service, and the Lame Crossing Sweeper painted his broom-handle black.

Mrs. Chicory, some weeks later, paid the Solicitor another 10s. 6d., as a fee, and asked him to do the rest.

What did he do?

Men who are mean during life and who would grudge a present of 5s. to the postman at Christmas, or who would spend a whole day in another man's motor car and fail to tip the Chauffeur at the end of the journey, often prove very generous with their money when they die and can no longer enjoy the satisfaction of possession, which during lifetime they cherished so dearly.

Such creatures usually bequeath their property to Charitable Institutions at the expense of deserving relatives, who have, at any rate, in Equity, a claim to at least some small share thereof.

The Law of Italy corrects this injustice, and no man can will away at death the whole of his property to strangers, if he leaves a Widow or Relatives living of a nearer kinship than a First Cousin.

Now Vincentio Dorando was an Italian subject, whose nearest living relative was a First Cousin once removed. He had been educated at Oxford and had spent the greater portion of his life in England, but at the time of his death he was domiciled in France. He left no property of any sort in Italy or France, and no duties were found to be payable in either of these Countries. He had property in England, however, which consisted of £15,000 Japanese 41⁄2½ per cent. Bonds at 94, a Freehold House valued at £2,500, and some Furniture and Pictures which were stored at Messrs. Hudson's Repository, and which were valued for Probate at £480. The only debt due at death was a Tailor's Bill for £62.

He had made a perfectly valid Will in England, by which he bequeathed all his property, with the exception of his Real Estate, to his old Oxford friend, Mr. James Duncan, for life, with remainder over to Mr. Duncan's eldest son. He left the Freehold House to another Oxford friend, Mr. Wallstone.

Show what Duties were payable to the Inland Revenue Authorities upon the death of Mr. Vincentio Dorando.

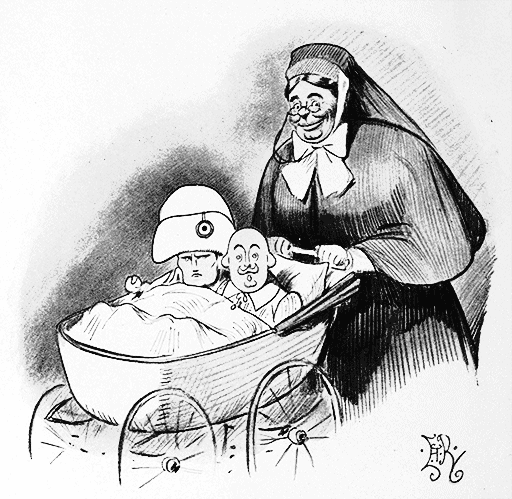

The Jollybuck Twins —as they appeared, no doubt, to Mrs. Jollybuck and the Nurse—prospective world-geniuses.

The Nurse described them as the most wonderful Twins she had ever seen; but then Monthly Nurses always speak in this way!

The Mother said that she had never known children exhibit such intelligence at so early an age; but then Mothers always think in that way, especially of their first!

The Father wanted to drown the yelling little brats, and had turned on both taps in the bathroom; but then Fathers always want to do something rash!

Altogether it was a very merry little family, and when the Twins were three months old and had been duly christened and vaccinated, Mr. Jollybuck called on his Solicitor and altered his Will so as to provide for the family which had been so anxiously hoped for and so long in coming.

But alas for Mrs. Jollybuck, for whom Widow's weeds were to be so soon necessary, and a plague on all false chemists who fail to label their blue bottles "With Care." Mr. Jollybuck swallowed Carbolic Acid instead of Ipecacuanha Wine, and after the payment of Estate Duty, Debts and all Expenses, except Legacy Duty, his Estate consisted of £16,000 Cash on Deposit at the London, City and Midland Bank, £15,000 India 31⁄2% Stock at 92, and Furniture valued at £500. By his Will he left:

(a) India Stock and the Furniture to his Widow, free of Duty.

(b) £6,000 to his Widow.

(c) £12,000 and the Residue of his Estate to his only Son.

(d) £12,000 to his Brother.

(e) £500 to his only Daughter.

Draw up a Statement showing the amount each beneficiary under Mr. Jollybuck's Will is entitled to receive.

Family Trees are almost as interesting to study as Bradshaw, and, at any rate in this case, quite as instructive. In fact, without a Tree it is almost impossible to remember who Mrs. Gubbins really was.

The following, which eliminates all irrelevant matters, gives the descendants of George Gubbins, the founder of the family:—

GENEALOGICAL TREE OF THE GUBBINS FAMILY

George Gubbins

_____________________|___________________

| | | |

George John Charles Oscar

| | | |

John George Oscar Charles

| | | ____________|_____________

| | | | | | |

George John Charles Rose Violet Daisy Poppy

Now John Gubbins, the grandson of George Gubbins, founder of the Gubbins Family, married Elizabeth Greatheart, on Christmas-Day, and on the anniversary of their wedding day little George Gubbins first saw the light. But little George knew not his father, for John Gubbins died when George was but two months old.

In his Will John Gubbins appointed his Cousin, George Gubbins, to be his executor, and thus it was that George Gubbins was brought into close touch with the Widow Gubbins.

Friendship ripened into love and resulted in Mrs. John Gubbins becoming Mrs. George Gubbins. In due course Mrs. George Gubbins presented her husband with a little boy, who was christened John after his first cousin once removed.

Little John grew in grace and played very prettily with little George Gubbins, who was his stepbrother and second cousin rolled into one, and altogether it was a very happy little party, until one day little John's Father, George Gubbins, was knocked down by a Steam Roller just in front of his own house, and was rolled into his own gravel drive.

Now the Steam Roller belonged to a Company, of which Oscar Gubbins, son of Charles Gubbins and grandson of George Gubbins the Founder of the Family, was a Director.

Hearing of the accident he hastened to comfort the Widow in her affliction, and succeeded so well that after a decent interval had elapsed Mrs. George Gubbins became Mrs. Oscar Gubbins.

A child was born two years later, three months prior to the death of Oscar Gubbins, the Father. The little boy was christened Charles, and after the funeral of Oscar Gubbins, Mrs. Gubbins took her three little boys, George, John and Charles, to Ventnor, in the Isle of Wight, for a change of air.

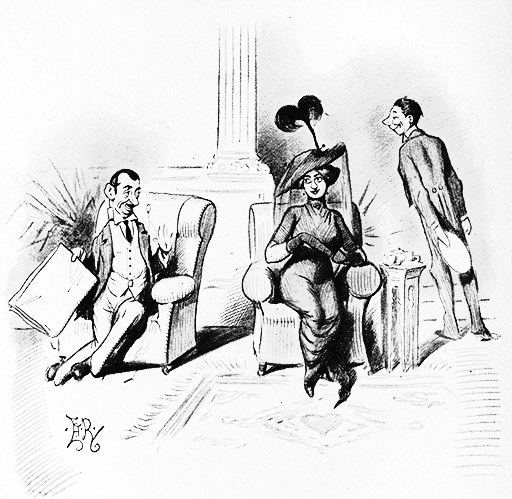

It was in the lounge of the Sea View Hotel at Ventnor that Mrs. Gubbins met Mr. Charles Gubbins, first cousin to her three late husbands.

Now Mr. Gubbins had ofttimes heard of the much-weeded Widow, but when he saw her for the first time with the naked eye, he realised what happy men John, George and Oscar Gubbins must have been.

