The Project Gutenberg eBook of Political and commercial geology and the world's mineral resources, by Various

Title: Political and commercial geology and the world's mineral resources

Author: Various

Editor: J. E. Spurr

Release Date: July 1, 2023 [eBook #71082]

Language: English

Credits: Charlene Taylor, Harry Lamé and the Online Distributed Proofreading Team at https://www.pgdp.net (This file was produced from images generously made available by The Internet Archive/American Libraries.)

Please see the Transcriber’s Notes at the end of this text.

New original cover art included with this eBook is granted to the public domain.

McGraw-Hill Book Co. Inc.

PUBLISHERS OF BOOKS FOR

Coal Age ▽ Electric Railway Journal

Electrical World ▽ Engineering News-Record

American Machinist ▽ Ingeniería Internacional

Engineering & Mining Journal ▽ Power

Chemical & Metallurgical Engineering

Electrical Merchandising

POLITICAL AND COMMERCIAL

GEOLOGY

AND THE

WORLD’S MINERAL RESOURCES

A SERIES OF STUDIES BY SPECIALISTS

J. E. SPURR, Editor

First Edition

Second Impression

Royalties received from the sale of this book will be

assigned to an institution of learning to finance

further studies along the lines followed in the volume.

McGRAW-HILL BOOK COMPANY, Inc.

NEW YORK: 370 SEVENTH AVENUE

LONDON: 6 & 8 BOUVERIE ST., E. C. 4

1920

Copyright, 1920, by the

McGraw-Hill Book Company, Inc.

THE MAPLE PRESS YORK PA.

[v]

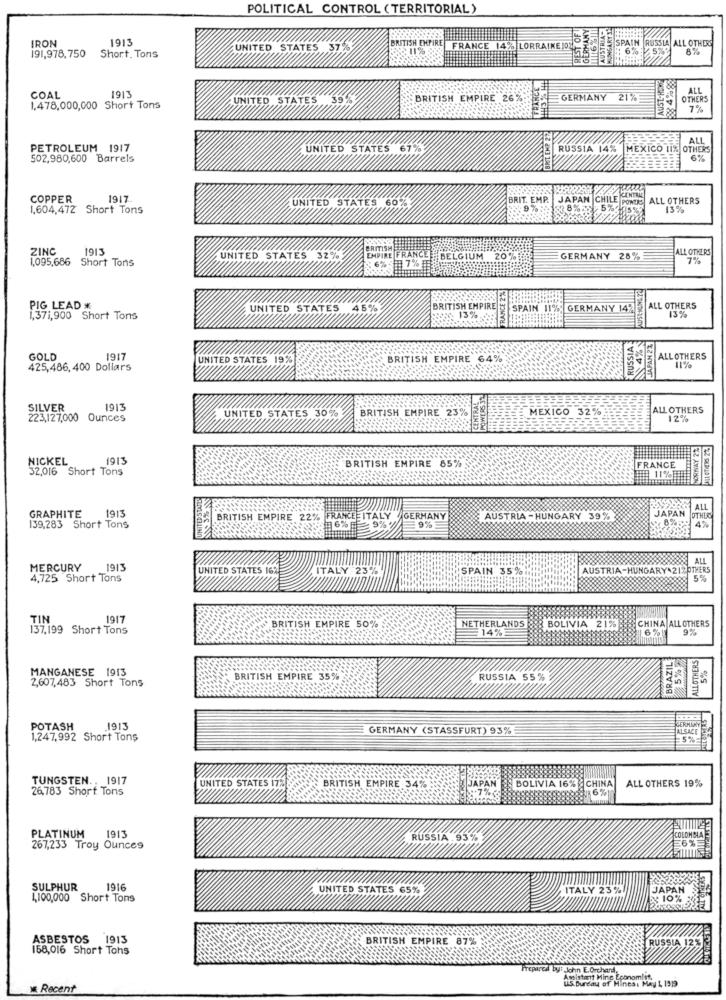

The purpose of the accompanying series of studies is to shed light upon the vast importance of commercial control of raw materials by different powers, or by the citizens of those powers, through invested capital. The question of domestic and foreign governmental policies of the United States is closely involved. It appeared to many of us who were engaged (as all the authors of these papers were) in studying the mineral problems during the war, that our Government had never grasped the vast political significance of commercial domination, and especially of the control of mineral wealth; and that other more seasoned nations had done so, and thereby affected the interests of America and her policy very deeply, without her being aware of the circumstance.

With the rapid increase of the world’s population and the exploring and exploiting of the hitherto undeveloped natural resources, competition for this wealth has become and will still become keener. In past ages war, pestilence, and starvation held down the earth’s population; and in the last few years all these grim spectres have returned in force, suggesting the possibility of a permanent return of the old primitive days. Nevertheless, modern science and organization, if not quenched by vast social disorders, will so safeguard life, as in recent times, that the world is in a fair way to become crowded. All of us, like Germany, yearn for our “place in the sun,” and our share of comfort and power. Of all the fundamental necessities for this, nothing is so much in the nature of a fixed and unmultipliable quality as the metals; they constitute the basis and foundation of our modern civilization and power over man and natural forces. Other raw materials are of vegetable or animal origin; they propagate and duplicate themselves in successive incarnations according to the law of life; they are born in some magical fashion of air and water, with a minimum of the earth, and they return their loans faithfully to air and water and earth with the passing of each generation and the dawning of a new. There is the hint of such a law of growth in the mineral kingdom, but it is so vastly slow that the evanescent animal man has no personal interest in it; for all his purposes and by all his standards of measurement it is inert, and these riches, once dug and used, will never again be available. The treasures of commercially valuable ore-deposits have been hid by nature whimsically throughout the earth, here and there, by no rule of geography or latitude, and with a great disregard of equality. A nation’s needs or desires for mineral wealth have no stated relation to its actual mineral possessions; what it needs[vi] is often in the territory of another nation which does not need it. Commerce is thus born, and the nation which must have the metal or ore in question backs up its commerce and helps it to fasten its claims for permanent control of the deposits in question, by legislation, by diplomacy, and, if need be, by war. In the case of war, the metallic prize falls to the strongest—usually the nation which before, through its necessities, exercised only commercial control, but which, as the result of the trial of strength, now frankly asserts its sovereignty.

Have we as Americans realized these forces? Absolutely not, I should say. How many realize that the Alsace-Lorraine question is and was not a sentimental one, but a struggle for the greatest iron deposits of Europe and the second largest in the world, which gave Germany her immense growth and power, and may now transfer that wealth and power to France? That the dispute between Poland and Germany as to Upper Silesia is not a question of nationality, sentiment, or even territory, but concerns the greatest coal field of Europe as well as great deposits of lead and zinc? If Poland gets this, she may rival Germany in wealth and importance; if Germany loses it, she may drop into the position of a second-rate power, now that she has also had to give up Alsace-Lorraine. To submit such a question to the vote of the native population is of the same order of fitness as tossing a coin for it; but how many of us have understood this? Population shifts and changes, swells or shrinks, may be at one time predominantly Polish and at another time mainly German; but the coal deposits are fixed. To clarify these things we should in place of Silesia say Coal, in the place of Alsace-Lorraine, Iron, and so on.

The reason we have not realized these facts is on account of our own vast mineral wealth, so abundant that not till recently has American capital and enterprise found it necessary to adventure into the outside world, as the European nations had long ago done. Their natural wealth was limited so that they have become familiar with those fundamental principles and laws of which we have been unconscious. From this has arisen European foreign policies, the protection of their national commerce and national capital in foreign enterprises and consequently at home; governmental participation in business combinations, as in Germany, England, France, and Italy; while the United States has been engaged in “trust-busting” and has neglected the protection of its investors in foreign countries. This illustrates the difference between European diplomacy and American guilelessness. How well this played into the hands of foreign powers it is unnecessary to explain. The spectacle of the United States maintaining a Monroe Doctrine of protection over Latin-American republics which she took no vigorous steps to unite with her by the powerful bonds of commerce, must well have excited the amusement of those European commercial nations like[vii] Germany who have been strengthening themselves in those countries by the closest commercial, and hence political, ties.

This volume simply takes up the study of the actual situation, as to the distribution and ownership of mineral supplies in the world, and the author of each chapter is a well-known specialist.

First is considered the question of petroleum, source of power and light, the key to the mastery of the air, and, on account of its fluid and easily transportable condition, of extraordinary future importance. Next are taken up the great fuel mineral, coal, and its ally, the great metallic mineral, iron, which must go together for the manufacture of iron and steel, the backbone of all our mechanical achievements. Next come those metals indispensable in steel making and in the manufacture of specially hard or tough steels. These are of great importance, and include manganese, chromium, nickel, tungsten, vanadium, antimony, molybdenum, uranium, and zirconium. Radium is closely associated with uranium and is considered with it. Closely allied with zirconium are thorium and mesothorium, and their treatment therefore closely follows that of zirconium.

The next great group is that of the major metals, other than iron and the ferro-alloy metals: copper, lead, zinc, tin and mercury, and aluminum. Aluminum ores are used not only as sources of the metal, but for the manufacture of refractories and abrasives. Therefore they are classed partly with the metallic and partly with the non-metallic minerals; and the other non-metallic minerals, used likewise for abrasives, refractories, and other uses—such minerals as emery and corundum, magnesite, graphite, mica, and asbestos—follow.

The next great group is that of the fertilizer minerals—phosphate rock, potash, nitrates and nitrogen, and pyrite and sulphur, all essential for agriculture.

The last group is that of the precious metals, gold, silver, and platinum, essential for coinage and in the arts.

These various studies are essentially both inclusive and elementary: together they form almost the first contribution to the branch of investigation—that of the relation of geology to industry, commerce, and political economy—which they cover; and it is natural that beginnings should be rather crude. Moreover, many of the chapters were written a year or more previous to the publication of the volume, and although brought to date to the extent possible in the brief time available, are considered inadequate by the authors themselves. Apologies for shortcomings and possible inaccuracies are therefore very much in order. Nevertheless, it is felt that the volume merits publication, and that the beginning here made is far better than no start at all.

Josiah Edward Spurr.