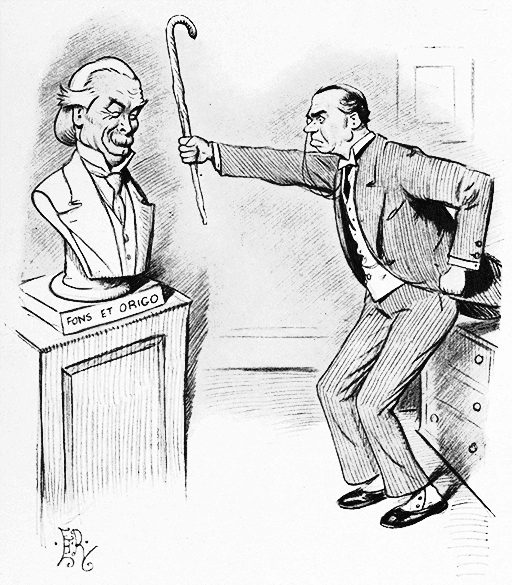

"When Mr. Charles Gubbins saw her for the first time with the naked eye, he realised what happy men John, George and Oscar Gubbins must have been."

And when Mrs. Gubbins first saw Mr. Charles Gubbins she thought how empty widowhood really was, and what fine men were the Grandsons of George Gubbins, Founder of the Gubbins Family.

Such feelings were not to be denied, and after three months of courtship Mr. Charles Gubbins and Mrs. Oscar Gubbins were declared man and wife by the Rev. Stephen Collins.

For 10 years Mr. and Mrs. Charles Gubbins lived together as happily as a married couple could, and four beautiful daughters, Rose, Violet, Daisy and Poppy were born to them.

And then Mrs. Gubbins died intestate leaving Personal Property valued for Probate at £12,000, and Real Property valued at £8,000.

How was this divided?

Some people say there is no romance in business and that a Brass Plate never brings Clients. Don't you believe that for one moment. Why, Jones owed all his misfortunes in life to a Brass Plate and a Motor 'Bus! It happened as follows:—

Mrs. James Wardle's Husband died on the 30th April, 1914. He was always called Mrs. Wardle's Husband, and he very properly left her his entire fortune, which, at his death, consisted of the following property:—

Freehold Property valued at £6,500, subject to a Mortgage of £4,500 at 5% per annum. The Interest was paid up to the 31st March, 1914.

£3,500 Local Loans 3% Stock quoted at 86-88.

£2,750 23⁄4% Annuities quoted at 77-8.

£2,000 Caledonian Railway Consolidated 4% Stock quoted at 98-100 cum. div.

£800 3% Bradford Corporation Stock quoted at 951⁄2-965⁄8 cum. div.

Life Policies and Bonuses £1,575.

Household Furniture £350.

£1,500 Loan at 5% per annum. The Interest had been received up to 31st December, 1913.

Sundry Debts due to Testator, £346.

Sundry Debts due by Testator, £550.

Funeral Expenses, £42.

Mr. Wardle had for many years left his affairs entirely in the hands of his Solicitor, but Mrs. Wardle, who was Sole Executrix, thought—and very properly too—that the combination of a Solicitor and a Professional Accountant was to be preferred. She therefore journeyed to the City with the intention of consulting her Stockbroker on the matter, but by a curious Providential dispensation, the Motor Omnibus broke down just opposite Jones' office, and his Brass Plate attracted the Sweet Lady's attention!

He prepared the Estate Duty Account, the affidavit being delivered on the 31st July, 1914, and he is now Mrs. James Wardle's Second Husband.

Do as Jones did, but ignore Income Tax, and beware of Widows.

Julius Jones was a poet, and although he died prematurely on the 30th June, 1914, his name will be remembered by posterity as the author of the beautiful Hymn, of which the first line runs "Farewell, old buck, we part to meet again!"

He left the following Estate:—

| Cash at Bank | £1,500 |

| Household Furniture | 350 |

| Life Policies | 2,000 |

| Securities valued at death at | 18,650 |

| Freehold Property | 8,500 |

| £31,000 |

Liabilities at death were £200, and Funeral Expenses amounted to £30. Legal Expenses were also paid, amounting to £170.

The Securities and the Furniture realised £19,000 and £300 respectively.

A Legacy of £500 was left to his Nephew (free of duty).

The eldest Son of the Testator (Patrick) was given the option by the Will to take over the Freehold Property at £7,500, which he elected to do. The residue of the Estate was to be divided equally between the three children of the Testator:—

Patrick,

Peter,

Paul,

but he directed that the amounts of £3,000 £2,000 and £1,000 advanced to them respectively on the 1st June, 1911, were to be brought into hotchpot.

Prepare an Account showing the division of the residue, taking into account the Duties payable, but ignoring Interest on Advances.

It would be indelicate to indicate the exact portion of Mr. Hobson's anatomy that was so fiercely attacked by the mad dog, but it is sufficient to say that the bite was the indirect cause of his death.

He anticipated the end, for shortly before he passed away he called in his Solicitor, Mr. Crawley, and made a fresh Will, which was duly witnessed by his aged Housekeeper, Mrs. Uskins, and the Gardener.

The Estate, which consisted entirely of Personal Property, comprised:—

(1) Share in the firm of Hobson Bros., £11,500.

(2) Bonds to Bearer valued at £6,300.

(3) Cash at Bank £220.

The debts due by deceased, including a Loan from the Bank secured on the Bonds to Bearer, amounted to £3,160, and the Funeral Expenses came to £42.

The Property was bequeathed as follows:—

Mrs. Hobson (Widow), £2,500.

George Hobson (Son, aged 27), £2,000.

Selina Hobson (Daughter, aged 18), £2,000.

Wickham Crawley (Solicitor), £200.

Maria Hawkins (Niece, aged 28), £1,000.

George Hobson, Junr. (Grandson, aged 4), £1,500.

Mrs. Uskins (Housekeeper), £500.

Mrs. Rumbolt (Deceased Brother's Wife), £500.

Mrs. Hobson, Senr. (Deceased's Mother), £2,000,

and the Residue to the Widow absolutely.

Prepare a Distribution Account.

Solomon Solfar was a solemn man, and his Will was proved in solemn form. He died quietly in his bed on the 1st April, 1912, leaving a Widow, two Sons (Matthew and Mark), and one Daughter (Mary).

On the 1st April, 1913, after all Debts, Testamentary and other Expenses had been paid, the Estate consisted as follows:—

£6,000 23⁄4% Annuities at 765⁄8.

£2,000 Swansea Corporation 3% Stock at 83 (Interest payable 1st January and 1st July).

£6,000 London and North Western Consolidated 4% Stock at 103 (Dividends payable 15th February and 15th August).

1,000 Birmingham Small Arms Cum. 5% Preference Shares of £5 each at £51⁄4 (Dividends payable 1st March and 1st September).

£5,000 British Westinghouse 4% Debenture Stock at 63 (Interest payable 1st January and 1st July).

Mr. Solfar made during his lifetime advances of £500 to each of his Sons, which at his death were brought into Hotchpot, and interest charged thereon at 5% per annum. He directed his Estate to be left in Trust, the Income to be applied, first in payment of £75 a quarter to Mrs. Solfar, and the balance to be distributed half-yearly in equal shares to Matthew, Mark and Mary.

Write up the books of the Trust, ignoring Income Tax, for the year ending 31st March, 1914, the balance of Income in hand on 1st April, 1913 (after making all necessary payments to the beneficiaries) being £12 0s. 0d.

The life of Hezekiah Hopkins had been a warning rather than an example to others, and the administration of his affairs at death caused his Executors and Trustees to use words which are only permissible amongst gentlemen when the ladies have withdrawn from the dinner table.

Mr. Hopkins died on the 25th June, 1913.

His Will had been proved, Estate Duty and Legacy Duty had been paid, but the Trust could not be closed owing to the fact that the Residuary Estate had been left to Nathaniel Hopkins, a nephew, for life with remainder over to the said Nathaniel's eldest god-son Walter Blackside, subject to an annuity of £200 which the Testator had covenanted to pay to the "Pride of Bristol," a prize fighter, who had acted as bodyguard to Mr. Hopkins during that gentleman's earthly peregrinations.