| Page | ||

| Preface | v | |

| Chapter | ||

| I. | Petroleum, by John D. Northrop | 1 |

| II. | Coal, by George S. Rice and Frank F. Grout | 22 |

| III. | Iron, by E. C. Harder and F. T. Eddingfield | 55 |

| IV. | Manganese, by D. F. Hewett | 90 |

| V. | Chromium, by E. C. Harder | 109 |

| VI. | Nickel, by C. S. Corbett | 129 |

| VII. | Tungsten, by Frank L. Hess | 142 |

| VIII. | Vanadium, by R. B. Moore | 163 |

| IX. | Antimony, by H. G. Ferguson and D. A. Hall | 172 |

| X. | Molybdenum, by R. B. Moore | 191 |

| XI. | Radium and Uranium, by R. A. F. Penrose, Jr. | 201 |

| XII. | Zirconium, by H. C. Morris | 209 |

| XIII. | Monazite, Thorium, and Mesothorium, by R. B. Moore | 216 |

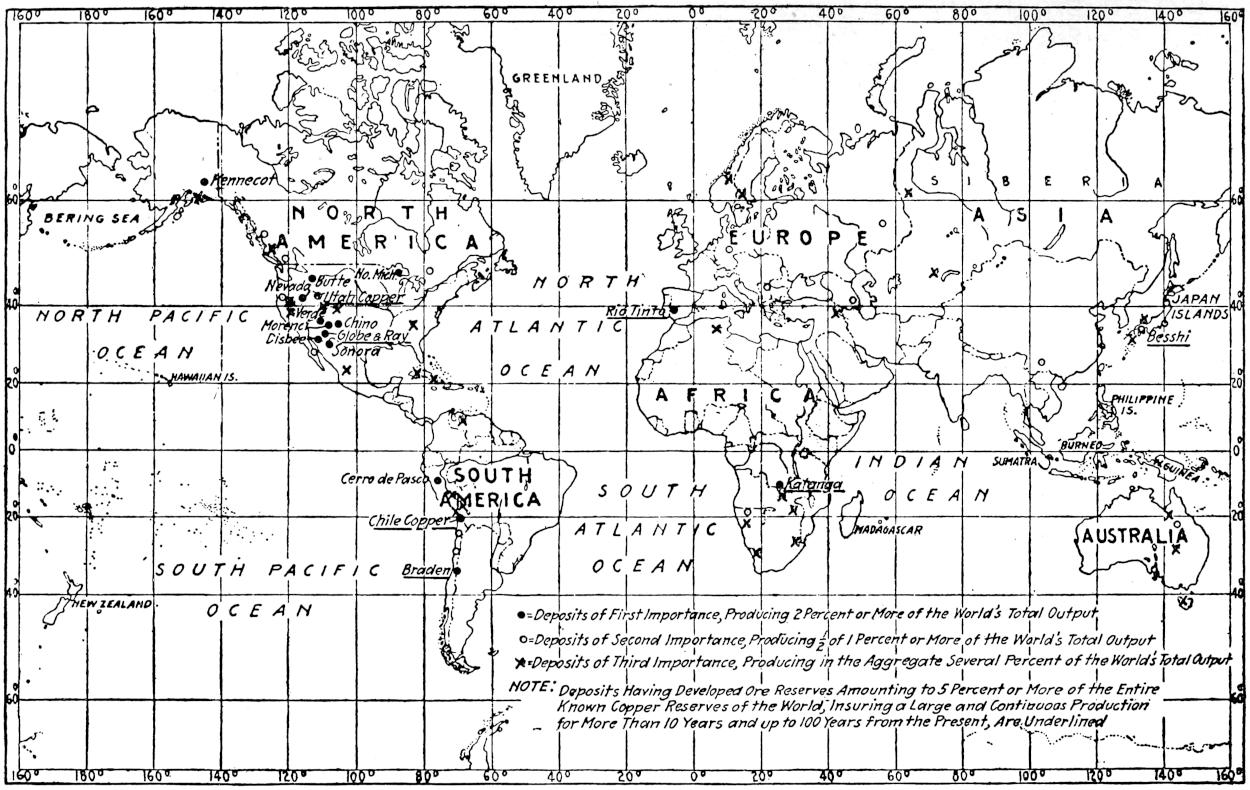

| XIV. | Copper, by F. W. Paine | 223 |

| XV. | Lead, by Frederick B. Hyder | 261 |

| XVI. | Zinc, by Frederick B. Hyder | 294 |

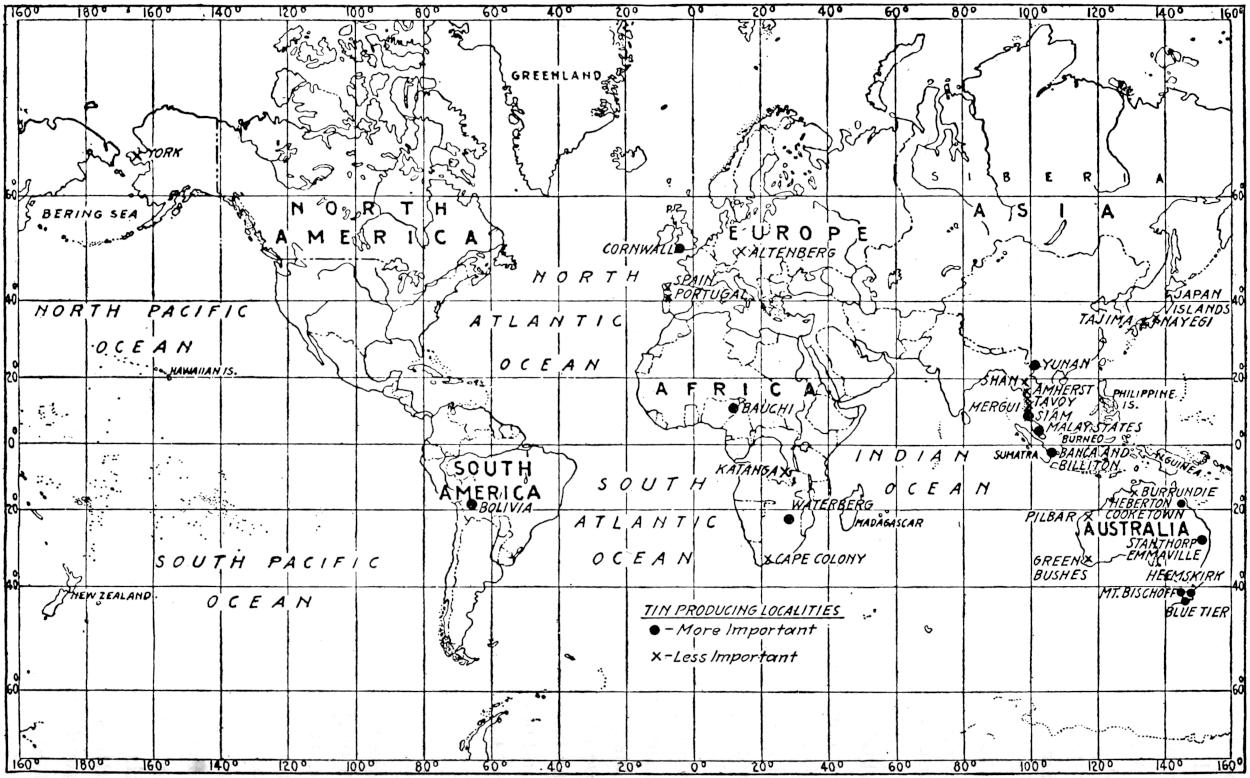

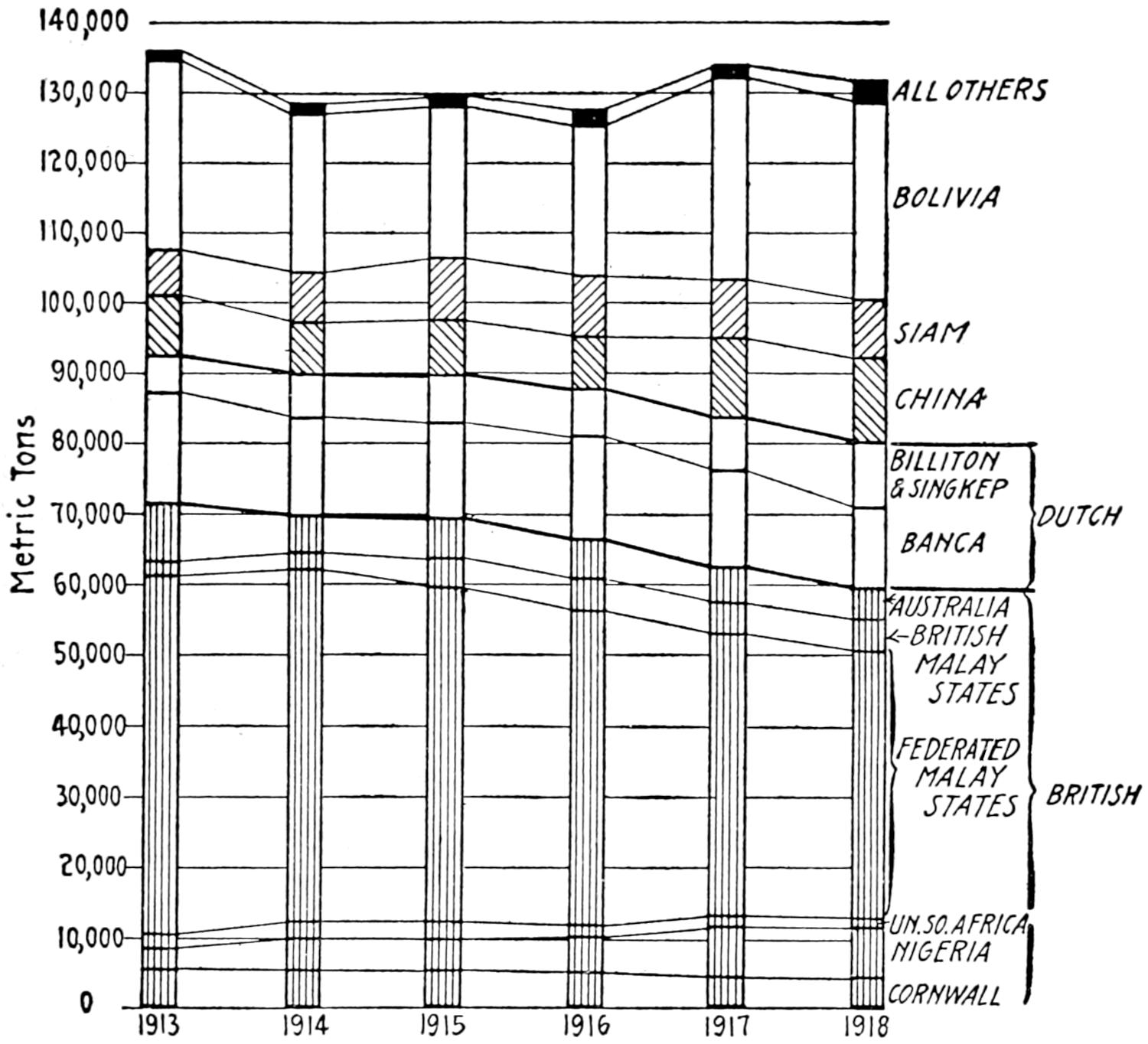

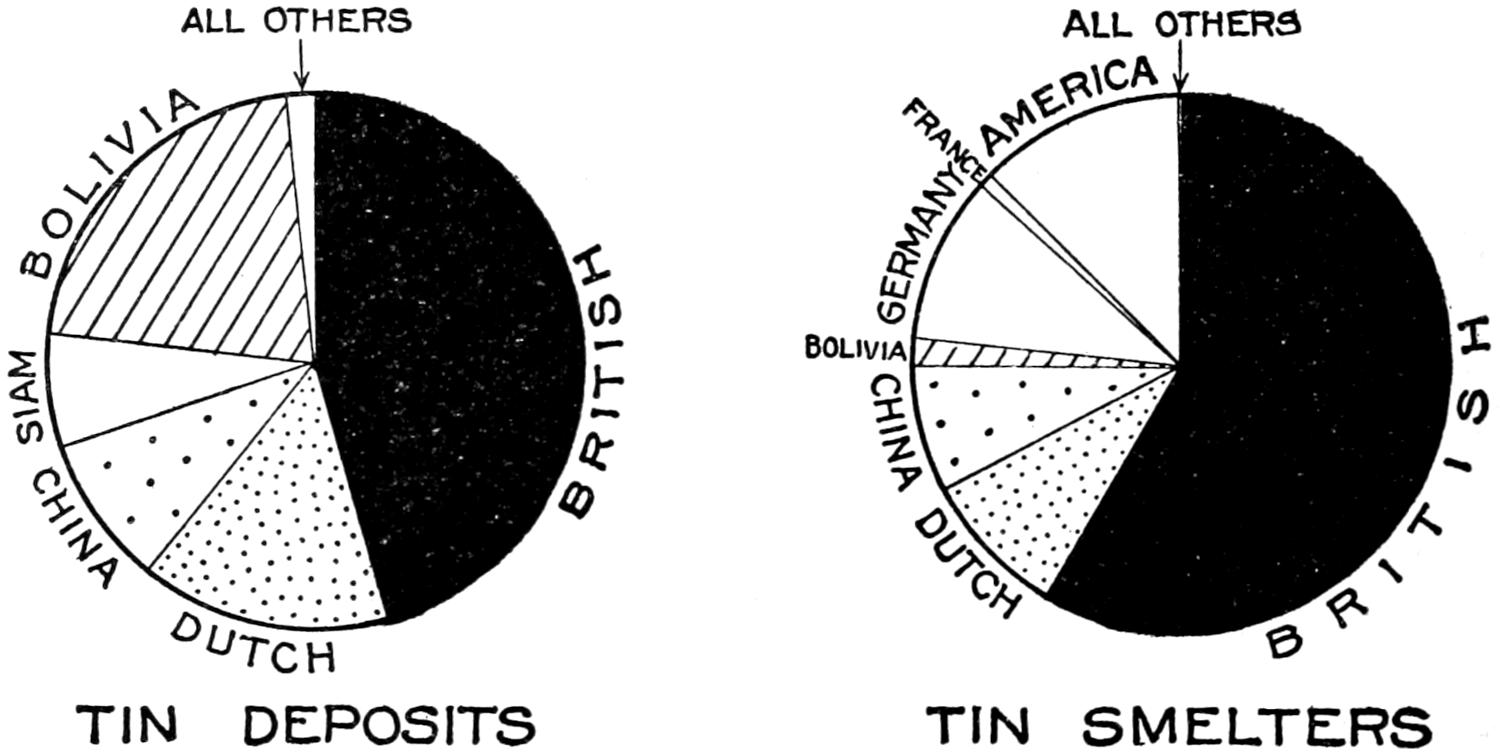

| XVII. | Tin, by James M. Hill | 317 |

| XVIII. | Mercury, by F. L. Ransome | 337 |

| XIX. | Bauxite and Aluminum, by James M. Hill | 349 |

| XX. | Emery and Corundum, by Frank J. Katz | 356 |

| XXI. | Magnesite, by R. W. Stone | 363 |

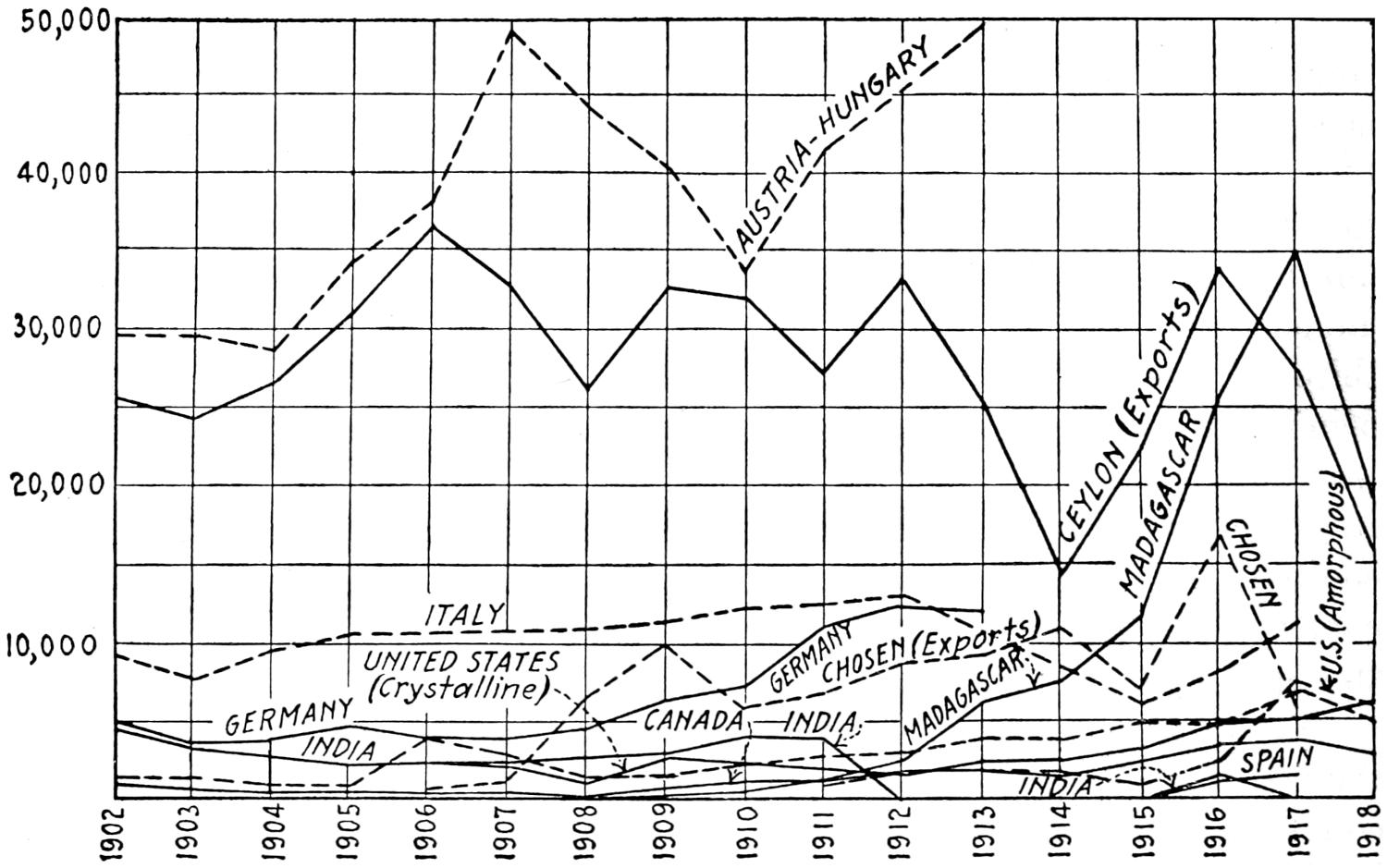

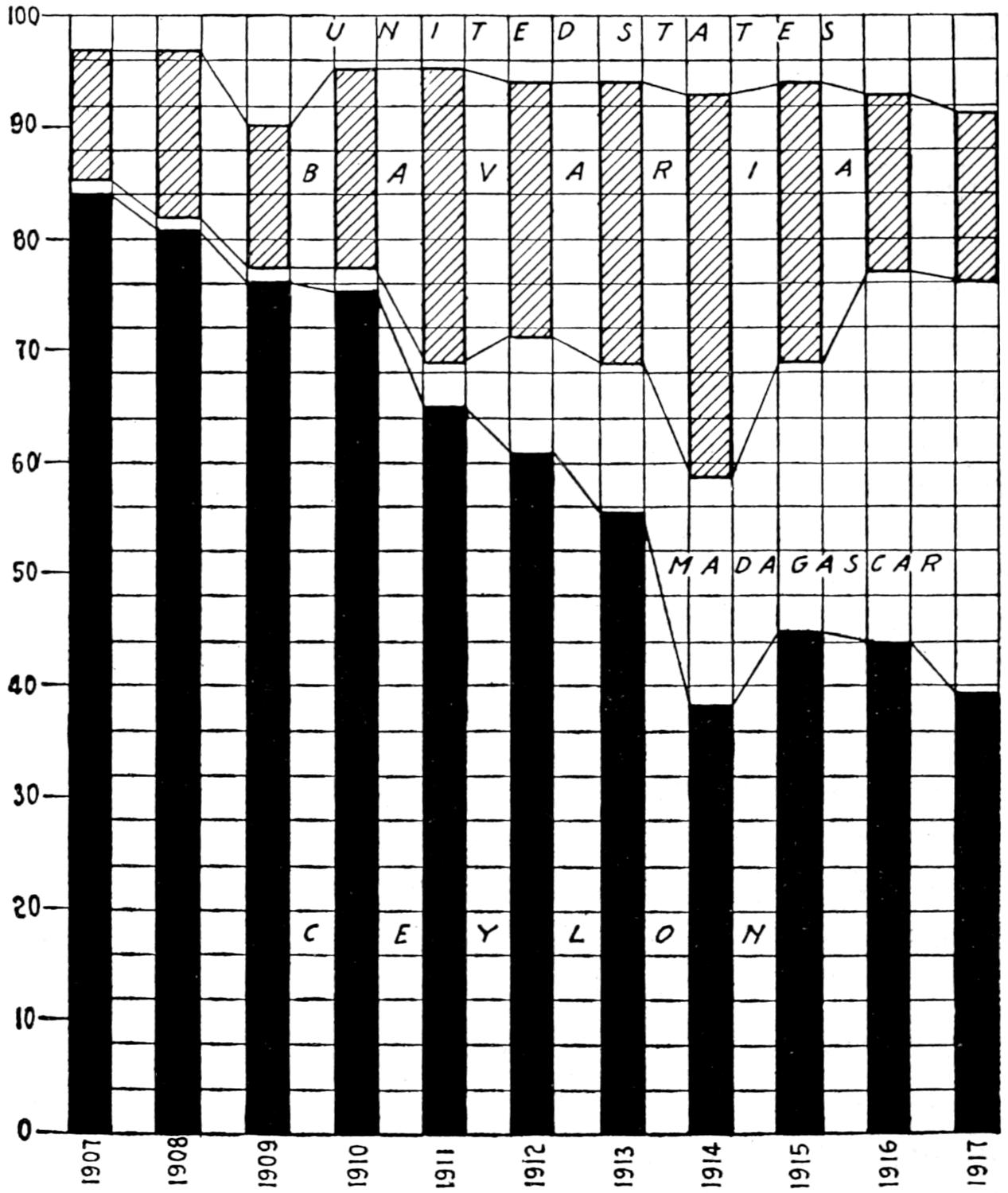

| XXII. | Graphite, by H. G. Ferguson, Frank F. Grout, and George D. Dub | 372 |

| XXIII. | Mica, by Durand A. Hall | 380 |

| XXIV. | Asbestos, by Oliver Bowles | 388 |

| XXV. | Phosphate Rock, by R. W. Stone | 402 |

| XXVI. | Potash, by Hoyt S. Gale and A. W. Stockett | 411 |

| XXVII. | Nitrogen, by Chester G. Gilbert | 421 |

| XXVIII. | Pyrite and Sulphur, by A. G. White | 447 |

| XXIX. | Gold, by John E. Orchard | 462 |

| XXX. | Silver, by F. W. Paine | 495 |

| XXXI. | Platinum, by James M. Hill | 506 |

| XXXII. | Who Owns the Earth? by J. E. Spurr | 522 |

[1] In this article, prepared in June, 1918, by Mr. Northrop, have been incorporated certain notes and additions; as, for example, information furnished by E. Russell Lloyd, of the United States Geological Survey; A. G. White and W. E. Perdue, of the Bureau of Mines, and others. (J. E. S.)

Coal and iron are the backbone of industrial civilization, and should be considered first in any attempt to analyze the ownership and control, as between nations, of the world’s mineral resources. Kin to coal in growing importance, however, is the lighter, fluid and volatile mineral substance, petroleum, whose significance is vast and as yet not wholly defined. More easily transportable than coal, and yielding refined products whose explosive action in internal-combustion engines furnishes greater power in proportion to weight than was once deemed possible, petroleum and its products, apart from their immense direct economic importance, may, in the automobile, the submarine, and the air plane, and through numerous other applications, control strategically, from a nationalistic standpoint, the more inert foundations of civilization. Moreover, the use of crude petroleum as fuel, especially for ships, is of the most vital importance in these days of greater competitive plans for expanding world-wide commerce, and establishing the strength and ready efficiency of navies. Great maritime nations must have, for their oil-burning ships, oil-bunkering stations under their own control in all parts of the world where they wish their commerce to dominate, and their navies to protect their interests efficiently.

The recognition by certain strong and aggressive nationalities of this critical factor has brought about a situation that is perhaps unparalleled[2] in the mineral history of the world. Coal and iron have always been decidedly static as to control—they have remained largely under the supervision and direction of the countries in which they occur. Transportation costs, the conjunction of iron and coal deposits, and other factors have prevented these minerals, in spite of their vast importance, from being fully used as a world commodity. By contrast, petroleum is coming to be universal, like gold, in its acceptance and applicability; but, unlike gold, it is essential in the highest degree to the advance of modern civilization. The fluidity of this mineral, its consequent amazingly cheap transportation and handling by pipe lines, the completeness with which it can be utilized, all combine toward making it in the future the crucial factor of commercial and of political control. Moreover, this fluidity of form and ease of application facilitate the control of petroleum by vast commercial organizations, like the Standard Oil of America, and others in various parts of the world; and even make its world control feasible and probable. Recognizing this tendency, many nations, like England, France, Holland, Argentina, and Mexico, have taken steps looking toward a partial nationalization of their petroleum resources, in order to protect themselves against foreign commercial aggression in this particular. England has gone farthest in this direction, and has reached and is reaching out aggressively into other countries to secure, through commercial control, backed where necessary by political pressure, a world empire of petroleum to serve her world-wide colonial empire. The United States, on the other hand, has dominated the world’s petroleum industry through her own vast resources, worked by interests which have grown without conscious governmental help or even in spite of governmental and popular opposition, and have reached out and secured footholds in other countries.

In the past the mineral development of the world has led to great changes in political sovereignty. Important as these have been, the events that may result from the nationalistic competitive exploitation and control of the world’s petroleum supply bid fair to exceed in importance all similar changes of the past. The perception of the problem and of the necessity, and the advantage of the initiative, naturally belongs to those nations with restricted area and resources, that have grown great by trading and by exploiting the resources of other countries. Such a nation, for example, is England, a country that is fortunately the natural ally of the United States. By contrast, in the United States, a nation concerned hitherto only with the development of its own vast resources, commercial enterprise in foreign countries has been backed by no fixed national policy, and indeed has often been treated as unworthy. In the new international era that was initiated by the World War, however, this policy of Chinese self-sufficiency and exclusion can not be safely continued, and the United States must not only perceive clearly the[3] tendencies and movements of other nationalities, but consider how best to direct its own commercial and political plans so as to uphold its independence and power. Such a policy would naturally lead to international agreements as to the distribution and division of petroleum lands, resources, and production, and probably no one thing would contribute more to the promotion of frank understanding between nations and the removal of obstacles to permanent peace.

Mr. Northrop’s paper follows:

In its crude or semi-refined state, petroleum is extensively utilized as fuel under locomotive and marine boilers and to a small extent in internal-combustion engines of the Diesel type. Certain grades of petroleum are utilized in the crude state as lubricants.

The principal use of petroleum is for the manufacture of refined products, of which the number and uses are legion. The lightest gravity, etherial products are employed as anaesthetics in surgery. The gasolines are the universal fuels of internal-combustion engines, and the naphthas are widely used as solvents and for blending with raw casinghead gasoline in the manufacture of commercial gasoline. The kerosene group includes a variety of products utilized primarily as illuminants, but in annually increasing quantities as fuel in farm tractors. The lubricating oils and the greases derived from petroleum are indispensable to the operation of all types of machinery. The waxes derived from petroleum of paraffin base are utilized in many forms as preservatives and as sources of illumination, and in the last three years have become indispensable constituents of surgical dressings in the treatment of burns. Petroleum coke, because of its purity, is in demand for use in certain metallurgical processes and for the manufacture of battery carbons and arc-light pencils. Fuel oils obtained as by-products of petroleum refining satisfy the fuel needs of many industrial plants, railroads and ocean steamers. Road oils, as the name implies, are employed for minimizing dust on streets and highways; and artificial asphalt, a product of certain types of petroleum, has in many localities superseded the use of other forms of asphalt for paving purposes.

—For petroleum as a fuel under boilers in the generation of steam there are numerous substitutes, including wood, charcoal, coal, peat, natural gas, artificial gas, and electricity; as a fuel in internal-combustion engines some demonstrated substitutes are natural gas, artificial gas, benzol, and alcohol, and in the Diesel type of engine certain vegetable and fish oils can be utilized.

For illuminating purposes, animal fats, oils distilled from coal, natural[4] gas, artificial gas, acetylene gas and electricity may be substituted for kerosene.

For certain types of lubrication carefully refined vegetable and mineral oils are acceptable, but for lubricating high-speed bearings and for all lubrication in the presence of high temperature and of steam no satisfactory substitutes for mineral lubricants derived from petroleum are known.

Substitutes for petroleum asphalt are available in the form of native asphalts, bituminous rocks, and coal-tar residues. For petrolatum, animal fats and vegetable oils can be substituted, and for paraffin wax, ozokerite might be made to satisfy such essential requirements as could not be met by refrigeration or by vegetable and animal oils.

Probable changes in practice that may be expected to affect the petroleum industry within the next ten years include an increased dependence by oil producers on geologic investigations in advance of drilling, the development of methods for deeper drilling than is now practicable, and the more efficient handling of individual wells and of entire properties, with a view to the ultimate recovery, at minimum cost, of a higher percentage of the oil originally present.

The tendency toward amalgamation of individual producing, transporting, refining and marketing interests into strong units capable of competition in domestic and foreign markets on relatively equal terms with each other and with pre-existing combinations of equivalent strength will doubtless increase, and with the growing strength of the several units will come an efficient and thorough quest for petroleum in all parts of the world.

In the refining of petroleum it is probable that methods will be devised and perfected for recovering more of the light-gravity products from low-grade petroleum and for the conversion of the less-salable products of petroleum into products of greatest current demand. Moreover, it is believed that internal-combustion engines will be so modified as to run successfully on petroleum products of lower volatility than gasoline. The use of petroleum as railroad, marine, and industrial fuel is destined to increase enormously in the next decade.

Although an important contributor to the oil-supply of Great Britain, the shale-oil industry has received little attention in recent years outside of Scotland. Investigations by the United States Geological Survey have demonstrated that the United States contains vast deposits of oil shale in Utah, Colorado, Wyoming and Nevada, much of which will average higher in oil content than the Scottish shale. Efforts already begun to develop methods for the recovery of shale oil on a commercial[5] scale in the United States will undoubtedly result in the establishment of a shale-oil industry in this country within the next two or three years. The future growth of this industry will depend largely on the rapidity of the decline in the domestic production of petroleum.

Commercial accumulations of petroleum are everywhere restricted to strata of sedimentary origin. In the United States petroleum is produced commercially from strata of all periods from Cambrian to Quaternary, the most prolific sources being in strata of the Carboniferous and Tertiary systems. The geological age of the chief sources of petroleum production in each of the other oil-producing countries of the world is indicated in the table following:

Table 1.—Geologic Age of Petroleum-bearing Formations

| Country | System |

|---|---|

| North America | |

| Canada | Silurian and Devonian |

| Mexico | Cretaceous and basal Tertiary |

| Alaska | Tertiary (?) |

| West Indies | |

| Trinidad | Tertiary |

| Cuba | Cretaceous and pre-Cretaceous |

| South America | |

| Colombia | Cretaceous and Tertiary |

| Venezuela | Cretaceous and Tertiary |

| Peru | Tertiary |

| Argentina | Jurassic, Cretaceous and Tertiary |

| Europe | |

| Russia | Tertiary |

| Roumania | Tertiary |

| Galicia | Tertiary |

| Italy | Tertiary |

| Germany (Alsace) | Tertiary and pre-Tertiary |

| Asia | |

| India | Tertiary |

| Turkestan | Tertiary |

| Persia | Tertiary |

| Africa | |

| Algeria | Tertiary |

| Egypt | Tertiary |

| Oceania | |

| Japan | Tertiary |

| Dutch East Indies | Tertiary |

| New Zealand | Cretaceous and Tertiary |

From the foregoing table one might conclude that a direct relation exists between the distribution of Tertiary rocks and the supply of petroleum, but in the United States, which produces two-thirds of the world’s[6] current supply, the quest for petroleum has, under scientific direction, included the entire range of the stratigraphic column, and has found petroleum in considerable quantities in the rocks of each geologic system younger than the Cambrian.

The fact that seeps and other surface indications of petroleum are generally more pronounced in the relatively younger Mesozoic strata than in the older Paleozoic formations, and the further fact that geologic exploration for oil and gas in countries other than the United States has been restricted in the main to areas containing the most pronounced indications of petroleum, tend to account for the predominance of the Tertiary system in the foregoing table and to indicate the fallacy of attempts to estimate the world’s reserves of petroleum on stratigraphic evidence alone.

Despite the broad geologic range of petroleum, its occurrence in specific members, formations, groups, series or systems is by no means universal. On the contrary, its occurrence is restricted to specific localities in which are fulfilled certain variable relations, as yet but little understood, that involve (1) the constitution, sequence and content of organic matter of the sediments; (2) the nature and degree of metamorphism they have undergone; (3) their structure; and (4) their degree of saturation with salt water. Because the most detailed geologic work is insufficient to provide a basis for the appropriate evaluation of the numerous factors involved, and because only a relatively small percentage of the areas of sedimentary rocks in the world have been examined geologically in appreciable detail, any estimate of the future supply of petroleum in the world is peculiarly hazardous.

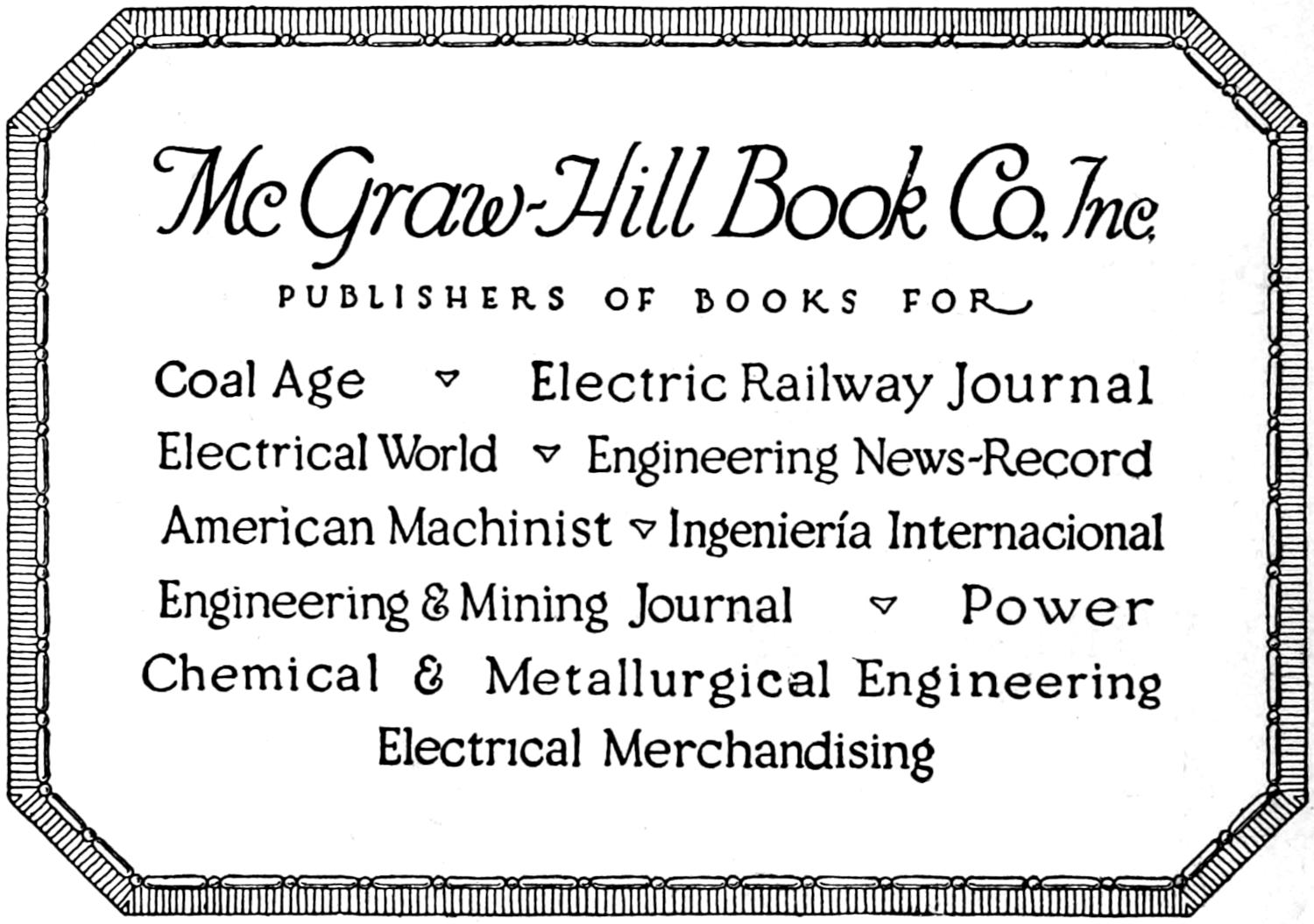

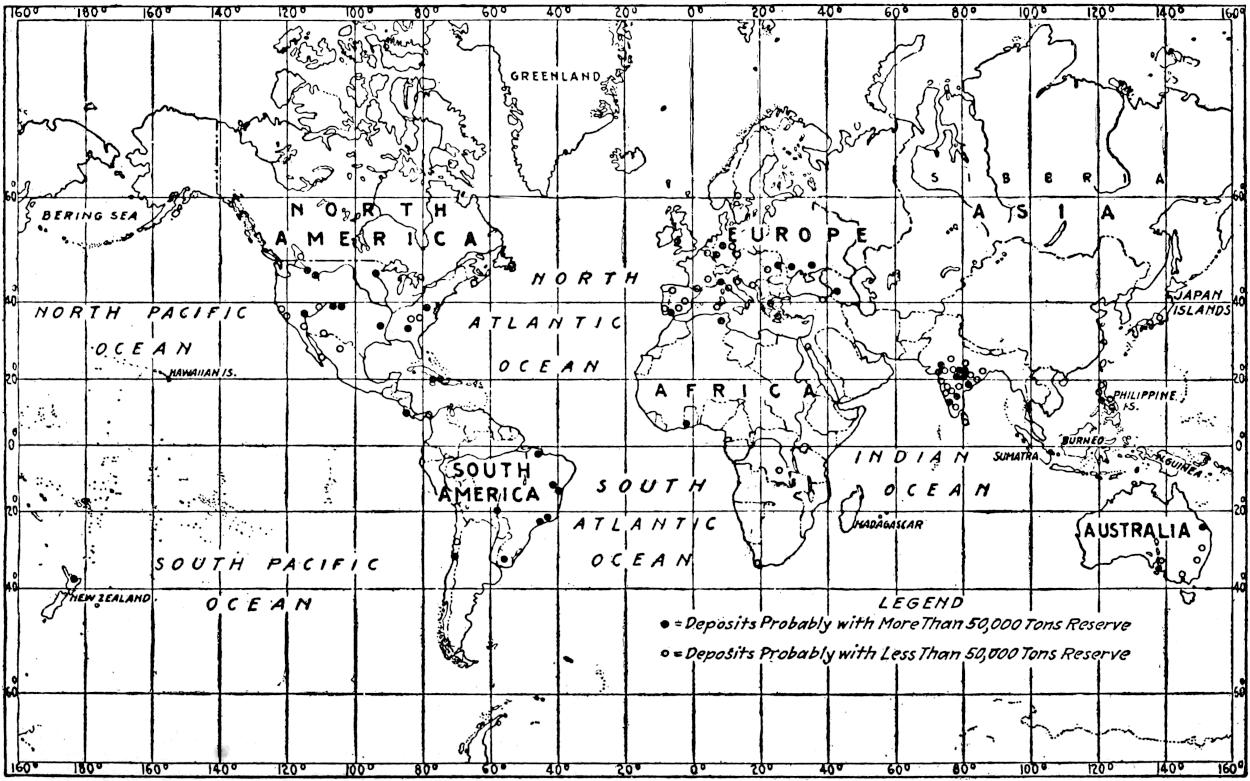

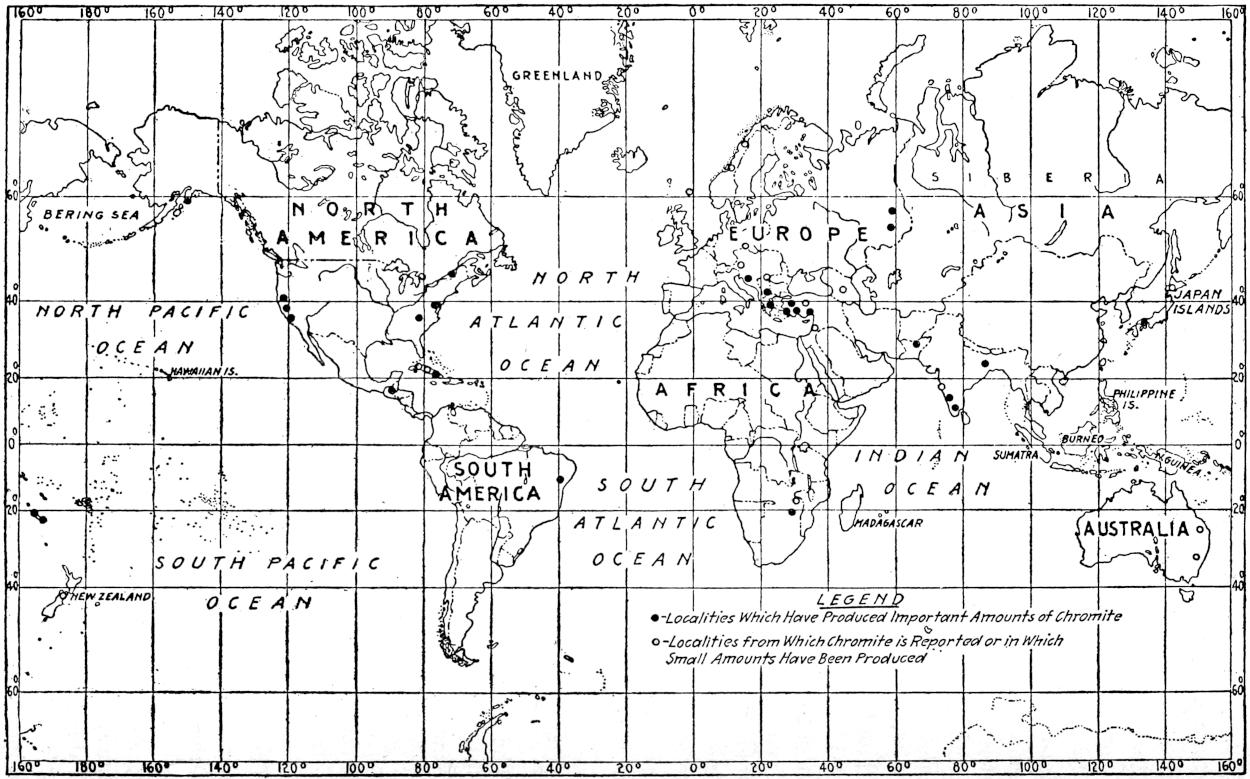

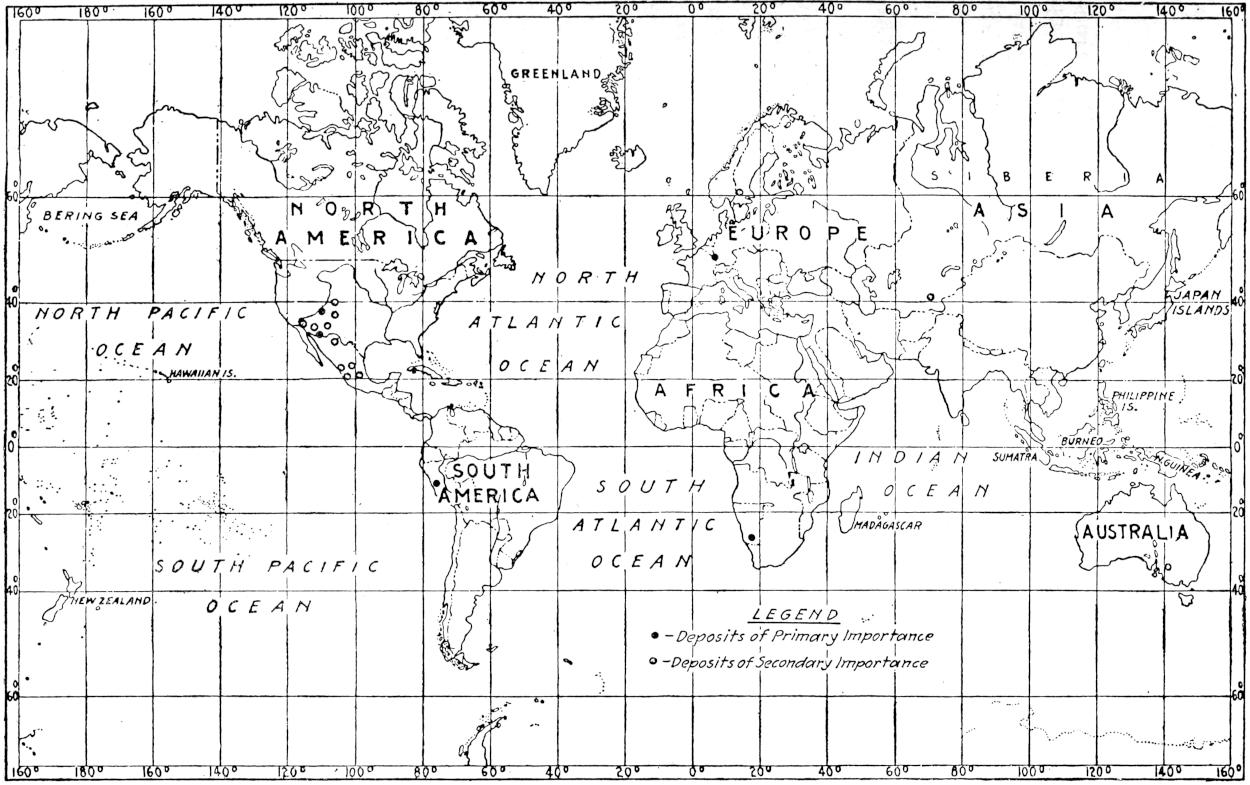

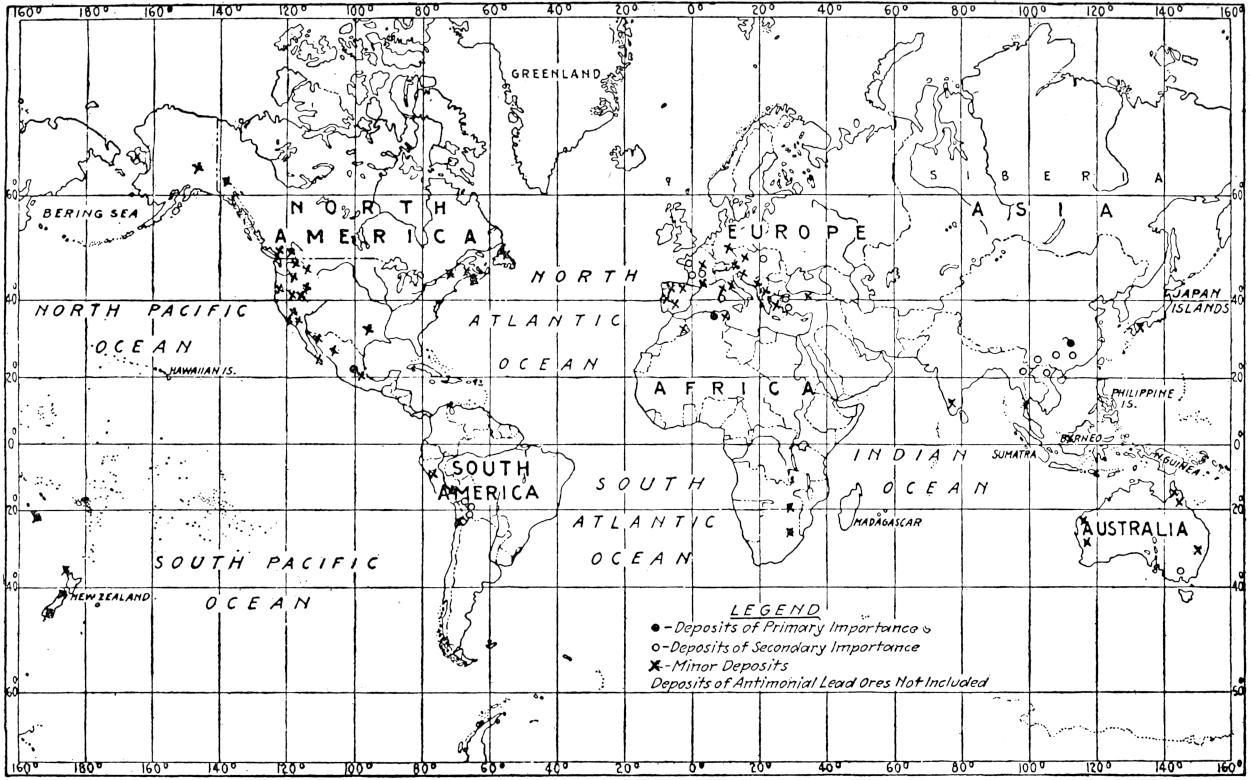

The geographical distribution of petroleum is as wide relatively as its geologic range. The oil fields of present commercial significance are situated, in the order of their importance as contributors to the world’s production of petroleum in 1917, in the United States, Russia, Galicia, Mexico, Dutch East Indies, India, Persia, Japan and Formosa, Roumania, Peru, Trinidad, Argentina, Egypt, Germany, Canada, Venezuela and Italy. Small quantities of petroleum have also been reported from Guatemala, Honduras, Costa Rica, Panama, Haiti, Porto Rico, Bolivia, Chile, Spain, Arabia, China, Australia, Papua, Philippine Islands, Nigeria, Belgian Congo, Gold Coast, Madagascar, and elsewhere. The geographical distribution of petroleum in the world is shown on the accompanying map. (Plate I.)

[7]

Plate I.—Geographical distribution of the producing petroleum fields of the world. By John D. Northrop.

[8]

In the opinion of the author the most conspicuous developments of the world’s supply of petroleum in the next decade will take place in the countries that border the Caribbean Sea and the Gulf of Mexico. The trend in this direction is unmistakable. From 1913 to 1917, the annual production of petroleum in Mexico increased from 21,000,000 barrels to 56,000,000 barrels, and the potentialities of future production in that country have been demonstrated to be almost beyond comprehension. The output, originally considered valuable only as a source of fuel oil, is now yielding, by modern refining methods, increasingly important percentages of illuminating oils and gasoline. The only obstacles to enormously increased production are unsettled political conditions and inadequate facilities for marine transportation. These obstacles will doubtless be overcome within the next few years, and barring unforeseen contingencies Mexico will soon rank second among the oil-producing countries of the world.[2] Judged by the results of exploratory work already done in Venezuela and Colombia, both of those countries are destined to contribute appreciably to the world’s supply of petroleum within the next decade. Recently Colombia has given enough evidence of ability to furnish high-grade petroleum from wells of large individual capacity to warrant the large interests holding concessions there to exert every effort to overcome the adverse natural conditions that have so long barred the way to exploitation. Enough drilling has already been done in Venezuela to demonstrate that the resources of heavy-gravity asphalt-base petroleum in that country are large, and the recent installation of a modern petroleum refinery for the treatment of these oils on the island of Curacao, off the Venezuelan coast, has provided the market necessary to active field development.

[2] Mexico ranked second in 1918 and 1919.

In Trinidad the production of petroleum exceeds 1,500,000 barrels a year and has doubled in the last few years. With the increased facilities for ocean transport of petroleum that are becoming available, a large output is assured.

Cuba is not expected to become an important producer of petroleum, and present knowledge concerning the petroleum resources of the Central American countries is not such as to warrant the belief that oil fields of material consequence will be developed in any of them.

Petroleum production in the United States is expected to reach its maximum within the next two or three years and to decline steadily thereafter, although this country is expected to remain the leading oil-producing country of the world for the greater part, if not all, of the coming decade.

As regards those oil-producing countries of North and South America that have not been already mentioned, no significant changes in their present status are anticipated.

The petroleum resources of Russia (including Asiatic Russia) are believed sufficient to assure that country retaining its position as the leading producer of petroleum in the Eastern Hemisphere far beyond the[9] next decade. During the last few years the output has been obtained under increasing difficulties, and as a consequence there has been no measure either of present productive capacity or of potentialities. Concerning the future of Russia as a source of petroleum Arnold[3] says: “Such large areas, both in European and Asiatic Russia, yield unmistakable evidence of the presence of oil in large quantities that it is to this country, among those of Europe and Asia, to which the future must look for a supply.”

[3] Arnold, Ralph: “The World’s Oil Supply”: Report Am. Min. Cong., 19th annual session, 1917, pp. 485-486.

Russia being endowed with petroleum reserves, both proved and prospective, of great magnitude, the ultimate position of that country as the leading oil-producer of the world seems reasonably assured. Its immediate future is too intimately dependent on the progress from political turmoil to warrant a forecast.