The Residuary Estate consisted of the following property:—

(1) Leasehold Property having 30 years to run, producing £900 per annum. The property, which was valued for probate at £15,000, and which was subject to a Ground Rent of £100 per annum, was sold on on the 24th June, 1914, for £16,400 and the proceeds invested on the following day in Consols at 73, including brokerage, &c.

(2) Deceased's Share in the firm of Hezekiah Hopkins &Co. This amounted to £18,000 upon the death of Mr. Hopkins, and, according to the Partnership Deed, was to be paid out by instalments of £6,500 a year including interest at 5% on the unpaid balances. The first instalment was to be paid on the first anniversary of deceased's death.

(3) A Reversionary Interest in the Estate of his Uncle Mr. John Oppit, the life interest of which was being enjoyed by Mrs. Oppit. This Reversionary Interest was valued, at the death of Mr. Hopkins for probate purposes, at £850, and was retained until the 25th June, 1916, when it fell into possession. It then consisted of £1,500 India 31⁄2% at 88.

(4) £10,000 invested in a Loan redeemable on the 24th June, 1915, with interest at 10% per annum payable half-yearly on the 25th December and the 24th June in each year.

The Trustees decided on their own responsibility to retain this investment, which was redeemed on the due date and the interest paid in the meanwhile.

(5) £10,000 India 3% Stock at 84, purchased by Deceased on 18th June, 1913.

Upon the 25th June in each year the balance of Corpus Realised was to be placed on deposit with the Hong Kong and Shanghai Bank at 4%, less any fraction of £100 which was to be retained on Current Account at the Union of London and Smith's Bank.

Mr. Nathaniel Hopkins died on the 25th June, 1916.

Write up the books showing the position of affairs when Mr. Blackside came into the property, ignoring Income Tax.

Mrs. Wiggins was the Life Tenant and Mr. Gilbert Gunter was the Remainderman of the Property left by the late Ebenezer Wiggins.

Mr. Gunter had begun to despair of ever enjoying the fruits of Mr. Wiggins' generous intentions, when, fortunately for him, on the 14th March, 1914, Mrs. Wiggins got a fish bone lodged in her gullet and died two hours later.

The Accounts had been prepared regularly on the 21st September each year, the anniversary of Mr. Wiggins' death, and the following is the Balance Sheet, dated 21st September, 1913:—

| EBENEZER WIGGINS Decd. | |||||||

| Dr. | Balance Sheet, 21st September, 1913. | Cr. | |||||

| £ | s. | d. | £ | s. | d. | ||

| To Estate Account | 33,900 | 0 | 0 | By Investments: | |||

| To Income Account | 125 | 0 | 0 | India 3 per Cent.: £25,000 at 72 | 18,000 | 0 | 0 |

| Chili 4 per Cent.: £5,000 at 90 | 4,500 | 0 | 0 | ||||

| London United Tramways: £10,000 4 per Cent. Debentures at 70 | 7,000 | 0 | 0 | ||||

| West African Trading Co., Ltd.: 1,000 Shares £1 each fully paid | 1,000 | 0 | 0 | ||||

| Freehold House | 2,600 | 0 | 0 | ||||

| Furniture and Effects | 800 | 0 | 0 | ||||

| Cash at Bank | 125 | 0 | 0 | ||||

| 34,025 | 0 | 0 | 34,025 | 0 | 0 | ||

Mr. Gunter requires Accounts to be prepared, showing the position of affairs at the 14th July, 1914, and volunteers the following information:—

(1) The Investments remain unaltered, with the exception of the India 3% Stock, which was sold on the 10th January, 1914, and the proceeds, viz., £18,500, were invested in a Mortgage at 5% Interest payable half-yearly on the 10th July and 10th January each year.

(2) The Coupons on the Chili 4% Bonds are payable on the 1st April and 1st October, and the Interest on the London United Tramway Debenture Stock on the 1st January and 1st July in each year.

(3) On 3rd July, 1914, a Final Dividend at the rate of 15% per annum, free of Tax, was declared by the West African Trading Company, Ltd., and paid on the 8th July, 1914, making, with the interim dividend paid on the 10th January, 1914, 10% for the year ended 30th June, 1914, free of tax.

(4) The Freehold House was let on a full repairing lease at an annual rental of £146, the assessment was also £146. The rent is payable quarterly on the usual quarter days.

(5) The Trustees had paid to the late Mrs. Wiggins £75 on account of income on the 12th day of each month, including March, 1914.

(6) The Professional Accountant's fee for writing up the books from the 22nd September, 1913, to 14th July, 1914, and making the necessary adjustments was agreed at 100 guineas, and this fee was to be apportioned between Mr. Gunter and the Estate of Mrs. Wiggins deceased equally.

Write up the Accounts for the period, making the necessary adjustments, and prepare Balance Sheet dated 14th July, 1914, showing the amount due.

Mr. Montagu Summers had a conscientious objection to the Income Tax, and a positive loathing of the Super-Tax, and the trouble lay in the fact that he had amassed a considerable fortune in the City of London.

Something had to be done, however, to relieve Mr. Summers of a portion of this scandalous taxation, and so, converting as much of his property into cash as he could spare, he invested the same in various ways in other countries.

He bought Russian 41⁄2% Bonds in Holland of the nominal value of 200,000 Guilders, and a Freehold Farm near Amsterdam, which cost in English money about £8,000.

He bought Freehold Land in Canada, for which he paid £80,000, and deposited with the Calgary Investment &Security Trust $300,000 at 5%.

He lent on Mortgage in New Zealand £40,000, and he had a balance of Fcs. 8,600 to his credit at the Swiss Bankverein, Berne.

"Mr. Montagu Summers had a conscientious objection to the Income Tax, and a positive loathing of the Super-Tax."

On the 14th November, 1913, Mr. Summers died of blood poisoning, the result of cutting a corn with a blunt razor.

His property in England consisted of his Furniture and Effects valued at £3,800, Cash balance at the London, City &Midland Bank, Queen Victoria Street, £300, and his interest as a Partner in the firm of Montagu Summers &Nephew, which was agreed at £32,640.

The Russian Bonds were sold on the Amsterdam Exchange for 180,000 Guilders, the Farm was valued at 112,800 Guilders, and the Land in Canada was estimated for duty purposes at $122,000.

Assuming the Death Duties in Holland to be 5%, in Switzerland nil, and the rates in the Colonies to be similar to what they are in this Country, show what Estate Duty would be payable in England.

The rates of Exchange can be taken as follows:—

Holland—12 Guilders = £1

Switzerland—25 Francs = £1

Canada— 5 Dollars = £1

All accruing income to be ignored.

Mr. Harold Wimpole died in his Opera Hat, and was buried in Willesden Cemetery.

His Will had been proved, Estate Duty had been paid, and the Widow, who was the sole Beneficiary, had found considerable consolation in the £56,200 which had come to her.

This £56,200 represented the Gross Estate, less Debts due by Mr. Wimpole at his death £1,416, Funeral Expenses £39 17s. 0d. which were regarded by all, including the Inland Revenue Authorities, as most reasonable, Estate Duty, Interest on Estate Duty £31 16s. 0d., Testamentary Expenses £140 3s. 0d. and Legacy Duty.

Eight months had passed away and the rules of Society permitted Mrs. Wimpole to smile occasionally; the Curate, who took an extraordinary interest in Mrs. Wimpole's salvation and the carving of an ancient Japanese Cabinet, had called for tea. The Reverend gentleman, with a sandwich in his hand, was recording the incidents connected with the birth of Buddha, when his fingers happened to touch the spring of a secret drawer in the aforementioned Cabinet.