The oil fields of both Roumania and Galicia are believed to have passed their maximum yield, and the possibilities of opening new fields of consequence in those countries are not considered large enough to justify a forecast of anything but a moderate decline of production in future years. No material change in the status of the negligible oil fields of Italy or of Alsace is anticipated at any time in the future.

With regard to the situation in Asia, the writer believes that the next decade will witness a steady increase in the output of petroleum in India, and the probable development of one or more important oil fields in Persia and possibly of fields in Asia Minor, Turkestan and China. In Oceania the same period will doubtless witness a material increase in the production of petroleum in Japan and Formosa and in the Dutch East Indies, together with the possible opening of new fields in Papua. Africa will doubtless receive considerable attention from oil operators in the next ten years, but on the basis of available evidence the results obtained in that period will probably not be large enough to affect the petroleum situation of the world.

The status of the political control of the world’s output of petroleum in 1917, as determined by the best data now available, is indicated in the table following.

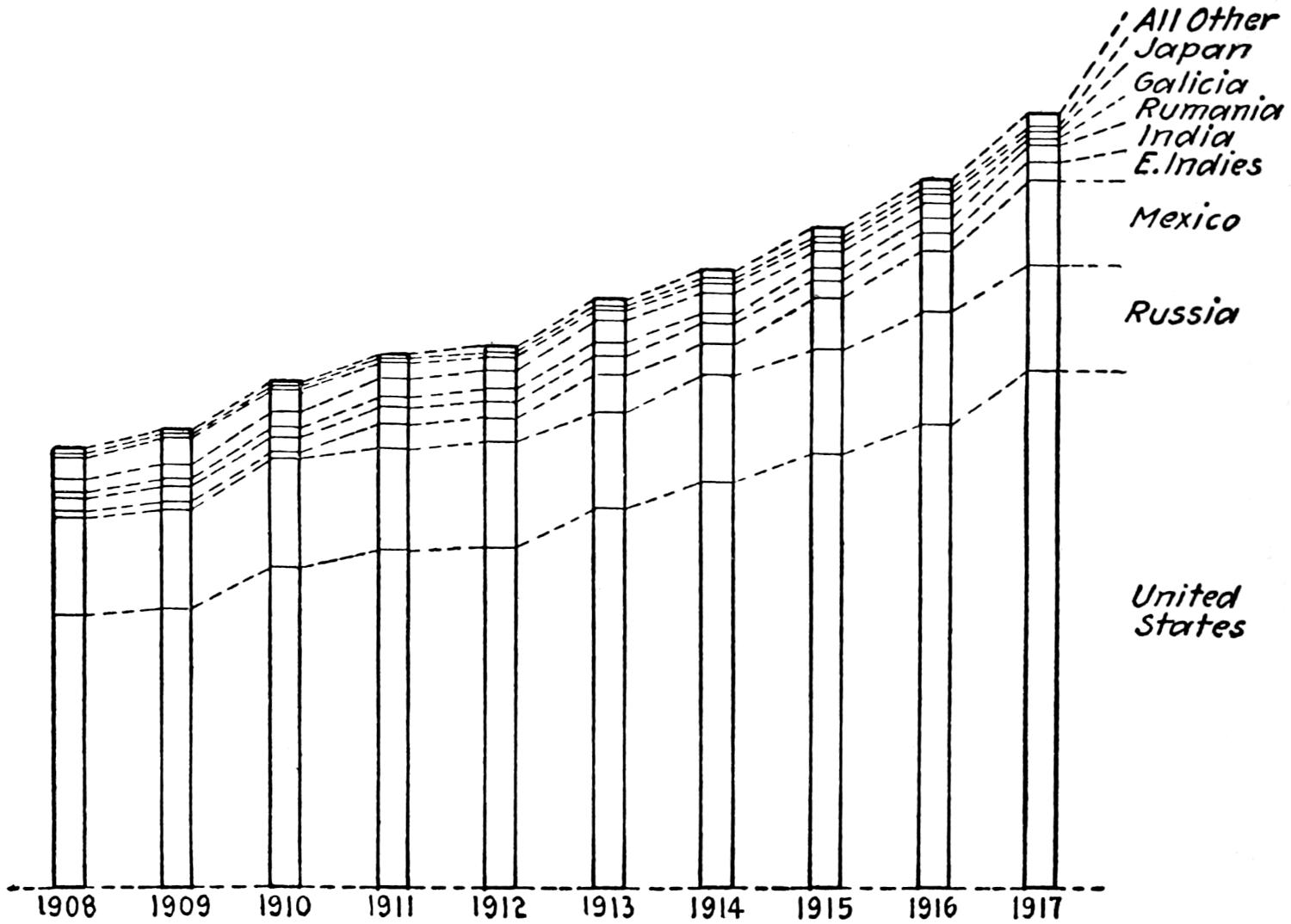

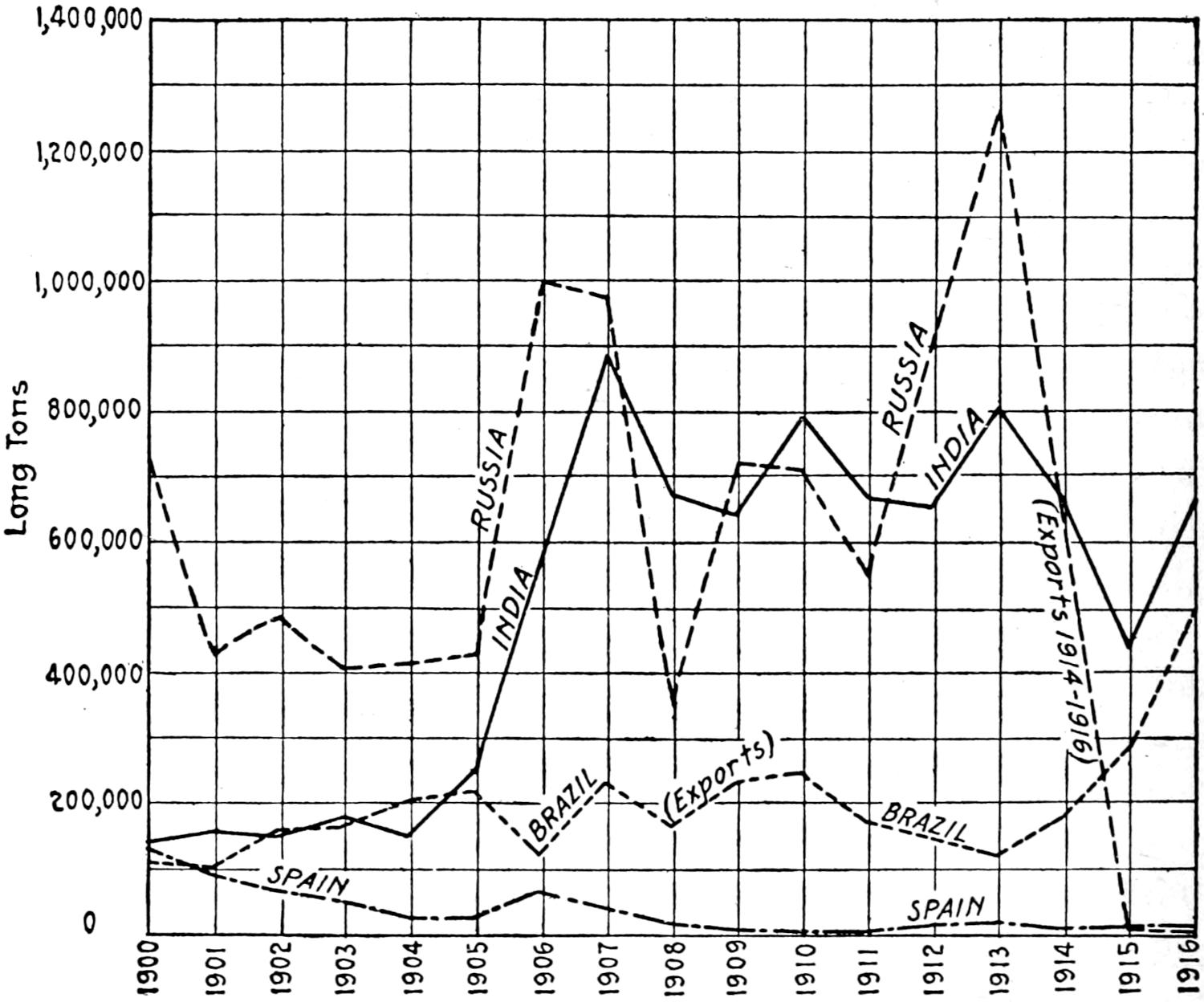

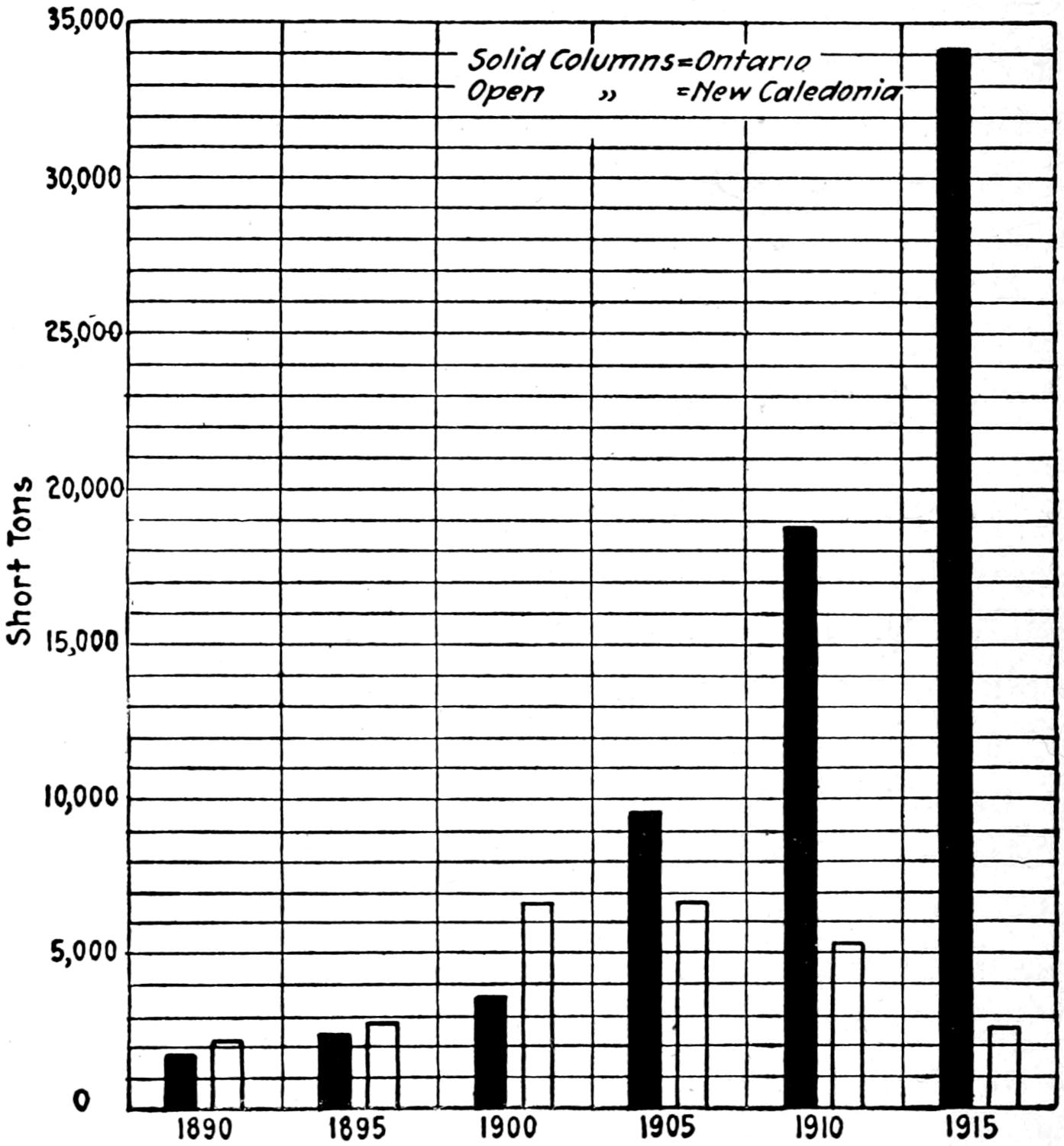

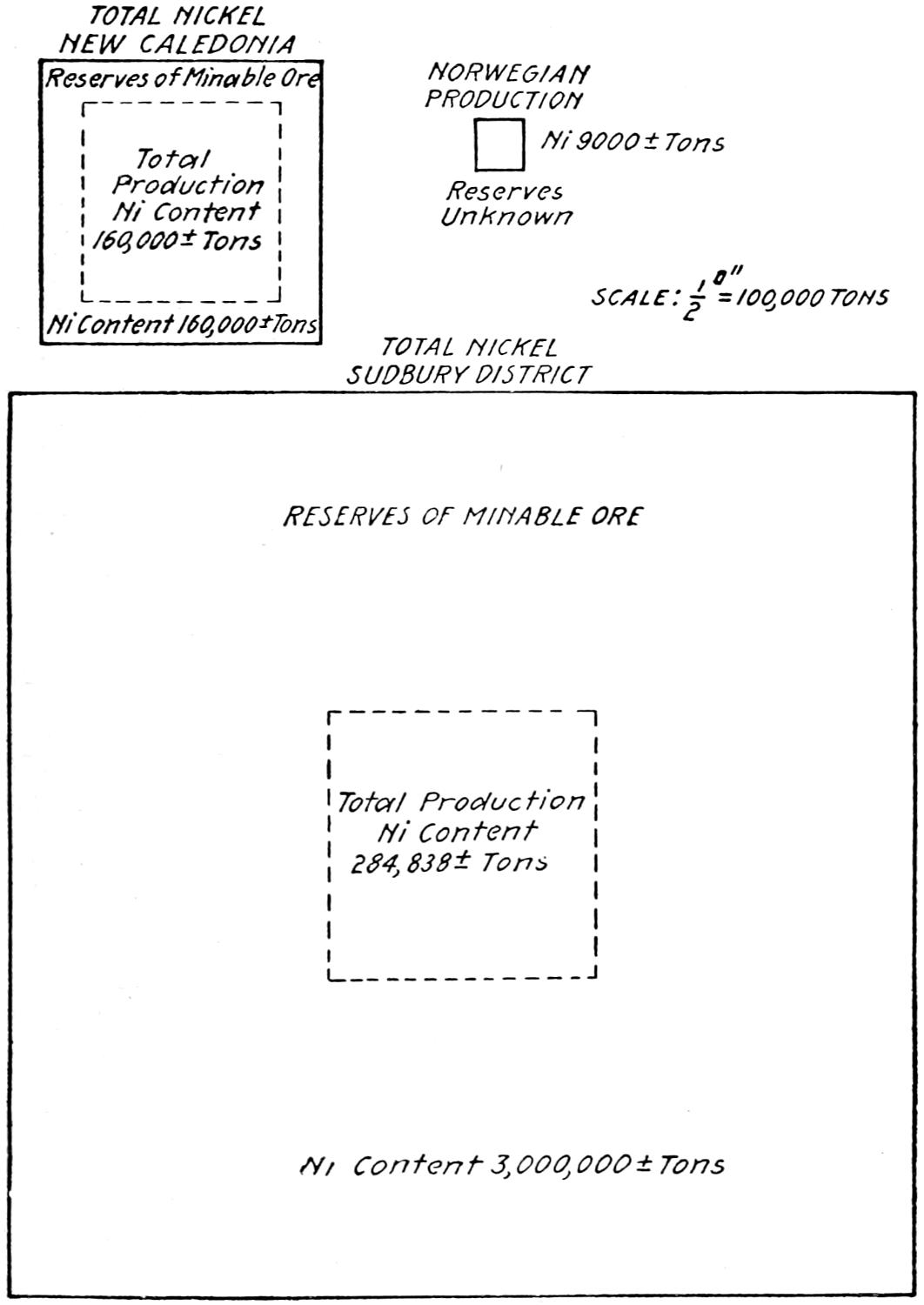

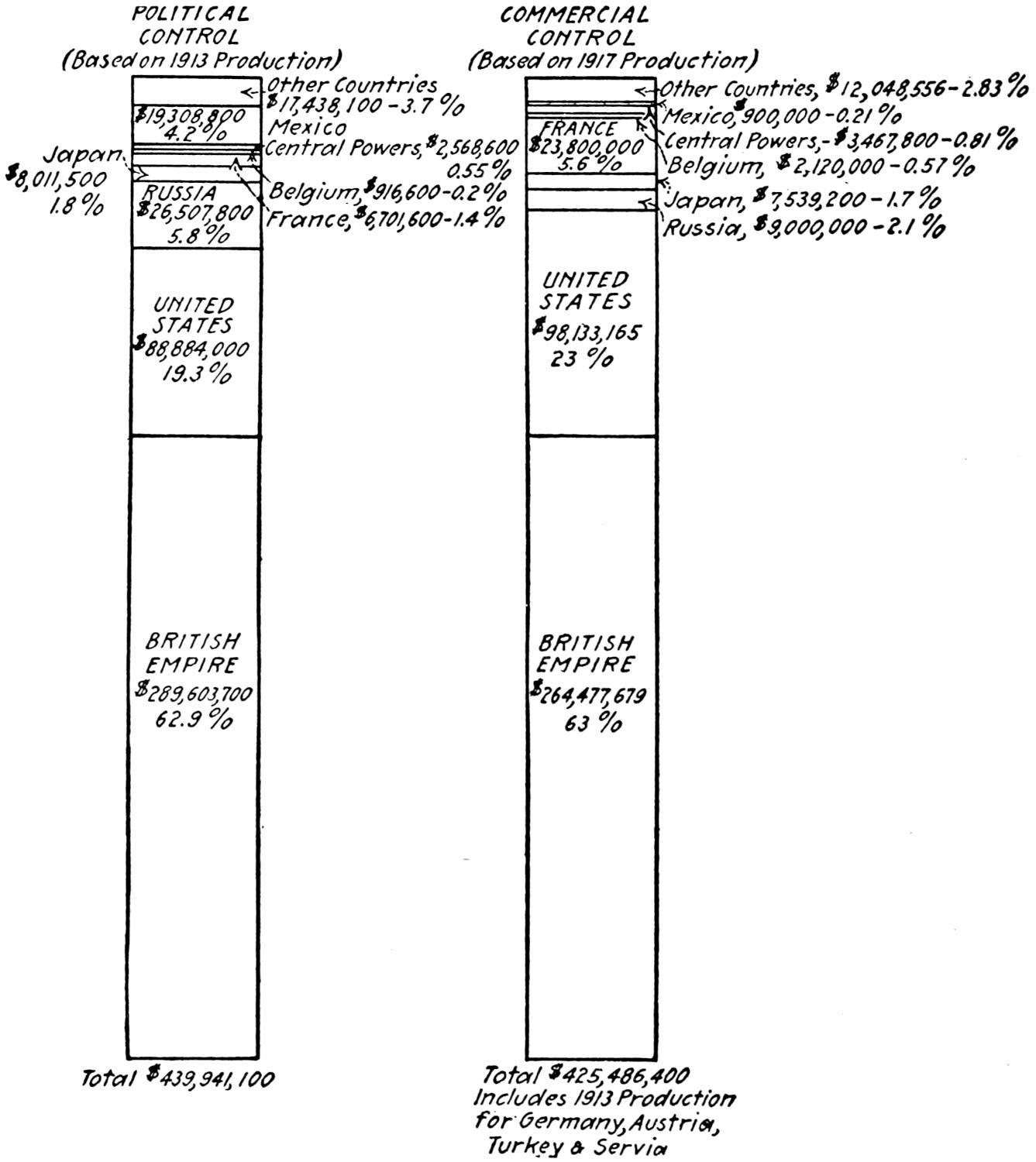

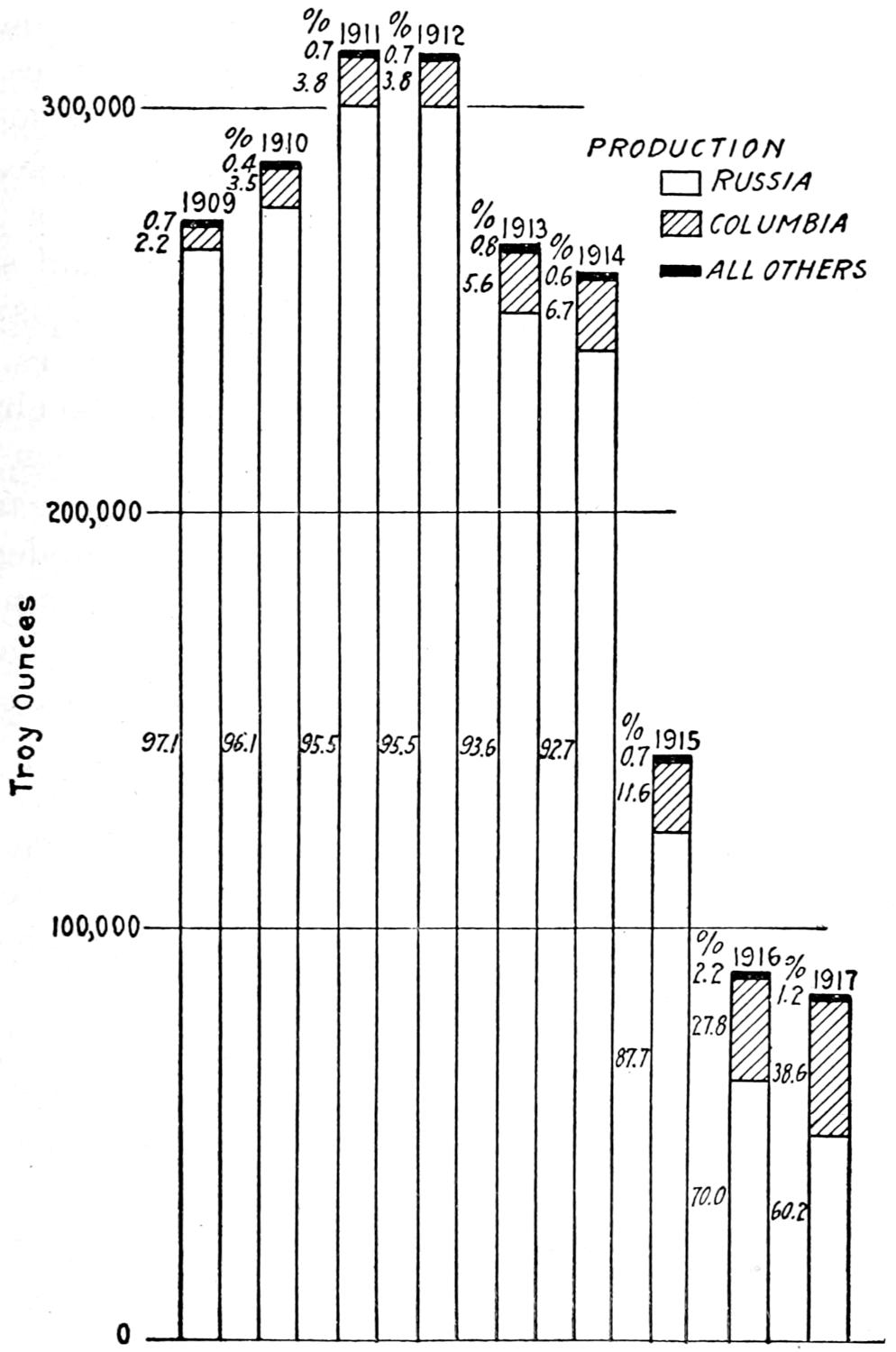

The accompanying diagram (Figure 1) shows the proportion of the world’s production of petroleum contributed annually by each of the principal producing countries in each of the last ten years.

[10]

Table 2.—Political Control of the World’s Production of Petroleum in 1917

| Source of production |

Quantity of production (barrels) |

Percentage of total |

Country exercising political control |

|---|---|---|---|

| United States | 335,315,601 | 66.17 | United States |

| Russia | 69,000,000 | 13.62 | Russia |

| Mexico | 55,292,770 | 10.91 | Mexico |

| Dutch East Indies | 12,928,955 | 2.55 | Holland |

| India | 8,078,843 | 1.59 | Great Britain |

| Persia | 6,856,063 | 1.36 | Persia |

| Galicia | 5,965,447 | 1.18 | Poland (?) |

| Japan and Formosa | 2,898,654 | 0.57 | Japan |

| Roumania | 2,681,870 | 0.55 | Roumania |

| Peru | 2,533,417 | 0.50 | Peru |

| Trinidad | 1,599,455 | 0.32 | Great Britain |

| Argentina | 1,144,737 | 0.23 | Argentina |

| Egypt | 1,008,750 | 0.20 | Great Britain |

| Germany | 995,764 | 0.20 | Germany |

| Canada | 205,332 | 0.04 | Great Britain |

| Venezuela | 127,743 | 0.03 | Venezuela |

| Italy | 50,334 | 0.01 | Italy |

| Cuba | 19,167 | ... | Cuba |

| 506,702,902 | 100.00 |

Fig. 1.—Proportion of the world’s output of petroleum contributed annually by each of the chief producing countries, 1908-1917.

[11]

Aside from the control exercised by Great Britain through its protectorate relation over the petroleum resources of Egypt, control of the petroleum resources of the various countries is mainly by virtue of state sovereignty. This political control is in proportion to the strength of the government in the country exercising it. Recent developments whereby the British government becomes the majority stockholder of a corporation controlling the oil resources of Persia, practically transfer the political control, as well as the commercial control, of Persian petroleum from Persia to England. Mexico’s recently attempted firm political control of her vast petroleum resources depends for its success upon her diplomatic ability in dealing with the stronger governments of England and the United States, whose nationals have acquired a commercial control that is threatened by Mexico’s new and decided nationalistic policy.

The commercial control of the world’s production of petroleum, as far as nations are involved, is determined in the main through direct ownership, of lands, leases and concessions, or by the control, through holding corporations, of subsidiary companies holding fee, leases, mineral rights or concessions of petroleum land. Except in Argentina, where the domestic petroleum industry is owned and operated by the state; in Germany, where the government participates directly in the financing of petroleum enterprises through the Deutsche Bank; and in Persia, where the British government owns a substantial interest in a company owning and operating extensive concessions, the commercial control of the petroleum industry is determined almost wholly by aggregations of private capital acting in their own interests.

Table 3.—Nationality and Extent of Control of Dominant Interest

| Country | Production in 1917 (barrels) |

Nationality of dominant interests |

Approximate extent of control by dominant interests (per cent.) |

|

|---|---|---|---|---|

| United States | 335,315,601 | United States | 96 | |

| Russia | 69,000,000 | British-Dutch | 40 | + |

| Mexico | 55,292,770 | United States | 65 | |

| Dutch East Indies | 12,928,955 | British-Dutch | 100 | |

| India | 6,078,843 | British | 100 | |

| Persia | 6,856,063 | British | 100 | |

| Galicia | 5,965,447 | German | 100 | |

| Japan and Formosa | 2,898,654 | Japanese | 100 | |

| Roumania | 2,681,870 | British-Dutch | 36 | |

| Peru | 2,533,417 | United States | 70 | |

| Trinidad | 1,599,455 | British | 80 | |

| Argentina | 1,144,737 | Argentinian | 100 | |

| Egypt | 1,008,750 | British-Dutch | 100 | |

| Germany and Alsace | 995,746 | German | 100 | |

| Canada | 205,332 | United States[4] | 80 | - |

| Venezuela | 127,743 | British-Dutch | 80 | (?) |

| Italy | 50,000 | French | 96 | |

[4] By control of refining facilities.

[12]

So far as the author is aware, Canada is the only country in which the petroleum industry may be said to be controlled by foreign (United States) interests, this control being by virtue of an essential monopoly of pipe-line and refining facilities.

The preceding table shows, according to the best information available, the nationality and approximate extent of control exercised by the dominant interest in each of the principal oil-producing countries of the world in 1917.

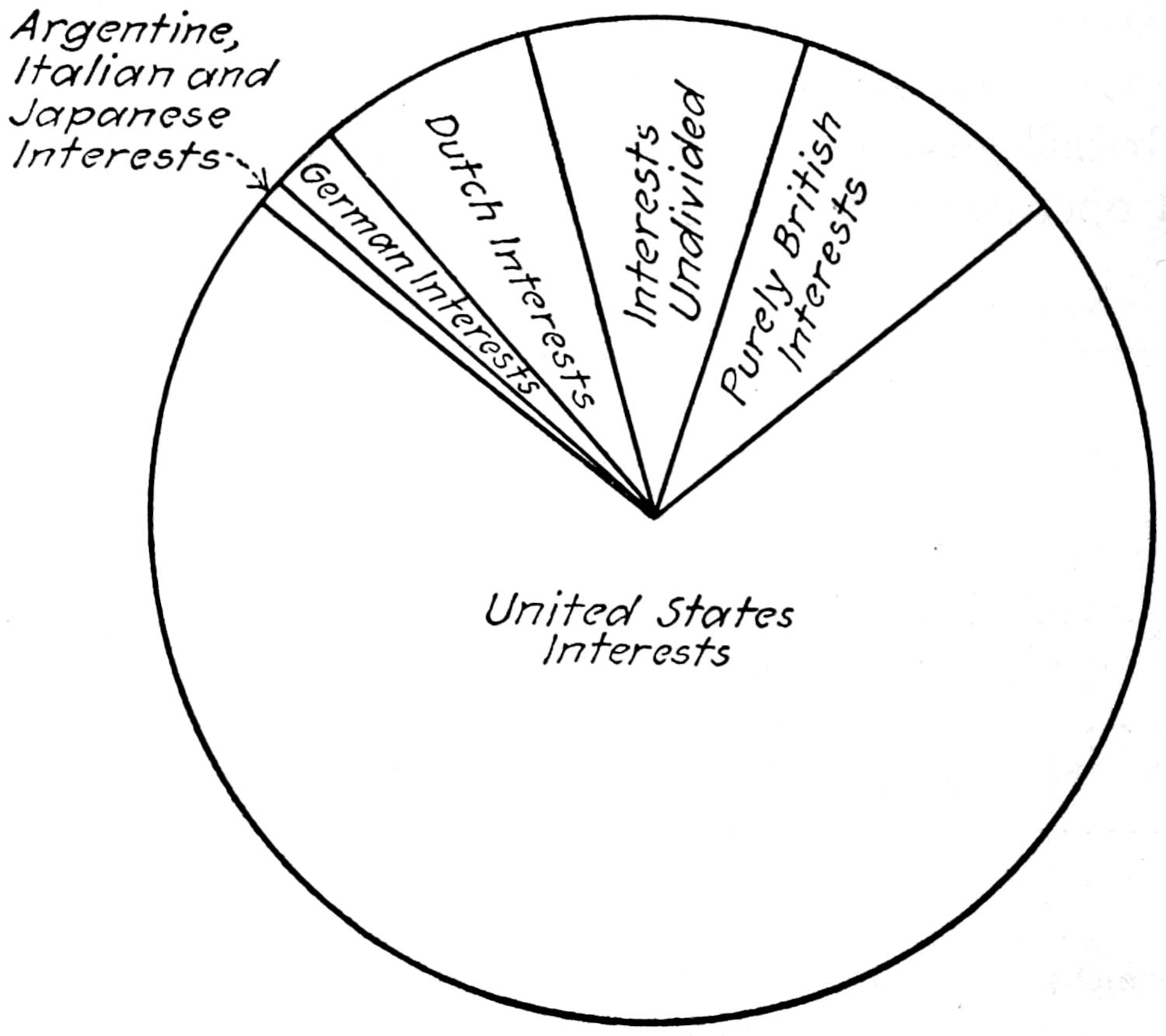

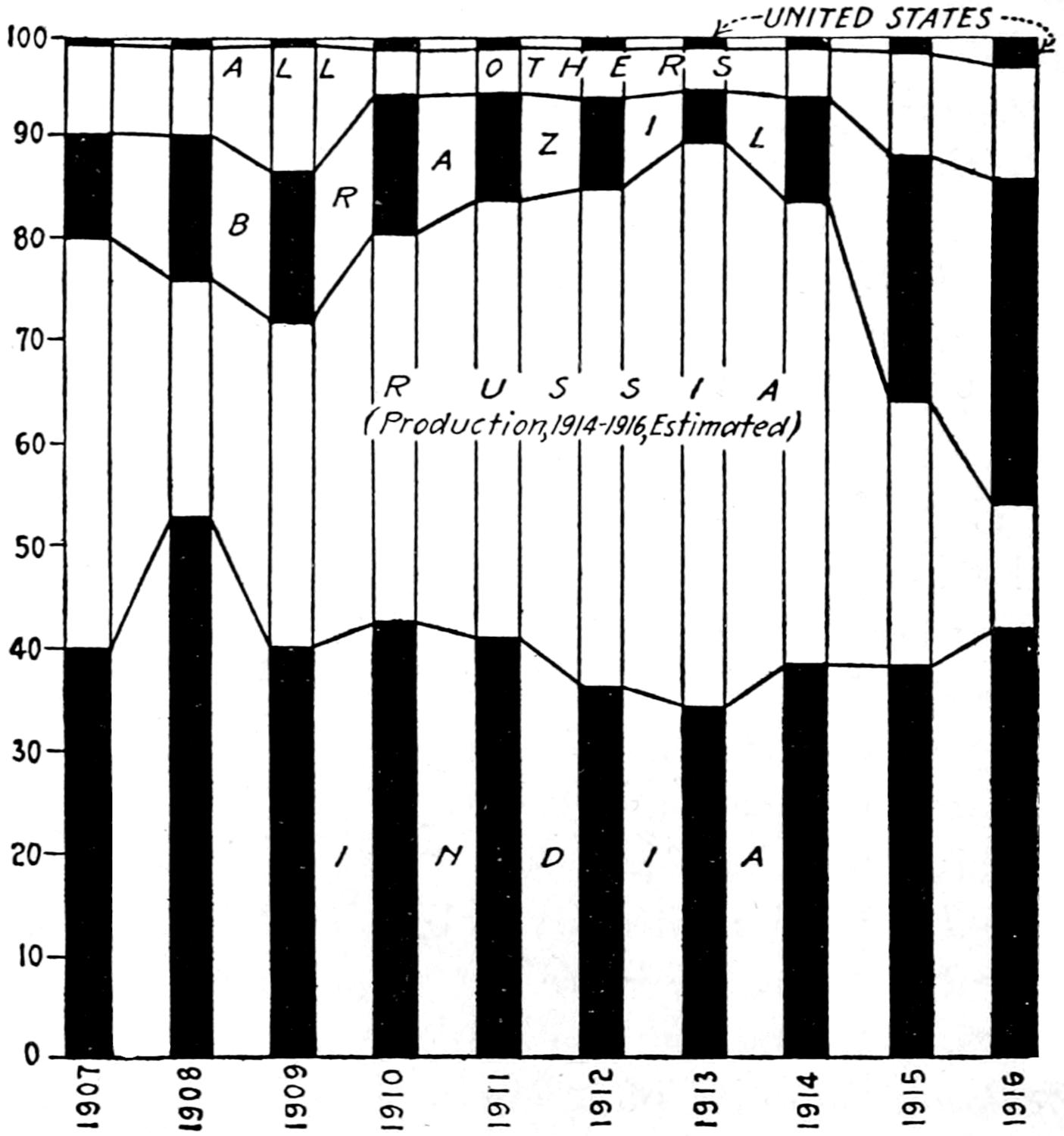

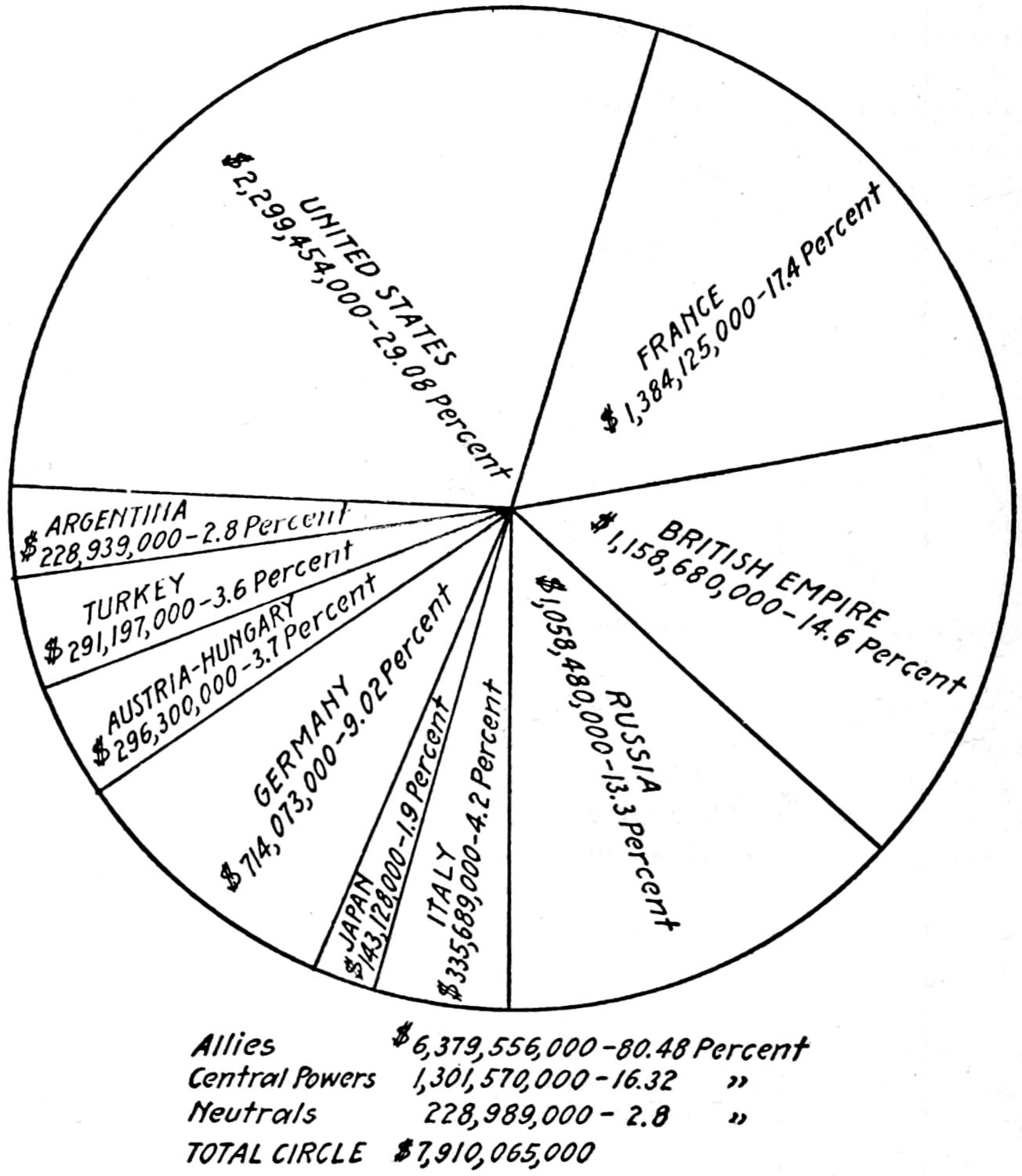

The accompanying diagram (Figure 2) shows graphically the approximate commercial control of the world’s production of petroleum in 1917.

Fig. 2.—Approximate commercial control of the world’s production of petroleum in 1917.

Commercial control of the petroleum industry in the United States is in the hands of the so-called “Standard Oil Group” of companies, through their control of most of the great pipe-line systems of the country, of probably 75 per cent. of the refining facilities and of a substantial part of the actual production. Other domestic interests having important shares in the control of the petroleum industry in the United States include the Southern Pacific Railroad Co., Cities Service Co. (Doherty interests), General Petroleum Corporation, Gulf Oil Corporation, Ohio Cities Gas Co., Cosden & Co., Sinclair Oil & Refining[13] Corporation, The Sun Co., the Texas Co., the Tide Water Oil Co., and the Union Oil Co. Foreign interests in the United States include purely British companies, which control a production of about 2,000,000 barrels a year; British-Dutch companies represented by the Royal Dutch-Shell Syndicate, which control a production of about 9,000,000 barrels a year, together with refining and marketing facilities; and Franco-Belgian companies controlling a yearly production of about 1,000,000 barrels. Aside from the very probable holdings by individual Germans of shares in companies engaged in one or more phases of the petroleum industry of the United States, the author is aware of no organized German interest in any phase of the domestic industry.

Commercial control of the petroleum industry of Russia is, under the political conditions now existing in central Europe, largely a matter of speculation. As nearly as can be ascertained, the dominant control is in the hands of purely British, Franco-British, and British-Dutch (Royal Dutch-Shell Syndicate) interests. Certain of the second-named interests are allied closely with an additional group of capitalists represented by the firm Nobel Bros., of much importance, the present control of which is by no means clear, from the literature available on the subject. Though originally Swedish, the financial interests now involved in Nobel Bros. are believed to include representatives of financial groups in England, France, and Germany as well, with control probably lying with the Anglo-Swedish interests. Before the war, direct German interest in Russian petroleum included control by the Deutsche Bank through a Belgian company (the Petrole de Grosny) of the important producing and refining company, A. I. Akverdoff & Co., control of which is now in British or British-Dutch hands. As in the United States, a considerable part of the actual production of petroleum in Russia is distributed among a large number of individually weak companies, dominated, through the control of pipe-line or refining facilities, by one or another of the principal groups.

Of considerable importance in Russian petroleum affairs at one time was the European Petroleum Union, organized for combat in the world markets with the Standard Oil trust. This union included among others such important petroleum operators as Nobel Bros., the Rothschild interests (now Dutch-Shell), Mantaschoff (now Russian General Oil Corporation) (British), and the Deutsche Bank, the latter controlling Akverdoff and Spies in Russia, together with important companies in Roumania and Galicia. How far this union controlled the affairs of its constituent companies is not evident from available data, and its present influence on companies now operating in Russia is uncertain.

Conditions in Russia make impossible any definite statement on the petroleum situation. A decree of the Bolsheviki government, dated June 20, 1918, on the nationalization of the petroleum industry, declared as the property of the state all movable and immovable property employed[14] in and belonging to that industry. Trading in oil was declared a state monopoly and was delegated to the chief petroleum committee of the fuel department of the supreme Council of National Economy. As the chief producing areas are now under British military control, this decree is ineffective.