The Curate looked at the Widow, and the Widow looked at the Curate, and there they stood together, hand in hand, like two young children, in silent amazement, for the secret drawer in the Japanese Cabinet disclosed 25 41⁄2% Foreign Government Bonds to Bearer, of the nominal value of £500 each, and several memoranda of Stock Exchange dealings between Mr. Wimpole and his Broker. The coupons were payable on the 10th March, and the 10th September in each year, and the last coupon which had been cut off was dated 10th September, 1912, exactly 8 months previous to the death of Mr. Wimpole. Mrs. Wimpole consulted the Reverend Oscar Veritas long and earnestly over the matter, and the Reverend Oscar admitted that it was a case necessitating very great firmness of character and honesty of purpose. Ultimately, however, he arrived at the conclusion that Mrs. Wimpole would be unworthy to bear his name in the future, unless she did her duty in the present instance.

What was the pecuniary value of the good man's conclusions to the Inland Revenue in the matter of Estate and Legacy Duty, bearing in mind the fact that the Bonds stood at 92 on the day of Mr. Wimpole's death, and 90, ten months later when Mrs. Wimpole's Solicitor finally settled the matter?

Note.—The Honeymoon was spent in Japan.

Sir Robert Rushforth, J.P., was a big man with a big heart and a wooden leg. He had inherited a fortune, gone bankrupt, and married a Widow, and if anyone had told him he wasn't a sportsman he would have called that individual a liar, and opened a second bottle.

He died on the 4th June, leaving all his property to his Widow, with the exception of his wooden leg, which he directed to be handed over to the Royal Hospital for Incurables, at Putney.

Such was the man, and the contents of his Will so exactly reflected the character of her husband that Lady Rushforth at once had recourse to the smelling salts on reading the document.

He directed the debts, from which he had obtained a legal discharge in Bankruptcy, to be paid in full, he forgave all his Debtors, and instructed his Widow, whom he had appointed sole Executrix and Residuary Legatee, to meet in full all his Gaming Debts. He further directed that a certain debt, in respect of which he had pleaded in his younger days the Statutes of Limitation, should be paid in full.

The name of this latter creditor was Gunter, and the debt, amounting to £25, was in respect of repairs to certain pigsties.

The discharge from Bankruptcy had been obtained by Sir Robert eight years previous to his death. His liabilities had amounted to £16,200, and he had paid 2s. 6d. in the £.

He owed his bookmaker, Mr. Hollins, of Houndsditch, £200.

He had lent his Vicar, the Rev. Aaron Cranium, £100, his sister Blanche £300, and his intimate but impecunious friend, Mr. Algernon O'Gizzard, £50. This latter loan was rendered necessary by reason of the fact that Mr. O'Gizzard had stood bail for a friend who had got into trouble with the police, and who failed to put in an appearance before the Magistrates on the day appointed. Now, Sir Robert happened to be on the Bench that morning, and ordered the bail to be estreated before he realised with whom he was dealing.

Apart from the above property Sir Robert left Personal Estate valued at £62,000. There was no Real Property.

Show what Estate Duty and Legacy Duty were payable upon Sir Robert's death.

Note.—The wooden leg was returned by the Secretary of the Royal Hospital for Incurables at Putney, and being found to be of no intrinsic value was eventually deposited in the family Mausoleum at Norwood.

Mr. James Hotchkiss died in the autumn of age on the morning of his 93rd birthday.

During his protracted life he had always surrounded himself with every comfort, and was reputed to be an exceedingly rich man.

No wonder then that his death should occasion an unparalleled outburst of grief and hatbands on the part of his weeping relatives.

After the funeral, the chief mourners met in the library and the Family Solicitor, with a glass of wine within easy reach, read out the last Will and Testament of James Hotchkiss Deceased.

This interesting document brought a ray of comfort to bleeding hearts, for several substantial Legacies were mentioned, all free of duty, and two at least of the prospective Legatees were observed to make rapid calculations on the left shirt cuff.

"To Rachel and Joyce Proudfoot (my sister's little girls, aged 32 and 27 respectively), £10,000 each."

Joyce: "Think of it, Rachel!! Ten thousand pounds!!! Why the young fellows will simply chase us!!!"

To Sophia Hotchkiss ("my own dear Wife") the deceased left his Horses, Carriages, Motor Car, Household Furniture, Pictures, including the Landscape by Earp, Linen, Plate, Glass, &c., absolutely.

To George Proudfoot ("my dear sister's only son") the deceased left his Hornèd Cattle, i.e., Cows, and £20,000.

To Rachel and Joyce Proudfoot ("my sister's little girls"), the deceased bequeathed £10,000 each. The Misses Proudfeet were aged 32 and 27 respectively.

To Richard, William and Algernon Hotchkiss ("my never-to-be-forgotten brother's sons") the deceased left £20,000 each, and to John Willett ("my faithful valet"), £2,000.

The Residue of the Estate was bequeathed absolutely to the Widow.

The Executors lost no time in having the Property valued and the debts due by the deceased at his death, ascertained, and their efforts disclosed "a very lamentable state of affairs," at least, such was the opinion expressed by the Reverend Stephen Collins who had called to comfort the Widow in her affliction.

The Horses, Carriages, Motor Car, &c., including the Landscape by Earp, were valued at £2,000; the Hornèd Cattle, i.e., the Cows, were put down at £400, and the rest of the Property at £40,893 16s 0d.

The Debts due by the deceased amounted to £1,720 0s. 0d., and the Funeral Expenses to £339 7s. 0d. These latter were considered unreasonable by the Inland Revenue Authorities, and in spite of several very eloquent appeals addressed to them by the Executors, including a touching letter from the Reverend Stephen Collins dealing with the blameless life of the deceased, the amount allowed was fixed at £33 16s. 0d.

The Testamentary Expenses, exclusive of Estate Duty, amounted to £186 13s. 0d.

What amount was eventually received by each Legatee?

"At the age of 16 he made the acquaintance of Miss Harriett Hopkins. In the following spring he had successfully reached the 'Walking-out' stage."

Mr. and Mrs. Turvey were justly proud of their son "'Erbert." He was their only child, and always wore a Frock Coat, Brown Boots and White Spats on Sunday. In fact, as everyone said, he gave a tone to Bethnal Green.

But the ways of Providence are strange, and it is futile to seek for explanations where none are vouchsafed. It is enough to say that Mr. Herbert's anatomy came into violent contact with a brewer's dray one Thursday afternoon, and that a promising young life was cut short at the early age of 19.

His Life Story has yet to be written, and it is but the barest outline that can be here recorded.

At the age of 16 he made the acquaintance of Miss Harriett Hopkins. In the following spring he had successfully reached the "walking out" stage. He was formally engaged at the age of 17 and at 18 he was married. Six weeks before he died he made two very remunerative investments. He borrowed from his Employers—without worrying them about so small a matter—the sum of £6, which he converted into £600 by successfully backing "Hump Back" at 100 to 1 for the "Cesarewitch." He also insured his life for £100.

Having satisfactorily adjusted the small matter of the Loan without in any way arousing his Employers' suspicions, he joined a Burial Club, made a Will, and died ten days later.

By his Will he appointed his Widow sole Executrix, and divided his Estate as to one-fourth part to his father Oliver Turvey, as to one-sixth part to a former landlady Mrs. Korphdrop, and the residue to his Widow.

The Estate consisted of the following:—

Cash £564.

Insurance Policy, £100.

Burial Club Money £14.

Household Furniture and Effects £12.

The Funeral Expenses amounted to £12.

Mr. Herbert Turvey was buried on the third Thursday after Guy Fawkes' Day, and on the following Tuesday fortnight the Widow gave birth to a son. Both mother and child progressed amazingly and everybody called to visit Harriett, but chiefly to satisfy their curiosity as to the amount which she inherited.

Don't keep them waiting.

Mrs. George Dumpkins was very vexed that any Estate Duty at all should be payable, and when she was told that a Corrective Affidavit would have to be presented she threatened to change her Solicitors. As she very properly said she had sufficient troubles already without having to pay for more, and the Chancellor of the Exchequer, whoever he was, ought to be ashamed of himself for taxing Widows so scandalously.

She entirely disagreed with the opinion of her Solicitor as to the necessity of presenting this Corrective Affidavit, and insisted upon having Counsel's opinion on the matter. The following facts were therefore submitted to the learned gentleman:—

Mr. Dumpkins' Estate had been proved for Probate purposes at £71,000, but during the year after death the following Assets were realised and Liabilities settled, viz.:—

£18,000 31⁄2% India Stock valued for Probate at 947⁄8, realised 91.

Share in Ship valued at £4,000, realised £3,500.

Sundry Liabilities estimated for Probate at £8,000, were subsequently found to be £8,700. (This included £75 cost of bringing deceased's body from abroad.)

Stock-in-Trade valued at £10,250, realised £9,400.

£6,000 Mortgage Debentures valued at £7,500 were sold at par.

The opinion of Counsel was received in due course, and the Solicitor smiled.

By what amount was the Estate Duty increased or decreased? Ignore any adjustment in respect of Interest on Estate Duty.

Mr. William Wiggins made all his money out of Pickles, and when he died his body was embalmed. To use the Widow's words, "'e 'opped it" on the 14th June, 1914.

He left his fortune to Mrs. Wiggins, his nephew Herbert Huggins (commonly known as 'Erb 'Uggins), and his cousin Joe Gubbins, in equal portions.

The Will was duly proved, Estate Duty at 9% was paid, and the interest on the Estate Duty amounting to £165 3s. 0d. was paid on the 14th November, 1914.

What was the value of the Net Legacy received by each Beneficiary? There was no Real Estate.

Mr. Justice Oats died in harness. He worked like a horse throughout his long career on the Bench, and was universally regarded as a thoroughbred sportsman. For nearly 25 years he had been a Judge of the Probate Division of the High Court of Justice, and like many others in a similar position, died intestate. Not that this was the intention of the learned Judge, for he had prepared a Will on the back of an envelope, but forgetting that even he was subject to the laws of the land, had entirely overlooked the necessity for signing it. He died, therefore, intestate.

His Net Estate, after the payment of the Estate Duty on the Personal Property, amounted to £68,570, of which the Real Property was valued at £24,200.

For many years the Judge had been a Widower, and his only child had died in infancy. His youngest brother, Alfred, was living, however, and he had a nephew, the son of his deceased brother Charles. The Judge had, in addition, three first cousins, one of whom was a lady who had thrice refused offers of marriage, the acceptance of any one of which would have made her Lady Oats. She was, however, a Quakeress, and her enemies hinted that she refused the Judge lest the combination of the name of her religious faith and her marriage name should bring upon her the nickname of "Lady Porridge."

How was the Judge's property divided?

The following letter was received by the Rev. Stephen Collins on the 22nd March, 1914:—

147, Eaton Avenue, W.

21st March, 1914.

My dear Mr. Collins,

As an old and much honoured friend of my late husband may I implore you to be with us at breakfast on Tuesday, the 1st April, at 9 a.m.?

My son Montgomery comes of age on that day and I feel that it would be a particularly appropriate occasion for his Vicar to say a few words on the seriousness of life, and the responsibilities of riches.

Perhaps you do not know that my husband left everything to me except £10,000 India 31⁄2% Stock which he bequeathed (in my opinion misguidedly) to our two boys, Montgomery and Algernon, in equal shares. At the date of the Colonel's death, six years ago, these were valued at 102, but now, alas, are worth no more than 90. The Income up to the 6th January last has been regularly handed over to the boys in accordance with their father's wishes, but on the 1st April, £5,000 of the Stock will have to be sold and handed over to Monty.

Mr. Crawley, my Solicitor, has promised to be present, and I have sent invitations to my Stockbroker, Professional Accountant, and the Bank Manager.

Do come, dear Mr. Collins,

And believe me to remain,

Yours very sincerely,

AUGUSTA MAWSTONE.

Note.—The breakfast was a great success. Everybody turned up and the Rev. Stephen Collins spoke for 47 minutes. The £5,000 Stock was sold at 90 net, and the necessary entries were made in the books of the Trust, showing the settlement of Montgomery's interest in the Estate.

What was it?

Sir John Hopper, Bart., died on the day set apart for the Feast of St. Valentine. He had been a Widower for some 12 years, and the age of his only daughter was 23.

The Family consisted of four Sons and one Daughter, whose names in order of age were:—

John Long,

George Rhode,

Oscar Truclod,

Charles Grarze,

Rose Marie.

Sir John died intestate, possessed of the following Estate:—

Net Residue of Personalty, £24,000.

Real Property:

Freehold Estate 4 miles outside Canterbury, Kent, £5,000. Delightful situation, 4 Reception Rooms, 8 Bed and Dressing Rooms, 2 Bathrooms, Modern Kitchen apartments, including Servants' Hall, usual Offices, Good Stabling and 4 Acres of Garden. Caretaker within.

Freehold Estate, 1 mile outside Guildford, Surrey, £8,000.

Freehold Estate in the City of Nottingham, £10,000.

Show how the Estate of Sir John Hopper will be divided.

Colonel Filbert, stepson to the late Sir Hazel Knut, paid a brief visit to the Brazils, and died on the voyage home on the 1st January, 1914.

He left a considerable Estate, and bequeathed many useful Legacies, all free of Duty, to deserving Relations and Friends. One of the provisions in his Will was to the effect that a sum of £5,300 should be placed on Deposit at the Bank to be paid over by instalments at regular intervals to his two Executors, John Bunting and Nathaniel Whittel, and was to be regarded by them as a Salary for their services.

Each was to receive a Starting Salary at the rate of £500 per annum, but whereas John Bunting's Salary was to be increased by £100 per annum, Nathaniel Whittel's Salary was to be increased by £25 half-yearly.

As soon as the £5,300 was exhausted the Salaries were to cease, and in the meanwhile the Interest on the Deposit was to be paid over to the General Estate.

The Salaries were to be drawn half-yearly, the first to be payable exactly six months from the date of Colonel Filbert's death.

Write up a Cash Account, showing how the Legacy of £5,300 was divided between the Executors.

Every Sportsman will admit that it is immoral to bet upon a certainty, and most business men will endorse the maxim that only fools speculate without inside information.

Now Mr. Hunter never gambled, but he was open, like most other men, to a sound speculation, and when he learned in his capacity of Clerk to a well-known Solicitor that Miss Rose Tulip had inherited a fortune of £60,000 odd, he naturally felt interested.

Many obstacles separated Mr. Hunter from the object of his choice, but he persevered, and on one particularly sunny afternoon he let loose a chance arrow with such well-directed aim that Miss Tulip's heart was forthwith pierced.

The Engagement caused some little flutter in the Dove Cot, and Lady Tulip, Miss Rose's widowed Mother, at once changed her Solicitors in spite of a promise on their part to decorate Mr. Hunter with the "Order of the Boot," a promise which was promptly converted into an accomplished fact.

Every effort was made to induce Miss Rose to reconsider her decision, but this only seemed to lead to further complications, for on the 14th July Mr. George Tulip announced his engagement to Mr. Hunter's only sister, Rebecca.

This was the last straw and the lamentations of the proud Tulip Family were only exceeded by the rejoicings of the Family Hunter.

The prospective Bridegrooms met and made all the necessary arrangements, and Mr. Hunter, who had had a legal training, drew up four simple Wills whereby each left to the Widow, or Widower, all the worldly goods of which he, or she, was possessed.

These documents were signed and witnessed, and four days later the double wedding was solemnized quietly at the Church of Saint Augustine.