Commercial control of petroleum in Mexico is divided among United States, British, and British-Dutch interests, which controlled about 65, 30 and 2 per cent., respectively, of the production in 1917. The interests of the United States include the Doheny group, operating principally as the Huasteca and Mexican Petroleum companies; the Standard Oil Co. of New Jersey, operating as the Penn-Mex Fuel Co.; the Sinclair interests, operating as the Freeport and Mexican Fuel Oil Co.; the Texas Co.; Gulf Co.; Southern Pacific Railroad; and others. The British interests are represented by the Pearsons, operating as the Mexican Eagle Oil Co.; and the British-Dutch interests by La Corona Petroleum Co., and Chijoles Oil, Ltd., controlled by the Royal Dutch-Shell Syndicate. No exclusively German interests are known to hold a substantial portion of any important company operating in Mexico.

Formerly concessions were freely granted to foreign individuals and companies for the exploitation of mineral deposits, and oil lands were sold by the native owners to foreigners. Article 27 of the constitution of 1917 expressly forbids any but Mexican companies acquiring directly or operating directly petroleum lands in Mexico.

All recent concessions for the exploitation of oil properties contain a provision stating that the concession will be declared null if any of the rights are transferred to any foreign government. The provisions and the intent of a series of presidential decrees issued on February 19, 1918, July 8, 1918, July 31, 1918, and August 1, 1918, are to nationalize all petroleum lands and to permit them to be worked only by Mexican citizens or by companies that agree to consider themselves Mexican and further agree not to invoke the protection of their governments. A bill was presented in December, 1918, to carry out Article 27 of the new constitution, but thus far no action has been taken in the matter. The decrees and legislation growing out of Article 27 have been protested by the chief petroleum companies operating in Mexico and by their respective governments.

Commercial control of the petroleum resources of the Dutch East Indies is in the hands of the Royal Dutch-Shell Syndicate and is essentially absolute by reason of the restrictions contained in the Netherlands East India Mining Act and subsequent supplements on foreign acquisition of mining rights in the East Indian Archipelago. Actual control is in the hands of the Bataafsche Petroleum Maatschappij, which has a capital of $56,000,000 divided into five shares, three of which are owned by the Royal Dutch Petroleum Co., and two by the Shell Transport[15] Trading Co. (British). Purely British interests control an inconsequential production of petroleum in British North Borneo and in Sarawak.

Prospecting licenses and concessions are granted only to Dutch subjects and to Dutch companies. It is officially stated that the object of these restrictions is not to exclude foreign capital; this is precisely their effect, and on account of the economic monopoly which the Royal Dutch-Shell now has of the petroleum industry of the Dutch East Indies, it would be very difficult for any new enterprise to gain a foothold.

Commercial control of the petroleum resources of India is exercised by the Burma Oil Co. through its dominance of production, refineries, and pipe-line facilities, and by reason of agreements as to marketing with its principal competitor, the British Burma Petroleum Co., both controlled by British capital. The Burma Oil Co. is allied with, if not directly controlled by, a group of British financiers, one or more of whom is interested in companies in Trinidad and in Persia.

During the war the petroleum industry of Roumania was temporarily wholly in control of German and Austrian interests. The advanced stage of development of the oil fields prior to the war and the intentional damage, much of which is irreparable, wrought in the fields by British detachments in 1916, when capture of the fields by Austro-German forces became inevitable, are believed, however, to have deprived Germany of a large part of the fruits of her conquest, as it is considered doubtful if the Roumanian fields can ever again be made to yield petroleum at the pre-war rate of 12,000,000 barrels per annum.

The American Petroleum Institute states that “Roumania is considering the erection of a state monopoly of both production and distribution on the ruins of the monopoly which Germany sought to establish there but was compelled by the armistice to renounce.”

Prior to the war Dutch or rather British-Dutch (Dutch-Shell) interests controlled about 30 per cent. of the annual production of petroleum in Roumania, German interests about 26 per cent., United States interests (Standard Oil Co. of New Jersey) about 18 per cent., French interests about 16 per cent., purely British interests about 6 per cent., and Belgian and Roumanian interests the remainder.

Through the Austrian “Society Gaz” and the German “Deutsche Erdoel Aktien-gesellschaft,” German interests have dominated the petroleum industry of Galicia for years through the direct control of the larger producing and refining interests and by reason of the fact that the smaller scattered interests were dependent almost entirely on the two leading companies, the Galizische Karpathen Petroleum A. G. (controlled by Society Gaz), and the Premier Oil & Pipe Line Co. (controlled by the Deutsche Erdoel A. G., which is in turn controlled by the Diskonto und Bleichroeder, a branch of the Deutche Bank) for their transportation and refining facilities. British and Dutch capital were involved in the[16] Galician fields prior to the war, but not, it is believed, to a controlling extent in either of the dominant companies.

The petroleum industry of Japan is controlled wholly by Japanese interests and to a preponderant extent by a single company, the Nippon Oil Co. So far as the author is aware, no foreign interests share in any way in the development or control of the Japanese petroleum industry.

Commercial control of the petroleum industry of Peru is exercised by the Standard Oil Co. of New Jersey through its subsidiary, the Imperial Oil Co. of Canada. This control involves about 70 per cent. of the annual production, the remaining 30 per cent. being divided in the ratio of 27 to 3 between British and Italian interests respectively. So far as is known no other interests are involved.

The interests engaged in the petroleum industry of Trinidad include financial groups purely British, controlling about 57 per cent. of the production; British-Dutch interests (Dutch-Shell) controlling about 23 per cent., and United States interests (General Asphalt Co.), controlling the remainder. The leading operator in Trinidad is the Trinidad Leaseholds, Ltd., a British company that in 1917 produced about 42 per cent. of the petroleum output credited to Trinidad that year.

Commercial control of the petroleum resources of lower Alsace has been in the hands of the Vereinigte Pechelbronner Oelbergwerke Gesellschaft and the Deutsche Tiefbohr A. G. Both of these companies are believed to be controlled by the Deutsche Bank through the Deutsche Erdoel A. G., and the Diskonto und Bleichroeder. The negligible production of petroleum in Hanover is doubtless under the same financial control, although data that would warrant a positive statement to that effect are not at hand.

The petroleum reserves of Argentina, which comprise the only areas from which petroleum is being commercially produced in that country, are operated by the state through the Comodora Rivadavia Petroleum Commission. German interests are thought to have been involved in two or three unsuccessful efforts in the last decade to obtain petroleum on tracts adjacent to the government reserves in the Comodora Rivadavia district.

The petroleum industry in Egypt is controlled wholly by British-Dutch capital operating as the Anglo-Egyptian Oilfields, Ltd., a subsidiary of the Royal Dutch-Shell Syndicate, through the Anglo-Saxon Petroleum Co., the last-named company being predominantly British.

Commercial control of the petroleum industry in Canada is exercised in effect by the Standard Oil Co. of New Jersey, through its subsidiary the Imperial Oil Co. of Canada. This control is exercised through a virtual monopoly of pipe-line and refining facilities, and by the producing interests, though British and Canadian, being individually small and unorganized.

[17]

The production of petroleum in Italy, which is small, represents the output of two companies, the Petroli d’Italia, in which French capital is predominant, and the Petrolifera Italiana, which is believed to be essentially Italian.

Financial groups interested in petroleum in Venezuela include the Royal Dutch-Shell Syndicate (British-Dutch), the General Asphalt Co., (United States), and a group of British financiers who control properties in Trinidad as well as the most important group of companies, other than Nobels and the Dutch-Shell, in Russia.

United States interests, including the Standard Oil Co., the Doherty interests, the Texas Co., the Gulf Corporation, and the Island Oil Transport Corporation, are predominant in the quest for petroleum in Colombia. The Venezuelan Oil Concessions, Ltd., an English company operating in Venezuela, is reported to have obtained a concession to explore for oil in the northwest district of British Guiana.

The Sinclair interests (United States) are particularly active in the search for petroleum in Costa Rica and Panama; and the Sun Co. (United States) is understood to be investigating petroleum possibilities in other Central American republics.

The Pearson interests (British) have expended considerable effort in the quest of petroleum in Algeria and Morocco, and in the former country American interests (E. E. Smith) are reported to have recently sought petroleum concessions from the French government.

British interests, including the British government, control extensive petroleum concessions in Persia, from which oil in unreported quantities is now being produced.

The most promising oil territory of Persia has recently been closed to American activity through the granting of a concession aggregating approximately 500,000 square miles to a British concern, the Anglo-Persian Oil Co., a majority of whose voting stock is owned by the British government. This concession runs until 1961. The importance of the oil territory is indicated by its reported potential capacity of 30,000,000 barrels yearly, with tremendous reserves undeveloped.

United States interests (Standard Oil Co. of New York) are understood to still retain control over the petroleum rights in certain provinces in China, where active prospecting in two or three localities a few years ago was reported to have yielded unfavorable results.

Petroleum in small quantities is produced in New Zealand by purely British interests.

—As regards probable developments in the petroleum industry within the next decade, the United States, thanks to the enterprise and foresightedness of financial interests of domestic origin, seems[18] to have a strong position. United States interests are practically supreme in the commercial control of the petroleum resources of the Western Hemisphere, dominating the petroleum industry in the United States, Canada, Mexico, and Peru, holding substantial interests in Trinidad and Venezuela and in the prospective petroliferous areas in Central America and Colombia. Its only competitors are British and British-Dutch interests, which control the petroleum situation in Trinidad and are not only strongly intrenched in the United States, Mexico, and Venezuela, but are aggressively seeking to enlarge their holdings in those countries and to gain footholds elsewhere. Unless the United States adopts measures, such as Federal operation of the trunk pipe-lines, to limit the aggressions of foreign capital in this country, and erects a firm forward-looking governmental policy toward the protection of investments of its citizens in petroleum properties in other countries, particularly Latin-American countries, it may witness its commercial supremacy in petroleum affairs wane and disappear, while it is yet the largest political contributor to the world’s supply of petroleum.

As contrasted with the strongly nationalistic and deliberately aggressive governmental policy adopted by Great Britain, France, Holland and some other nations, the United States has never adopted any policy founded on recognition of the importance of political and commercial control of petroleum. American companies may not own and operate oil lands in the British Empire, in the French possessions, or the Dutch colonies, but the only American restrictions on foreign activity in the petroleum industry are those which cover all minerals contained in public lands. Only American citizens, or those who have declared their intention of becoming American citizens, can apply for patents to such land. However, after the application is made, there is no restriction on transfer of the mineral rights thus secured.

—British and British-Dutch interests easily dominate the petroleum situation in the Eastern Hemisphere by supremacy in the petroleum industries of Russia, Persia, India, and the Netherlands East Indies. Domination of the petroleum situation in Russia alone is believed tantamount to dominion of the petroleum situation in the entire Eastern Hemisphere for the greater part of the next century. The strength of Great Britain’s present position in the world’s petroleum affairs lies in a strong governmental policy and in the wide scope of British petroleum investments, embracing practically every country where petroleum is an important product and nearly every country where it is a product of potential importance. The general policy of the British Empire seems to be to control all oil development and restrict operations by foreign capital. In Australia licenses are required for the exploitation of oil lands, and only companies incorporated in the United Kingdom or a British possession may receive such licenses. The Governor General[19] has the right of pre-emption of all oil produced and in case of war may take control of all oil properties. In Canada, in those western provinces where minerals are the property of the Crown, petroleum and natural gas lands may be leased only to British companies. A similar restriction exists in Burma. In Burma a monopoly of the petroleum industry for 99 years was granted to the Burma Oil Co. in 1865. This grant seems to have been inspired by fear of the Standard Oil Co. of the United States, for the agreement between the company and the government stipulates that the former shall not amalgamate with other oil companies. Regulations of like effect exist in other British colonies where oil exists; in Barbados the British government has the right of pre-emption of all oil residues; in British Guiana, non-British companies can only hold lands by special license of the Governor; in British Honduras all mineral oil is reserved to the Crown; in southern Nigeria, the Gold Coast, Trinidad, and Tobago the British government has the right of pre-emption over all petroleum.

The recent granting of a concession amounting to a monopoly in the most promising oil district of Persia (a region that many oil experts believe likely to become one of the most important in the world) to a British company controlled directly (by stock ownership) by the British government, signifies an aggressive policy of England, outside of her own dominions, to secure and hold, under government control, oil lands in all parts of the globe.

It is understood that the best-known oil territories in Venezuela are already covered by concessions that are practically all controlled either directly or indirectly by British interests, chiefly the Dutch-Shell Syndicate.

So far as observed, German interests actually dominate the petroleum industry in Galicia and at home. Whether forced back on its own petroleum resources or on these reinforced by those of Galicia, Germany will obviously have an inadequate supply, and in consequence German interests are likely to be particularly aggressive in seeking petroleum in Mesopotamia, Africa and South America.

—Since control of the petroleum interests of the Rothschilds passed into the hands of the Royal Dutch-Shell Syndicate (British-Dutch), the influence of French finances in petroleum affairs has been negligible, outside Galicia and Italy, where its potency was not great. French capital will undoubtedly participate in efforts to determine the petroleum reserve of the Barbary States, French dependencies, but it will hardly be much involved in organized efforts to control the world situation with respect to petroleum.

The French mining law holds that oil and gas belong to the state, and may be exploited under concessions, the area and time limit of which are matters of negotiations between the applicant and the authorities.[20] It is understood that the French government is unwilling to grant oil concessions except to companies the majority of whose stock is held by French citizens. A company incorporated recently to work the Algerian oil fields contains in its articles of incorporation the provision that 60 per cent. of its stock must be held by French citizens.

—Japanese investments in the world’s petroleum industry have not yet attained significant proportions outside Japan itself, though the Japanese government is officially alive to the importance of Japanese investments in petroleum properties in Mexico, particularly Lower California and Sonora; China; and undoubtedly Russia. Hence large investments of Japanese capital in the petroleum industry in one or all of those countries may be expected in the near future.

Petroleum in its crude or semi-refined state is used as fuel under locomotive and marine boilers and as a lubricant. The principal use of petroleum, however, is in the manufacture of numerous refined products. Some of the more important products and their uses are as follows: ether, as an anæsthetic in surgery; gasoline, as fuel in internal-combustion engines; naphthas, as solvents and in the manufacture of commercial gasoline; kerosene, as an illuminant and as a fuel for farm tractors; lubricating oils; waxes, as preservatives, illuminants, and surgical dressings in treatment of burns; petroleum coke, in metallurgical processes and in the manufacture of battery carbons and arc-light pencils; heavy fuel oils; road oils; artificial asphalts, for pavements. The use of petroleum and its products as fuel, as a lubricant, and for illumination may be considered essential. Substitutes for most of these uses are known, but they are either inefficient or not readily available.

The most prolific sources of petroleum are in sedimentary strata of the Carboniferous and Tertiary periods. Because the most detailed geologic work is insufficient to provide for the appropriate evaluation of the numerous factors involved in the occurrence of petroleum, and because only a relatively small percentage of the areas of sedimentary rocks throughout the world have been examined geologically in any appreciable detail, it is difficult to estimate the future supply of petroleum or to predict that large accumulations will be discovered in any particular region.

The principal countries contributing to the world’s production of petroleum rank as follows in general order of importance: United States, Russia, Mexico, Dutch East Indies, Roumania, India, Persia and Galicia. Other countries produce less than 2 per cent. of the annual total. The greatest change that is likely to come in the geographical distribution of production is a larger output from the countries bordering the Caribbean[21] Sea and the Gulf of Mexico, and from the Persian and Mesopotamian fields. Mexico now ranks second to the United States, and South American countries promise to become more important contributors to the world’s production than they now are. Russia is expected to become ultimately one of the chief producers of petroleum.

Within the next decade, through improved methods of production and through the further amalgamation of producing, transporting, refining, and marketing companies into strong units, the output will undoubtedly be larger and will be more economically produced. In the refining of petroleum it is probable that improved methods will make possible the recovery of a larger percentage of lighter products from low-grade petroleum. Internal-combustion engines are being modified so as to run on petroleum products of lower volatility than gasoline. The use of petroleum as fuel under railroad and marine boilers is expected to increase enormously in the next decade. As the output of the producing fields declines, the vast deposits of oil shale in the western United States will be developed as a source of oil.

So far as is known, political control of the petroleum resources of the world is determined by state sovereignty (see Plate I, page 7). In normal times, the United States controls politically over 66 per cent. of the present output of petroleum. Russia and Mexico ranked second and third in 1917, controlling 13.6 per cent. and 10.9 per cent., respectively. The remaining 9 per cent. was controlled by Great Britain, Holland, Persia (British government owned), Roumania, Austria-Hungary, Japan, Peru, Germany, Argentina and Italy in the order named.

The table showing the nationality and the approximate extent of the commercial control exercised by the dominant interests in each of the principal oil-producing countries, and Fig. 2 (page 12) are the best possible summaries of commercial control. United States capital is supreme in the commercial control of the petroleum industry of the Western Hemisphere. British and British-Dutch interests easily dominate the petroleum situation in the Eastern Hemisphere. France no longer exercises control over any important fields. Japanese interests, controlling at present all the oil fields of Japan, may be expected to make large investments in the petroleum fields of Mexico, China and Russia.

[22]

Coal is among the most important of all minerals. It furnishes power and heat, and its distillation yields a great number of useful materials, such as gas for lighting and fuel, explosives, ammonia, aniline dyes, etc. Coke, which is bituminous coal with the more volatile constituents removed by distillation, is used for smelting metallic ores; and thus the contiguity of fields of high-grade coking coal and of iron ore determined the location of the centers of steel industry, which are the very main-springs of our modern machine-made civilization. Near such coal districts, other manufactures of all kinds naturally developed, the coal being cheaply available for power and constituting practically the only source of power in regions where cheap hydro-electric power is not available. About 66 per cent. of the coal mined goes to the production of power, including transportation; about 12 per cent. to coking and the by-products; and about 22 per cent. to the heating of buildings.

Commercial coal is of three varieties: (1) anthracite (Pennsylvania anthracite is popularly termed hard coal), and semi-anthracite containing a high percentage of fixed carbon and a relatively low percentage of the volatile constituents (3 to 12 per cent.); (2) bituminous (ambiguously termed “soft coal” in the United States), containing less fixed carbon and more volatile matter (12 to 40 per cent.); and (3) lignite, containing a still smaller proportion of fixed carbon and a large proportion of water. Of the bituminous coals, some coke satisfactorily, but many do not, so that good coking coals are highly prized. Anthracite, because it makes no smoke, is in great demand for house heating; whereas bituminous coal is chiefly used for power production, including locomotive and steamship firing. Lignites as a rule are used only where the better grades of coal are not available.

Coal was first used for heating before steam power came into use, and iron was smelted with charcoal instead of with coke as at present.

Ship bunkering calls for the best grades of bituminous coal, low in ash and preferably high in fixed carbon, because the use of low-grade coals would require carrying larger amounts, leaving less space for cargo. However, no country that has enough coal to bunker ships, need be dependent[23] on foreign supplies; the low grade of coal would simply reduce efficiency and thus increase expense.

—The proportion of coal used for power, as distinct from that used for heat and coal products, is increasing, and is now two-thirds of the total. As a source of power there is really no complete substitute for coal. All the great industrial nations, like England, Germany and the United States, have developed their industries on the basis of large coal supplies. Some countries make large use of hydro-electric power, but for most it is an insufficient substitute. Wood and other fuels are rarely sufficient to maintain an industry built up on a supply of coal. Oil is being successfully substituted in some industries, notably in shipping, but the importance of coaling stations will no doubt persist.

The technique of coal mining in many districts, and the development of heat, power and coal products are not far advanced. Wasteful methods are used, mostly as a result of competition and lack of co-operation and organization among producers. Economies are being advocated, however. Labor-saving machinery has been installed in many mines. A number of power plants have been erected near the mine mouth and the power distributed electrically, thus eliminating freight charges on coal. Central heating and power plants that can burn coal efficiently will no doubt be more popular and numerous in a few years. Government control and legislation may be expected to hasten the changes. In Europe the technique of coal mining, except in undercutting machinery, is further advanced than in the United States, as regards mining all the coal and in supporting the surface.

Improvements in coking ovens may soon make possible the manufacture of some sort of coke from almost any bituminous coal. While all coke may not be satisfactory for modern blast-furnace practice, any future lack of coke will probably be offset by the development of electric smelting, so the seriousness of the metallurgical need is doubtful. The proportion of by-product coke ovens, which make for cheaper coke by providing for other marketable products, is increasing.

Coals are found in the sedimentary deposits of several geological eras: Paleozoic, Mesozoic, and Tertiary. The Paleozoic era, embracing the Carboniferous period, is by far the most important as regards quality and availability of its coal resources; but the lower-grade and chiefly lignitic coals of the Mesozoic and Tertiary are of great importance locally, and there are enormous reserves that exceed in quantity the generally higher-grade coals of the earlier periods.

The geologic distribution of coal is described in “The Coal Resources[24] of the World,” the most important and comprehensive compilation on coal reserves ever made, which was undertaken by the Executive Committee of the Twelfth International Geologic Congress, held in Canada in 1913. As the compilation was made with the assistance of geological surveys and mining geologists of the several countries of the world, it is cited in this paper as authoritative on geologic distribution and resources.