After the ceremony Mr. and Mrs. Hunter and Mr. and Mrs. Tulip journeyed to Liverpool Street Station and caught the 2 o'clock train to Clacton, where the honeymoon was to be spent.

They arrived comfortably in time for tea, and Mr. Hunter insisted on treating the whole party to Winkles.

Now, whether it was the Winkles or whether it was the pins, is a matter upon which the two London Specialists who were called in failed to agree, but the fact remains that within a very short time of devouring the aforementioned delicacies, the whole party became alarmingly ill, and two days later Mr. Tulip and Mrs. Hunter died.

Mr. Tulip's Estate, which consisted entirely of Personalty, was valued for Probate at £8,420, and Mrs. Hunter's Estate, which consisted entirely of Realty, was valued at £72,422.

What Legacy and Succession Duty was payable on behalf of Mrs. Tulip, and by Mr. Hunter?

The Rev. Stephen Collins delivered a very moving address on Total Abstinence at the Mothers' Meeting on the 14th June, 1913, and three weeks later Mr. Gunter died.

Now some of the parishioners were inclined to connect the two events, particularly as Mrs. Gunter happened to form one of the band of Mothers on that memorable occasion, and was known to have given her husband Toast and Water for Supper on the following evening.

Be that as it may, it is an undoubted fact that Mr. Gunter, in a codicil to his Will, nominated the Rev. Stephen Collins in place of Mrs. Gunter as Life Tenant of the Income arising from the property of which he (Mr. Gunter) died possessed.

After the payment of all Duties, Debts and Expenses, this property consisted of Assets producing Income as follows:—

(1) £300 per annum, free of tax, payable quarterly on the usual quarter days.

(2) £160 per annum, free of tax, payable half-yearly, on the 30th June and 31st December.

(3) £140 per annum, free of tax, payable yearly, on the 29th September.

The Income was received regularly on the due dates and the Reverend Gentleman had given a formal receipt for everything due up to and including the 31st December, 1913.

On the 30th April, 1914, Stock No. 1 was sold cum. div. at a profit of £500, and the proceeds were re-invested in a security, the income from which was £320 per annum, free of tax, payable half-yearly on the 30th June and 31st December.

On the 20th June, 1914, Stock No. 2 was sold ex. div. at a loss of £100, and the proceeds were re-invested in a Stock ex. div. bringing in £140 per annum, free of tax, payable quarterly on the usual quarter days.

The Rev. Stephen Collins recognises that the Trustees are honourable men and that their intentions are worthy, but nevertheless he is anxious and wishes to be in a position to reassure Mrs. Collins as to the income which he will receive for the year ending 31st December, 1914.

It is interesting to note that Mr. Collins has now published the Address delivered at the Mothers' Meeting on the 14th June, 1913, trusting that the seed sown broadcast may find its way into fruitful soil.

A prosperous Solicitor usually occupies very dirty offices, and his furniture is mostly Mid-Victorian and rickety.

Mr. John Storalore was no exception to this rule and never seemed to object to such surroundings, but on the contrary always appeared to be surrounded by such objects.

He was sitting in his office one June afternoon and was dozing over some particularly dusty documents when his clerk announced Sir Pufferby Pawstone. Now Sir Pufferby was an important client who always had his hair cut and called on his Solicitor when he found himself with nothing better to do. It is not surprising, therefore, that Mr. Storalore should receive him with open arms and assume a very profound expression.

After the usual courtesies had been exchanged, and Lady Pawstone's health touched upon, Sir Pufferby announced that he desired to make a Will.

Mr. Storalore was all attention and took elaborate notes of Sir Pufferby's testamentary wishes, which were extensive and complicated. This done, Sir Pufferby begged Mr. Storalore to give him a brief and concise account of the steps which it is necessary for Executors and Trustees to take in the administration of the affairs of a deceased person from the moment of death up to the final distribution of the Residue.

Do not worry about what Mr. Storalore actually said to Sir Pufferby, for Sir Pufferby was an old woman, and Mr. Storalore knew his client, but say what he would have said to you in answer to such a question.

Mr. George Huggins died on the 31st October, 1913, and with the exception of a few legacies, bequeathed free of duty, he left the whole of his property to his Widow for life with remainder over to his friend Mr. Giblets, provided that gentleman outlived Mrs. Huggins.

Now this arrangement placed Mr. Giblets in an embarrassing predicament, especially as Mrs. Huggins' health improved so wonderfully after her husband's death.

It appeared to Mr. Giblets, therefore, that matrimony was the only safe solution of the difficulty, and so he went on his knees before the Widow. But the lady grasped the situation immediately, and declined the honour.

Friendship being thus early at an end Mr. Giblets resolved to worry the Widow, bearing in mind the saying that "Worry kills." So he set himself to quibble about every detail in the administration of the late Mr. Huggins' Estate, particularly as regards the apportionment of Revenue between Capital and Income. But the Widow would not worry, and wisely suggested to the Solicitors that all matters involving accounts should be left to some first-class Firm of Professional Accountants to settle.

This was done, and the following are the Cash Receipts and Payments made by the Trustees up to the 30th June, 1914.

| Receipts. | |||||

| 1913. | £ | s. | d. | ||

| Oct. | 3 | Cash at Bank and in house | 532 | 17 | 4 |

| Nov. | 5 | Yorkshire Coal Co., dividends half-year ending 30th September, 1913, free of tax | 15 | 0 | 0 |

| 1914. | |||||

| Jan. | 5 | Dividends on India Stock, less tax | 47 | 1 | 8 |

| " " | 14 | Sale of Investments | 1,764 | 8 | 9 |

| Feb. | 8 | Caledonian Railway Dividends, half-year ending 31st December, 1913 | 32 | 19 | 2 |

| March | 3 | Sale of Furniture | 243 | 6 | 8 |

| " " | 25 | Quarter's Rent of Property to date, less tax at 1s. 2d. | 16 | 1 | 10 |

| " " | 31 | North British Investment Trust Dividends, 6 months to date, free of Tax | 70 | 0 | 0 |

| " " | 31 | West Ham Gas Co., half-year's Debenture Interest, less tax | 47 | 1 | 8 |

| Apr. | 5 | Dividends on India Stock, less tax | 47 | 1 | 8 |

| June | 15 | Sale of Jewellery | 32 | 5 | 0 |

| " " | 25 | Quarter's Rent of Property | 20 | 0 | 0 |

| Payments. | |||||

| Nov. | 7 | Medical Attendance and Nursing fees | 31 | 10 | 0 |

| " " | 25 | Mrs. Huggins, on account | 50 | 0 | 0 |

| Dec. | 31 | Estate Duty | 532 | 6 | 8 |

| " " | 31 | Interest thereon | 2 | 13 | 3 |

| 1914. | |||||

| Jan. | 16 | Valuation fees | 15 | 15 | 0 |

| Feb. | 1 | Widow, further on account | 50 | 0 | 0 |

| " " | 16 | Funeral Expenses | 31 | 10 | 0 |

| March | 25 | Half-year's Ground Rent, due this day, less tax | 4 | 18 | 11 |

| " " | 31 | Debts due at death | 73 | 6 | 8 |

| Apr. | 1 | Widow, further on account | 50 | 0 | 0 |

| " " | 30 | Legacies | 250 | 0 | 0 |

| May | 3 | Duty thereon | 20 | 0 | 0 |

| " " | 31 | Executorship Expenses | 5 | 6 | 8 |

| June | 1 | Solicitor's Costs re Probate | 32 | 6 | 8 |

| " " | 15 | Mason's Expenses, restoring, &c, Tombstone | 15 | 15 | 0 |

| " " | 30 | Paid Widow Balance due to her. |

What amount was paid to Mrs. Huggins on the 30th June, 1914?

Mr. Nathaniel Soworthy, a great breeder of prize pigs, had the misfortune to be knocked down one day by his favourite Berkshire Boar, and his head was cut open on the corner of the pig-sty. Notwithstanding the fact that Mr. Soworthy prided himself exceedingly on the extreme cleanliness of his pig-sties, where, as he was often heard to say, he would be quite ready to eat his own dinner, he discovered on that lamentable occasion what must have been the sole surviving microbe on the premises which, entering his circulation, set up blood poisoning with the result that he passed away a few days later, viz., at 6 p.m. on the evening of the 31st January, 1914.

Mr. Soworthy was a man of many hobbies, and in addition to his prize pigs he possessed a unique collection of silver salt-cellars reputed to be one of the finest in the country. This was valued for Probate at £5,000, while the pigs were estimated to be worth £2,500.

In addition he died possessed of the following property:—

£5,000 India 3% quoted at 753⁄8-7⁄8.

10,000 Ordinary Shares of £1 each in the Improved Pork Pie Factory, Ltd., valued at 25/- per share.

£4,000 Mortgage at 41⁄2% on the farm known as "Little Watchem," interest payable 30th September and 31st March, paid to 30th September, 1913.

Cash in the house, £15.

Cash at the Bank £355 on Current Account and £2,000 on deposit at 3%, interest payable 30th June and 31st December.

£5,000 Policy in the Live Stock Breeders' Mutual Assurance Society, upon which the Bonus at the date of death amounted to £190.

Household Goods, Horses, and Motor Car, £3,500.

Implements of Husbandry, £150.

The Freehold Estate, comprising Mansion House, Park, and Home Farm known as "The Piggeries," valued at £15,000, subject to a Mortgage of £10,000 at 41⁄2%, interest payable 30th November and 31st May, paid to 30th November, 1913.

He was also life tenant of Real Property producing £3,000 per annum, in respect of which there was income accrued due but not received prior to death amounting to £900.

By his Will he left the following bequests:

£1,000 in trust to the President for the time being of the Royal Society for the Propagation and Improvement of Pigs, to be invested and the interest awarded annually in prizes for the best sucking pigs.

£100 to the Perennial Society of Whole Hoggers, of the local branch of which he was the esteemed and Honorary President; and

His famous White Sow, known as the "Soworthy Sow," to his lifelong friend the celebrated judge of pigs, Mr. Anthony Golightly Wackenbath.

The prize pigs were directed to be sold and realised £2,690. The collection of silver salt-cellars was bequeathed to the Victoria and Albert Museum on condition that it should be shown as a whole and named the Soworthy Collection. This bequest was accepted.

The debts due at death amounted to £215, and the funeral expenses to £45.

Within a week of the funeral the famous Soworthy Sow died in giving birth to a fine litter of ten little pigs, two of which unfortunately pre-deceased their Mother. The result of this event had been awaited before sending the Sow to Mr. Wackenbath, who was thus deprived of this mark of the deceased gentleman's affection. The value of the Sow alive had been £50, but dead she was not worth more than £3 10s. 0d., while the litter, whose father was the same Berkshire Boar that had been the unwitting cause of Mr. Soworthy's death, were worth £2 a-piece.

Prepare the Estate Duty Account, the affidavit being brought in on the 31st March, 1914. Show the amount of duty and interest payable.

Referring to the preceding Problem, all bequests were left free of duty and the residue of the estate was left in equal shares to Mr. Soworthy's grand-daughter, his brother, and his adopted son.

The India Stock was sold on the 25th March, 1914, at 77; the Shares in the Improved Pork Pie Factory, Ltd., realised 24/- per share net on the 25th May, 1914, after receipt on the 1st May of a Final Dividend of 1/- per Share paid in respect of the year ending 31st March, 1914, an interim dividend of 6d. per share having been received by Mr. Soworthy prior to his decease.

The Mortgage on "Little Watchem" Farm was called in and paid off on the 30th June, 1914, while "The Piggeries" was directed to be sold and realised £14,500 after payment of all expenses, completion being made on 31st May.

The household goods and implements of husbandry were sold at the same time and produced £3,000 and £120 respectively.

The Policy money with bonus was received on February 25th and the proceeds of the sale of pigs on March 5th, while the income from the Real Estate was received on February 10th.

Estate and Legacy Duties were paid on March 31st, and the debts, funeral expenses and legacies were also paid on the same date. Executorship expenses amounting to £250 were paid on June 14th.

On the last day of each month such portion of the cash balance as was available in round thousands was placed on deposit at 3%.

Prepare Residuary Account as at June 30th, 1914, and state the duties payable on the Residue.

Referring to the two preceding Problems, prepare an Account to be rendered by the Executors to the Residuary Beneficiaries, showing the realisation and distribution of the Estate, the final payment to the Residuary Beneficiaries taking place on July 1st, 1914.

To anyone not in the secret, the conduct of Mr. Pipkin would appear inexplicable, for on March 3rd, 1914, he very deliberately entered a Tobacconist's shop, ordered a threepenny cigar, and afterwards resigned his position as Assistant Book-keeper in Messrs. Macfarlane's Grocery Establishment.

The secret, however, lay in the fact that Mrs. Pipkin had come into money, and Mr. Pipkin very naturally felt himself independent of other people and yearned for the ease and comfort appertaining to the position of a retired gentleman of means.

Mrs. Pipkin's fortune consisted of a life interest in the Property left by Mr. Austen Friars, who died on the 28th February, 1914.

This property was represented by the following assets:—

£2,000 31⁄2% Hongkong Stock, interest payable half-yearly, on the 1st April and 1st October.

200 Shares of £5 each (£2 10s. 0d. called up and paid) in the Commercial Banking Co., Ltd.

Freehold House bringing in £80 a year, payable quarterly, on the usual Quarter Days. This house was assessed at £67, and the Income Tax was paid by the Tenant on the 5th January, 1914.

750 £1 Shares, fully paid, in the Perpetual Rays Co., Ltd.

April, 1914, was the very happiest month in Mr. Pipkin's whole life, and he spent most of his time smoking his pipe in his back garden, or improving his mind by contemplating the educative pictures of the local Cinema.

The months of May and June, however, did not prove quite so pleasant, and by the middle of July Mr. Pipkin actually threatened Mrs. Pipkin that unless she kept the baby quiet he would look out for another job.

And then August came round which proved to be the most miserable month of Mr. Pipkin's whole life, for Mrs. Pipkin was suddenly taken ill after consuming a liberal portion of Tinned Salmon. Never before did he realise how much he loved his Wife or what a blow to his heart her death would be. He never left her bedside and he spared no expense, but, in spite of all, Mrs. Pipkin passed away on the 19th August, 1914.

It would be idle to attempt to depict Mr. Pipkin's feelings; it is enough to say that he became a poorer but a wiser man.

On the 3rd April, 1914, a dividend for the year ending 31st January, 1914, at the rate of 71⁄2% was declared on the 200 shares in the Commercial Banking Co., Ltd., and a similar dividend was declared on the 4th April, 1915, in respect of the year ending 31st January, 1915.

On the 19th August, 1914, a final dividend at the rate of 15% per annum, free of tax, was declared on the 750 Shares in the Perpetual Rays Co., Ltd., for the half year ending 30th June, 1914. An interim dividend had been received on the 31st January, 1914, in respect of the half year ending 31st December, 1913, at the rate of 10% per annum, free of tax.

No interim dividend was paid during the Company's year ending 30th June, 1915; but on the 31st July, 1915, a dividend at the rate of 10%, free of tax, was declared in respect of the year ending 30th June, 1915.

Show the exact amount payable to Mrs. Pipkin and her Estate in respect of her life interest under the Will of Mr. Austen Friars.