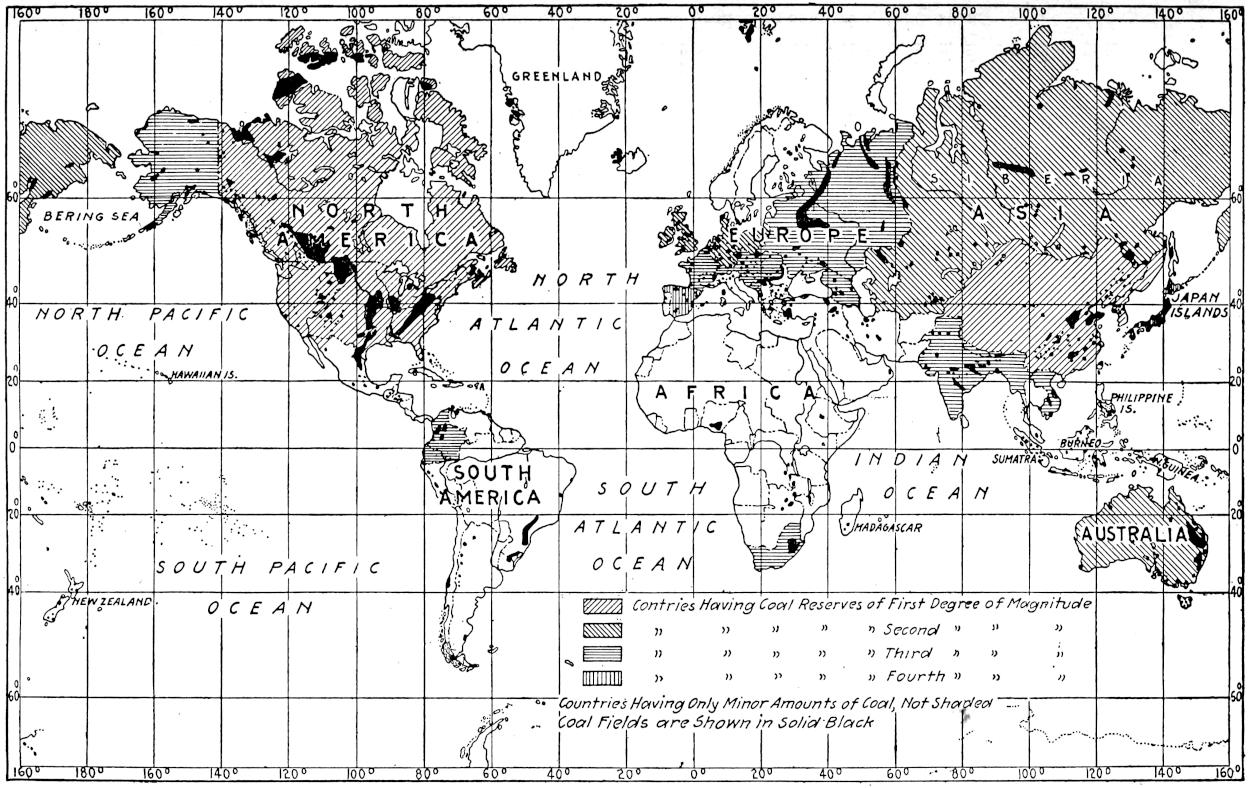

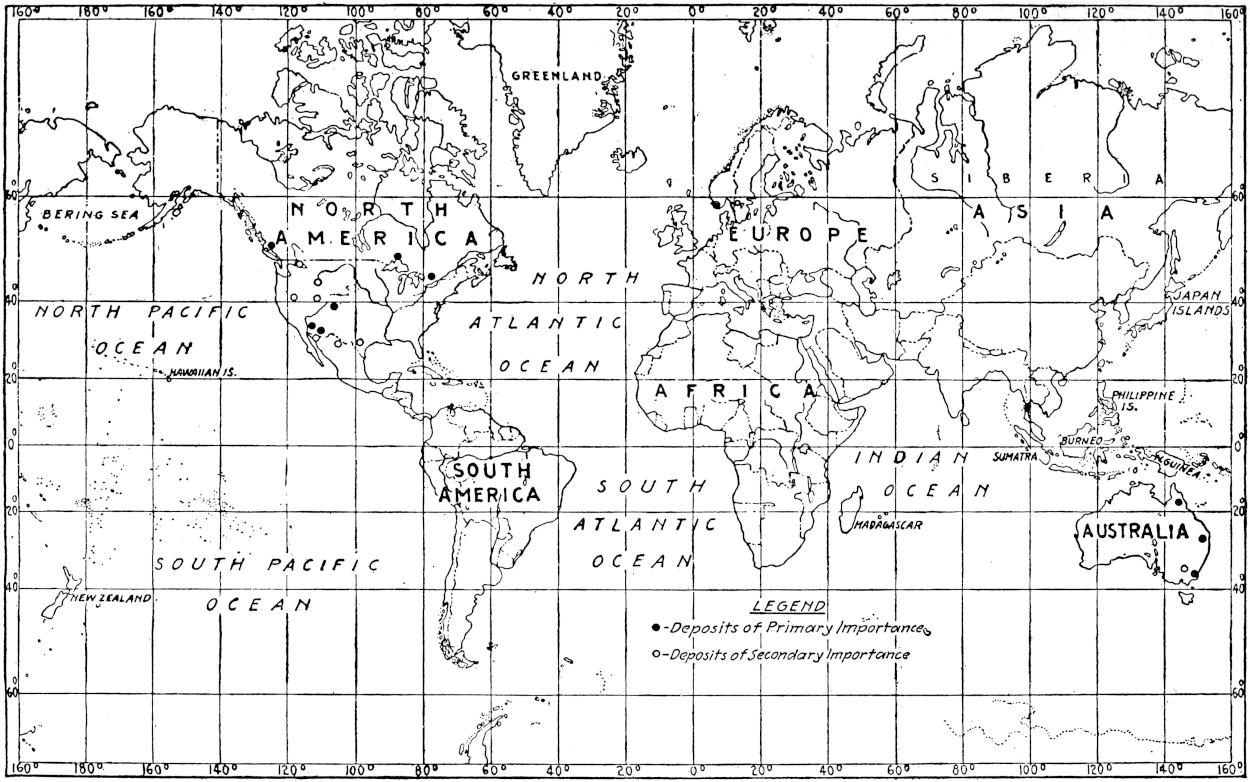

The geographic distribution of the chief coal fields of the world is shown in Plate II.

In North America the most important coals in the Central and Eastern part are of Paleozoic age, but in the Rocky Mountain region vast quantities of coal occur in the Cretaceous (Mesozoic) strata. In the Gulf province and in the Northern Great Plains province of the United States, which extends into Canada, are coals of Triassic (Mesozoic) age that are relatively unimportant at present.

In beds of the Eocene period of the Tertiary era are large deposits of brown lignite locally converted by mountain-building forces into bituminous and semi-bituminous coal, and also a little anthracite under difficult mining conditions. Such locally altered beds are found in the State of Washington, in British Columbia, and in Alaska.

The limited coal resources of South America, in those deposits east of the Andes and in southern and eastern Brazil, are of Paleozoic age. Small areas of Tertiary coals are found in southern Argentina and in Chile.

Key to Plate II.

World’s Coal Reserves as of 1916—Coal Fields in Solid Black.

1. Countries possessing coal reserves of the first magnitude (4,000,000 million to 1,000,000 million tons): The United States (3,527,000 million), Canada (1,234,000 million), and China (1,500,000 million).

2. Countries possessing coal reserves of the second degree of magnitude (500,000 million to 100,000 million): The British Isles (189,533 million), Germany (before the war) (423,356 million), Siberia (173,879 million), and Australia (165,572 million).

3. Countries possessing coal reserves of the third degree of magnitude (80,000 million to 16,000 million tons): France (before the war) (17,583 million), Alaska (16,293 million), Colombia (27,000 million), Austria-Hungary (before the war) (55,553 million), Russia in Europe (before the war) (60,106 million), India (79,001 million), Indo-China (20,000 million) and South Africa (56,200 million).

4. Countries possessing coal reserves of the fourth degree of magnitude (16,000 million to 6,000 million tons): Spain (8,768 million), Japan (7,970 million), Belgium (11,000 million), Spitzbergen (8,750 million).

5. Countries possessing coal reserves, but of inferior magnitude (less than 4,000 million tons): Brazil, Argentina, Chile, Peru, Ecuador, Venezuela, Greenland, Holland, Denmark, Sweden, Italy, Bulgaria, Turkey, Greece, Roumania, Asia Minor, Persia, Arabia, various islands of Malaysia and various countries in Africa. Coal fields shown in black—country not shaded.

[25]

Plate II.—Geographical distribution of the coal deposits of the world, and relative reserves. By F. F. Grout.

[26]

In Europe the principal coal deposits occur in the Carboniferous system, either in the upper or the lower part. The Lower Carboniferous is the principal series in which coals occur in Scotland, whereas the most important coals in England and in Wales lie in Upper Carboniferous rocks. In northern France, in Belgium, and in Westphalia, Germany, the middle Carboniferous measures contain the most important reserves. Mesozoic coals are found in northern Australia and in central France. The lignites or brown coals of middle Europe are locally very important in Germany; those of Austria are found in numerous small but thick deposits of the Tertiary age.

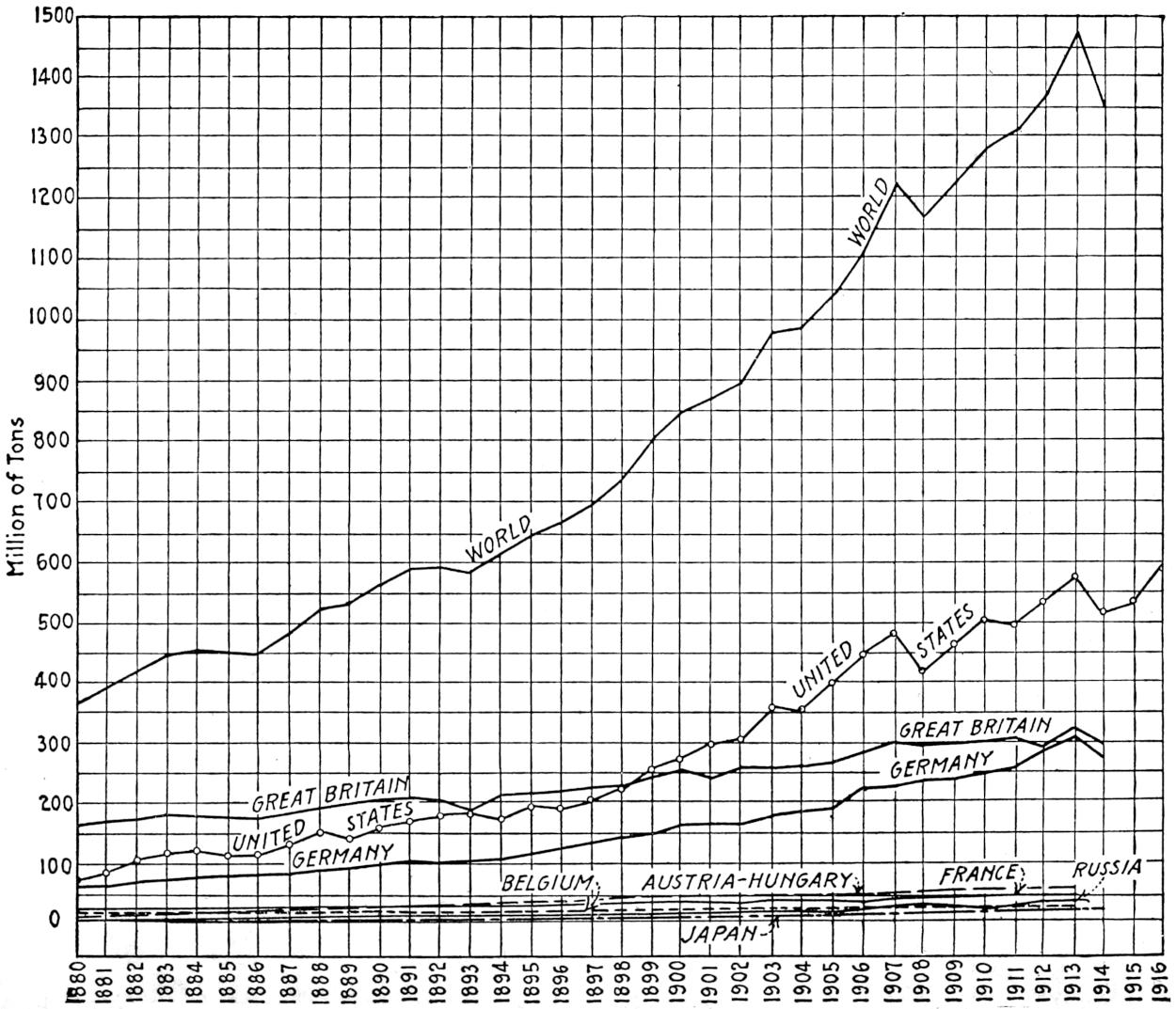

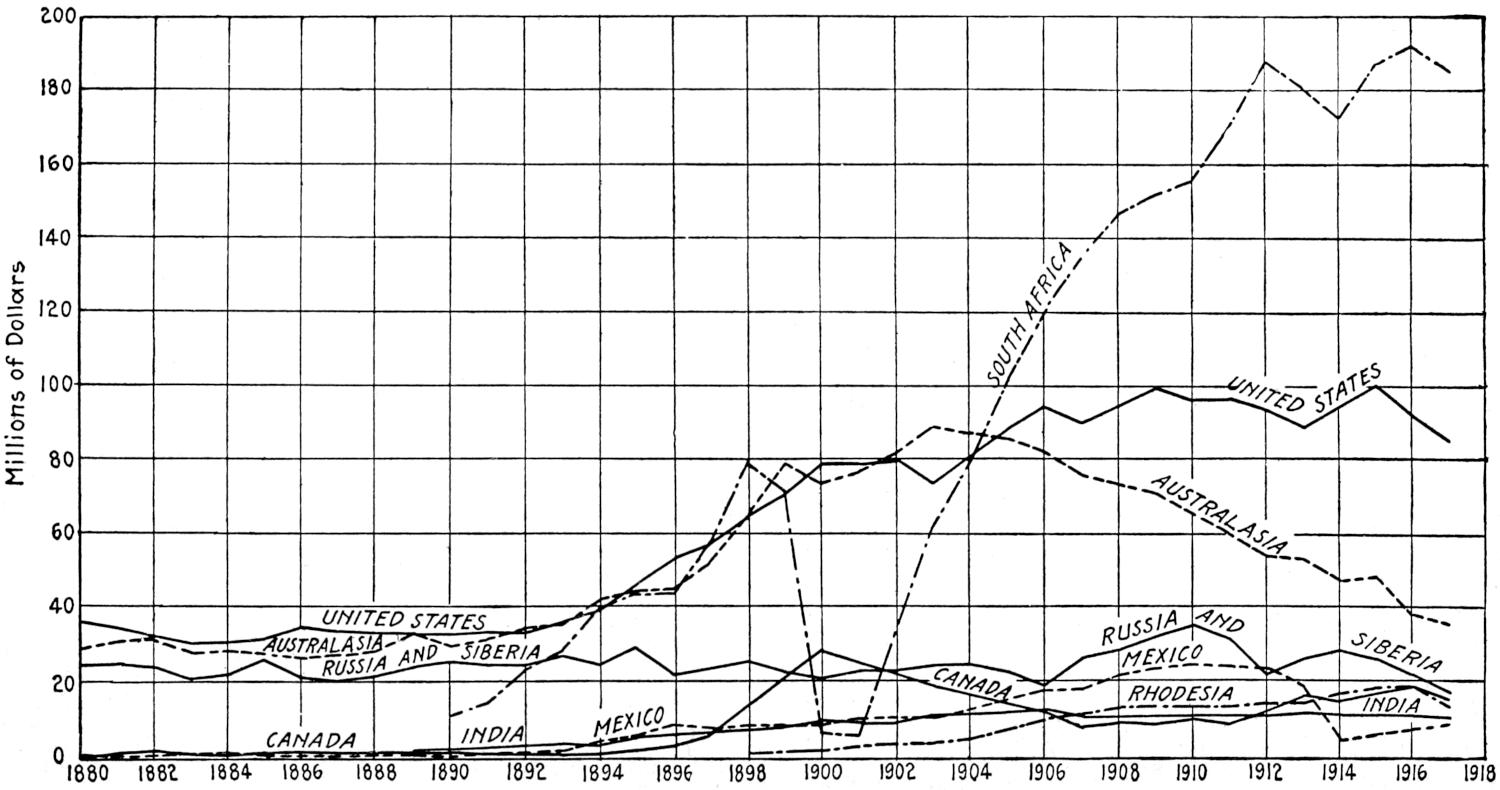

Fig. 3.—Coal output of the chief coal-producing countries, 1880-1916.

The principal coal resources of Africa are in the southern part of the continent and are chiefly in deposits whose ages range from Carboniferous to Triassic.

[27]

In Asia the coal fields are not well defined. There are coal basins of note in India and China. In China important coals are found in the Upper Carboniferous. Coals of the Lower Carboniferous are found east of the Urals and also in Turkestan. In Japan the Mesozoic coals are important. Tertiary coals are widely distributed in Asia but are not high-grade nor of importance.

It may be safely stated that geological reconnoissance has covered the world so well that further development is not likely to disclose coal resources of great magnitude not now known with more or less exactitude. Estimates of resources of some regions will undoubtedly be revised many times, especially those of reserves in the middle portion of Africa, in South America, and China.

As the great World War began on July 31, 1914, the last normal production figures were for 1913. The following table of the world’s production of coal for the years 1911-1914 is from “Mineral Resources” of the U. S. Geological Survey, the compilation being credited by Mr. Lesher, of the Survey, to Mr. Wm. G. Gray, statistician of the American Iron and Steel Institute, and Prof. G. A. Roush, editor of “Mineral Industry.”

The output (1880-1916) of the chief coal-producing countries of the world is shown graphically in Figure 3.

Table 4.—The World’s Production of Coal (in Short Tons)

| Country | 1911 | 1912 | 1913 | 1914 | ||||

|---|---|---|---|---|---|---|---|---|

| United States | 496,371,126 | 534,466,580 | 569,960,219 | 513,525,477 | ||||

| Great Britain | 304,518,927 | 291,666,299 | 321,922,130 | 297,698,617 | ||||

| Germany | 259,223,763 | 281,979,467 | 305,714,664 | 270,594,952 | ||||

| Austria-Hungary | 54,960,298 | 56,954,579 | 59,647,957 | |||||

| France | 43,242,778 | 45,534,448 | 45,108,544 | |||||

| Russia | 29,361,764 | 33,775,754 | 35,500,674 | |||||

| Belgium | 25,411,917 | 25,322,851 | 25,196,869 | |||||

| Japan | 19,436,536 | 21,648,902 | 23,988,292 | 21,700,572 | ||||

| India | 13,494,573 | 16,471,100 | 18,163,856 | |||||

| China | 16,534,500 | 16,534,500 | 15,432,200 | [5] | ||||

| Canada | 11,323,388 | 14,512,829 | 15,115,089 | 13,597,982 | ||||

| New South Wales | 9,374,596 | 10,897,134 | 11,663,865 | 11,644,476 | ||||

| Transvaal | 4,343,680 | 8,119,288 | [6] | 5,225,036 | ||||

| Spain | 4,316,245 | 4,559,453 | 4,731,647 | |||||

| Natal | 2,679,551 | See note 6 | 2,898,726 | |||||

| New Zealand | 2,315,390 | 2,438,929 | 2,115,834 | |||||

| Holland | 1,628,097 | 1,901,902 | 2,064,608 | |||||

| Chile | 1,277,191 | 1,470,917 | 1,362,334 | |||||

| Queensland | 998,556 | 1,010,426 | 1,162,497 | 1,180,825 | ||||

| Mexico[28] | 1,400,000 | [5] | 982,396 | |||||

| Bosnia and Herzegovina | 848,510 | 940,174 | 927,244 | |||||

| Turkey | 799,168 | 909,293 | ||||||

| Italy | 614,132 | 731,720 | 772,802 | |||||

| Victoria | 732,328 | 664,334 | 668,524 | |||||

| Orange Free State (Orange River Colony) | 482,690 | 609,973 | ||||||

| Dutch East Indies | 600,000 | [5] | 622,669 | 453,136 | ||||

| Indo-China | 460,000 | [5] | 471,259 | |||||

| Serbia | 335,495 | 335,000 | ||||||

| Sweden | 343,707 | 397,149 | 401,199 | |||||

| Western Australia | 300,000 | [5] | 330,488 | 351,687 | ||||

| Peru | 300,000 | [5] | 307,461 | 301,970 | ||||

| Formosa | 280,999 | 306,941 | ||||||

| Bulgaria | 270,410 | 324,511 | ||||||

| Rhodesia | 212,529 | 216,140 | 237,728 | |||||

| Roumania | 266,784 | |||||||

| Cape Colony (Cape of Good Hope) | 89,023 | See note 6 | 67,481 | |||||

| Korea | 138,508 | |||||||

| Tasmania | 70,000 | [5] | 59,987 | 61,648 | 68,130 | |||

| British Borneo | 100,000 | [5] | 49,762 | |||||

| Spitzbergen | 44,092 | |||||||

| Brazil | 16,535 | |||||||

| Portugal | 10,000 | [5] | 16,938 | 27,053 | ||||

| Venezuela | 10,000 | [5] | 12,000 | [5] | 13,355 | |||

| Switzerland | 8,267 | |||||||

| Philippine Islands | 2,000 | [5] | 2,998 | |||||

| Unspecified | 1,016,947 | [5] | ||||||

| Total | 1,309,565,000 | [7] | 1,377,000,000 | [7] | 1,478,000,000 | [7] | 1,346,000,000 | |