The following lines were addressed by the Trustee to the Professional Accountant:—

| PARTICULARS OF INVESTMENTS LEFT BY H. H. HUCKETT, Deceased. | |||

| Short Name of Investment. | Full Name of Investment. | Amount left by Deceased. | Cum. Div Price at Date of Death |

| Bags | Buenos Ayres Gt. Southern Rly. Ordinary Stock | £60 Stock | 116-117 |

| Coils | Californian Oilfields Ordinary Shares | 40 Shares £1 each | 53⁄4-61⁄4 |

| Can. Pacs. | Canadian Pacific Rly. Common Stock | 100 Shares $100 each | 2331⁄2-2341⁄2 ($5=£1) |

| Berthas | London, Brighton &South Coast | £40 Stock Rly. Deferred Stock | 893⁄4-901⁄4 |

| Lions | J. Lyons &Co., Ltd., Ordinary Shares | 60 Shares £1 each | 65⁄16-69⁄16 |

| Brazil Tracs. | Brazil Traction Light and Power | 42 Shares $100 each | 89-90 ($5=£1) |

| Knackers | Harrison, Barber &Co., Ltd. | 80 Shares £5 each | 11⁄2-2 |

| Breads | Aerated Bread Co., Ltd. | 20 Shares £1 each | 41⁄4-41⁄2 |

| Saras | Great Central Rly. Deferred Stock | £400 Stock | 141⁄4-141⁄2 |

| Middies | Midland Rly. Deferred Ordinary Stock | £1,000 Stock | 701⁄2-71 |

| Tanks | Tanganyika Concessions | 20 Shares £1 each | 23⁄8-25⁄8 |

| Claras | Caledonian Rly. Deferred Converted Ordinary Stock | £57 Stock | 181⁄4-181⁄2 |

| Chinas | Eastern Extension Telegraph Co. Ordinary Shares | 200 Shares £10 each | 127⁄8-133⁄8 |

| Megs | Mexican Rly. 1st Preference Stock | £90 Stock | 136-137 |

| Virgins | Virginia New Funded Bonds | 10 Bonds $100 each | 84-86 ($5=£1) |

| Doras | South Eastern Rly. Deferred Stock | £40 Stock | 583⁄4-59 |

| Vestas | Railway Investment Co. Deferred Stock | £100 Stock | 141⁄2-151⁄2 |

| Matches | Bryant &May, Ltd., Ordinary Shares | 10 Shares £1 each | 7⁄8-11⁄8 |

| Bones | Wickens, Pease &Co. Ordinary Shares | 12 Shares £5 each | 3⁄4-11⁄4 |

| Noras | Great Northern Rly. Deferred Stock | £80 Stock | 501⁄2-511⁄2 |

The late Mr. John Bunyon died in affluent circumstances after having, by the exercise of keen business instincts, overcome those obstacles which confront every great philanthropist who combines the cause of humanity with the desire to achieve wealth and fame.

In his early days he vended to a suffering but suspicious public, a commodity known as "Bunyon's Specific"; and it was his custom at this time to commence his nightly oration to his potential patients at the street corner with the words, "Ladies and Gentlemen, I have extracted corns from all the Crowned Heads of Europe."

In later years, when by the aid of judicious advertising he had convinced the public that no home was complete without his famous Specific, Mr. Bunyon sold his business to a Limited Company, and on then calculating his wealth, found himself rich beyond the dreams of avarice.

He thereupon decided to enter Society, and after some difficulty procured an introduction to Mr. James Rooker, who obtained for him—for a consideration—the entrée into that sphere of Social life which he was so eminently fitted to adorn. On Mr. Rooker's advice, he purchased a Freehold House in a favourable quarter of the West End of London, but owing to a desire not to disturb certain Investments, he raised £2,500 of the purchase price by Mortgage, which at the time of his decease had not been repaid.

In view of the great services rendered to him by Mr. James Rooker, Mr. Bunyon promised to remember him and his family in his Will; which led Mr. Rooker to be very solicitous concerning Mr. Bunyon's health until he was certain that a Will had been executed, and subsequently caused him much speculation as to whether an early decease of his Patron might not be more beneficial than the advantages to be gained from him whilst alive.

Mr. Bunyon's death put an end to these speculations, and it occurred under the following circumstances. Having met Mr. Rooker by appointment at that gentleman's house, they spent a merry hour at the card table, much to Mr. Rooker's advantage. They then sallied forth in a Taxi-cab; when suddenly remembering that he had parted with all his ready cash, and knowing that Mr. Rooker never paid for cabs on principle, Mr. Bunyon ordered the chauffeur to drive to Attenborough's and there placed his diamond pin in pledge for the sum of £5. Feeling somewhat faint after this exertion, he instructed the chauffeur to drive to a Chemist's where he ordered a pick-me-up. The Chemist not knowing his customer, considered his symptoms a fit case for a dose of "Bunyon's Specific," of which Mr. Bunyon unwittingly partook, and so met his death.

Mr. Bunyon's Will was found to contain the following Legacies and Devises in favour of the Rooker Family:—

Mr. James Rooker, my Diamond Pin.

Mr. Tracey Rook Rooker, 1,000 Shares in "Bunyon, Ltd."

Mr. Ricardo Rook Rooker, my Freehold House in London.

Miss Christabel Rook Rooker, £100 of Consols out of my £2,000 Consols.

Miss Emmeline Rook Rooker, £100 payable out of my £2,000 Consols.

It was found that both the Shares in "Bunyon, Ltd." and the Consols, had been sold shortly before Mr. Bunyon's death. The Freehold House was valued at £6,500, the Diamond Pin at £25.

The Net value of his Estate when aggregated was £108,000. What did the Rooker Family receive, and what duties were payable by them?

Transcriber's Note: In the following, the original text of the Foreword is repeated with an informal English translation by proofer "Lucy 24" (Louise Hope). This was not in the original text, but is provided by the transcribers for the convenience of the reader. The English text is placed in the public domain.

By D. F. de l'Hoste Ranking, M.A., LL.D.

by appointment to H.M. THE KING J. MILES &Co LTD Printers 68 &70. Wardour ST, London, W.

End of the Project Gutenberg EBook of De Mortuis Nil Nisi Bona, by

Ernest Evan Spicer and Ernest Charles Pegler

*** END OF THIS PROJECT GUTENBERG EBOOK DE MORTUIS NIL NISI BONA ***

***** This file should be named 41888-h.htm or 41888-h.zip *****

This and all associated files of various formats will be found in:

http://www.gutenberg.org/4/1/8/8/41888/

Produced by tallforasmurf and the Online Distributed

Proofreading Team at http://www.pgdp.net (This file was

produced from images generously made available by The

Internet Archive/American Libraries.)

Updated editions will replace the previous one--the old editions

will be renamed.

Creating the works from public domain print editions means that no

one owns a United States copyright in these works, so the Foundation

(and you!) can copy and distribute it in the United States without

permission and without paying copyright royalties. Special rules,

set forth in the General Terms of Use part of this license, apply to

copying and distributing Project Gutenberg-tm electronic works to

protect the PROJECT GUTENBERG-tm concept and trademark. Project

Gutenberg is a registered trademark, and may not be used if you

charge for the eBooks, unless you receive specific permission. If you

do not charge anything for copies of this eBook, complying with the

rules is very easy. You may use this eBook for nearly any purpose

such as creation of derivative works, reports, performances and

research. They may be modified and printed and given away--you may do

practically ANYTHING with public domain eBooks. Redistribution is

subject to the trademark license, especially commercial

redistribution.

*** START: FULL LICENSE ***

THE FULL PROJECT GUTENBERG LICENSE

PLEASE READ THIS BEFORE YOU DISTRIBUTE OR USE THIS WORK

To protect the Project Gutenberg-tm mission of promoting the free

distribution of electronic works, by using or distributing this work

(or any other work associated in any way with the phrase "Project

Gutenberg"), you agree to comply with all the terms of the Full Project

Gutenberg-tm License available with this file or online at

www.gutenberg.org/license.