Table 5.—Reserves

Total coal reserves in millions of metric tons have been estimated, by continents, as follows:

| Continent | Millions of tons |

|---|---|

| North America | 5,073,000 |

| Asia | 1,280,000 |

| Europe | 784,000 |

| Australia and Oceania | 170,000 |

| Africa | 58,000 |

| South America | 32,000 |

[29]

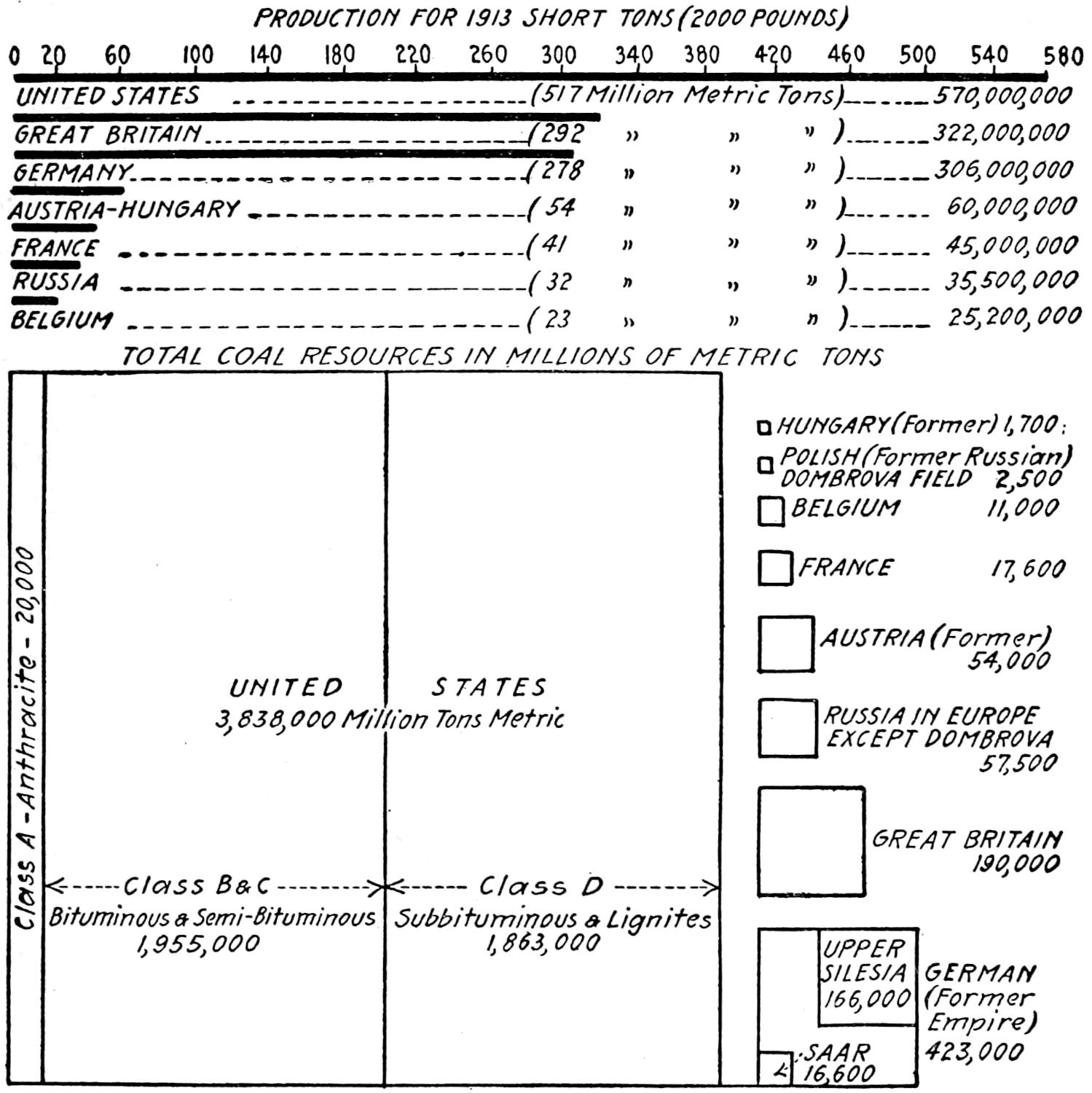

The countries on pre-war basis having the greatest reserves are as follows:

| Country | Millions of tons |

|---|---|

| United States (half lignite) | 3,527,000 |

| Canada (three-fourths lignite) | 1,234,000 |

| China | 996,000 to 1,500,000 |

| British Isles | 190,000 |

| Siberia (largely lignite) | 173,000 |

| Germany (including Upper Silesia and the Saar) | 423,000 |

| New South Wales | 118,000 |

| India | 79,000 |

| Russia including Dombrova field (Poland) | 60,000 |

| Austria (chiefly in Bohemia, Silesia and Galicia) | 54,000 |

| France | 17,600 |

Fig. 4.—Coal reserves of chief producing countries, according to “Coal Resources of the World,” in millions of metric tons. Squares are to scale: lines showing relative production are not on same scale as squares.

The reserves of the principal productive coal fields are graphically shown in Figure 4.

The distribution of the coal deposits of the world and the estimated reserves in these deposits are shown in Plate II.

[30]

The districts with coal for export have been chiefly the British Isles, United States and Germany; there might be included also New South Wales, British South Africa, Japan, French Indo-China, Canada, New Zealand and Spitzbergen. China, with her large reserves, may become an exporter in the future; or, if her industries develop, may find use for her coal at home.

Anthracite of good grade is found in large amounts in Pennsylvania and South Wales only. Poorer supplies are known in Germany, France, Italy, Indo-China, and also in the states of Colorado and New Mexico.

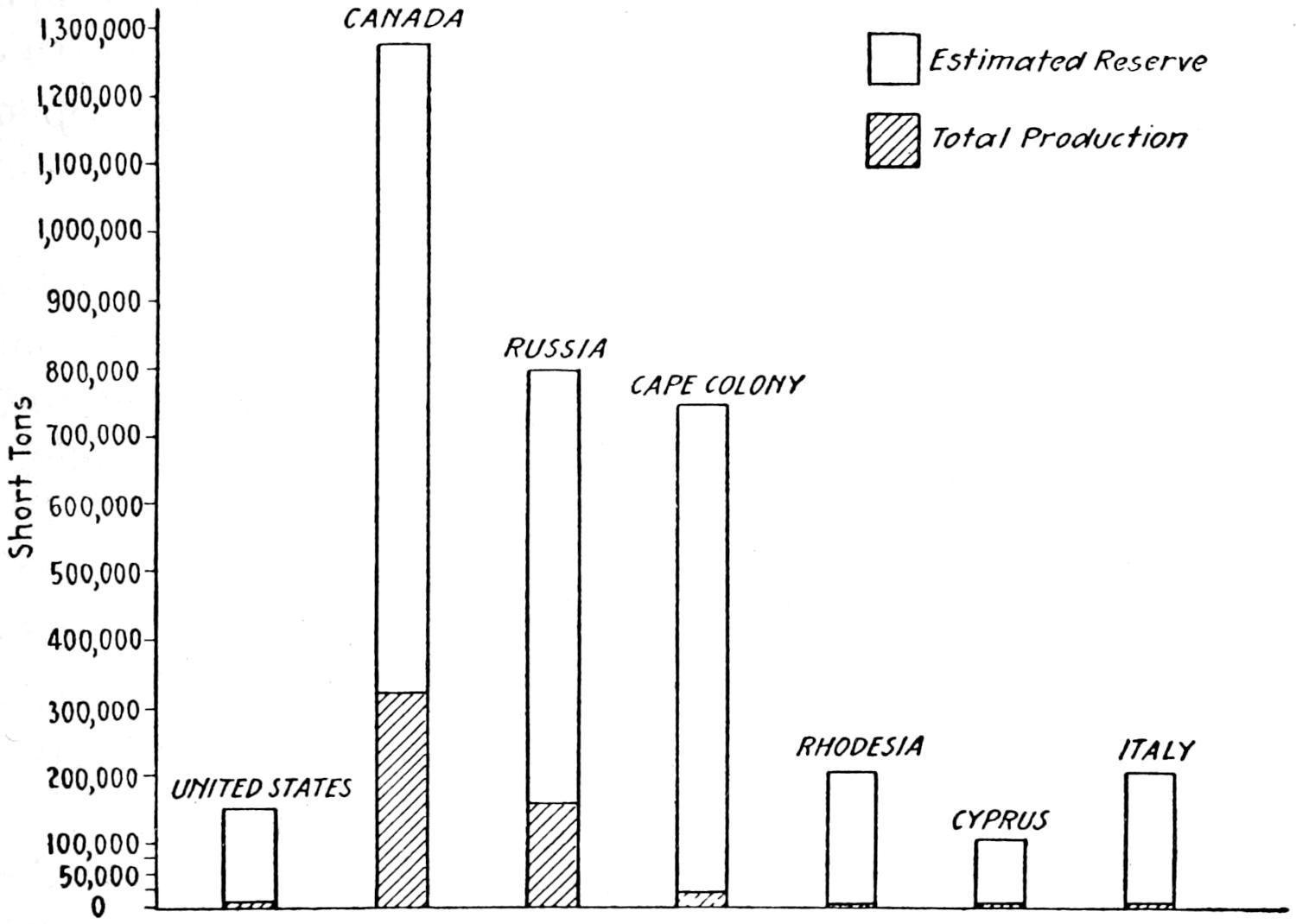

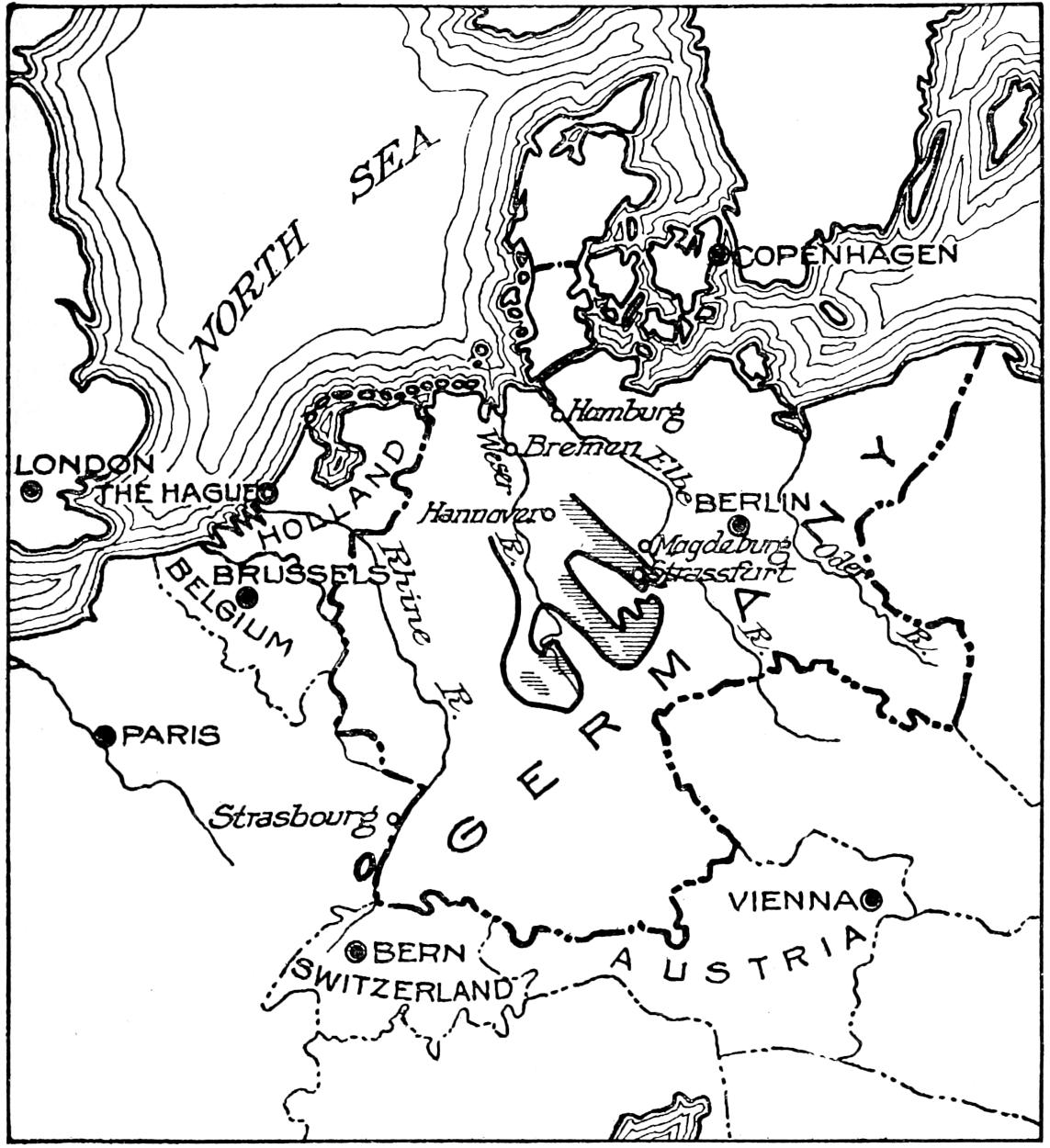

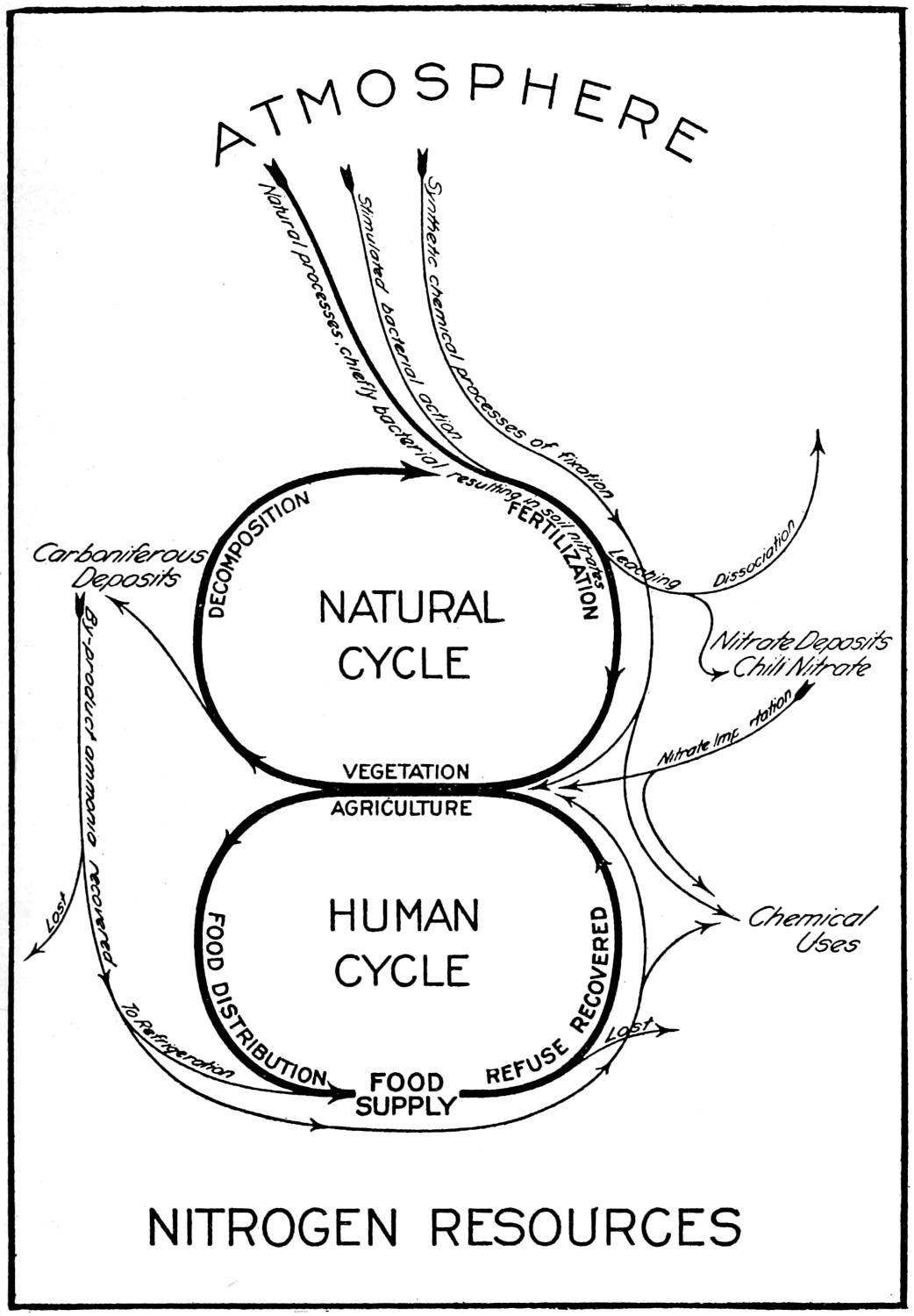

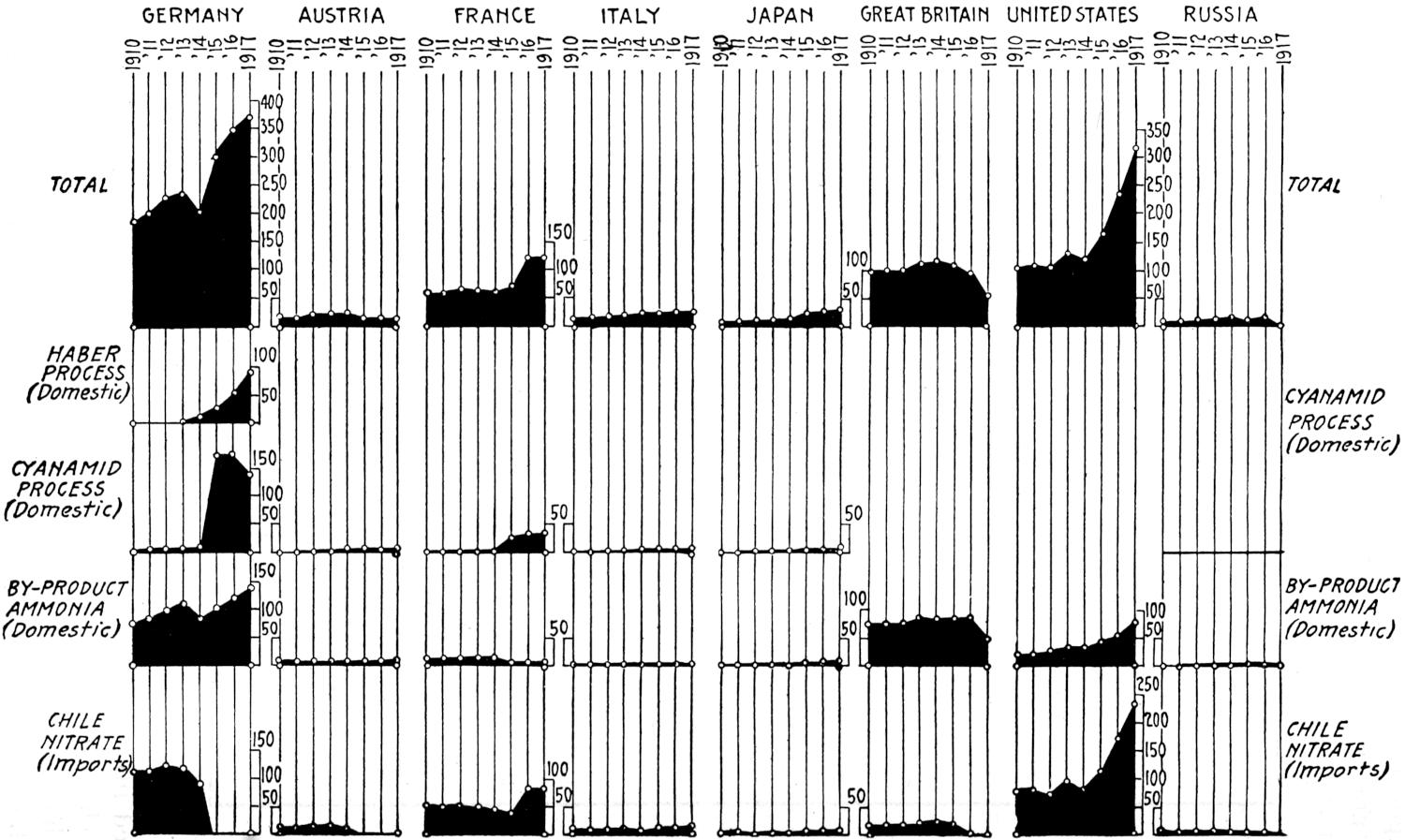

Coking coals in large amounts are found in the eastern United States, Germany and the United Kingdom and are coked extensively. Smaller amounts of coke are made in France, Belgium and old Austria. Relatively very small amounts are made in Canada, Chile, New South Wales, Japan and Spain.